Xi Jinping’s old school is teaming up with a university that’s even older

A state-owned developer linked to Beijing’s Tsinghua University has set up a joint venture to build a £100 million ($133 million) biomedical center at the alma mater of Isaac Newton and Francis Bacon, according to an announcement by Cambridge Universitys’s Trinity College this month.

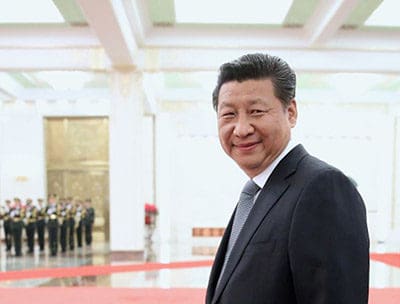

TusPark, which operates a chain of 30 high tech parks across China, will be developing a 34,000 square foot biomedical hub at Cambridge in cooperation with the college, which also claims Jawaharlal Nehru and Alfred Tennyson among its distinguished alumni. TusPark is affiliated with China’s Tsinghua University, and counts among its alumni Chinese president Xi Jinping as well as his predecessor Hu Jintao and outgoing central bank governor Zhou Xiaochuan.

The investment by the government-linked developer comes despite severe restrictions on outbound real estate investment from China which saw deal volumes plummet 51 percent in the third quarter of 2017 from the same period last year.

Building a Sino-British Biomedical Hub at Cambridge

Cambridge Science Park covers 150 acres

The joint venture research facility at Cambridge is aimed at supporting early stage life science ventures and existing corporations, and is positioned as a complement to the university’s Bradfield Centre, which is designed to incubate early stage technology companies. Both facilities are to be situated in the 150 acre (607,000 square metre) Cambridge Science Park, which is already home to some 85 companies.

In a statement, the elite UK institution indicated that business park investment “will be followed in due course by deeper academic collaboration between Trinity College and Tsinghua University.

TusPark, which is based in Wudaokou just outside of Tsinghua University, has mainland developments in the cities of Kunshan, Suzhou and Nanjing in China’s Jiangsu province, as well as in Zhongguancun high tech park in the nation’s capital. The developer has recently been pushing into co-working projects with partners in the US, India and southeast Asia and its Hong Kong branch has locations in Kwun Tong, Central and Causeway Bay.

Property consultancy JLL represented TUS Park in the investment, according to an account in London’s Estates Gazette. The mainland developer is a rival to Beijing’s Advanced Business Park, which is currently developing a $2.2 billion commercial project on London’s Royal Albert Docks.

China-UK Uni Romance Leaps the Great Wall of Capital

The deal between the two super-school related developers comes despite a clampdown on many other Chinese property investments in the UK and globally.

In August of this year Beijing-based developer Dalian Wanda was forced to quickly flip a $605 million project in London’s Nine Oaks area after its cross-border spending spree fell out of favor with Chinese regulators concerned about a foreign exchange exodus. The measures against Wanda and other mega-investors such as HNA Group and Fosun reduced China’s outward flow of investment in foreign real estate projects to $2.5 billion in the third quarter the lowest total in nearly four years, according to a recent report by Cushman & Wakefield.

Despite the general shutdown, some of China’s larger state-owned investors and the country’s sovereign wealth funds continue to close overseas deals. Earlier this month the US unit of Shanghai Municipal Investment agreed to team up with America’s Toll Brothers on a $323 million residential project office project in New York City, and in October, Beijing-based Cindat Capital Management entered a £525 million ($703 million) deal with a UK investment firm to buy British hospitality chain Qhotels.

Leave a Reply