Wanda’s AMC Theatres have been hit hard by the pandemic

Beijing-based Dalian Wanda Group is discovering yet again that Hollywood is a tough town, as its last remaining overseas trophy warned US financial regulators that it could run out of cash this year.

With attendance down 85 percent this year compared to 2019, AMC Entertainment Holdings warned the US Securities and Exchange Commission (SEC), on Tuesday that it could run out of cash within less than half a year, despite having reopened most of its theatres as the COVID-19 pandemic rages unabated in much of the US.

Even with 494 of its 598 US theatres opened, the cinema chain told the SEC that, “…given the reduced movie slate for the fourth quarter, in the absence of significant increases in attendance from current levels or incremental sources of liquidity, at the existing cash burn rate, the Company anticipates that existing cash resources would be largely depleted by the end of 2020 or early 2021.”

Wanda had spent $2.5 billion to acquire AMC in 2012 as the first installment in a cross-border push that from 2013 to 2017 built a $5 billion overseas real estate portfolio. Since that peak three years ago, the conglomerate helmed by China’s one-time richest man Wang Jianlin has liquidated its properties in the US, Europe and Australia, as well as overseas entertainment assets acquired during the binge.

Openings Delayed

AMC noted in its statement to the SEC that major movie releases which had been scheduled for this quarter have now been either delayed until next year or shifted directly to streaming, while indicating that more release dates may be moved in the future.

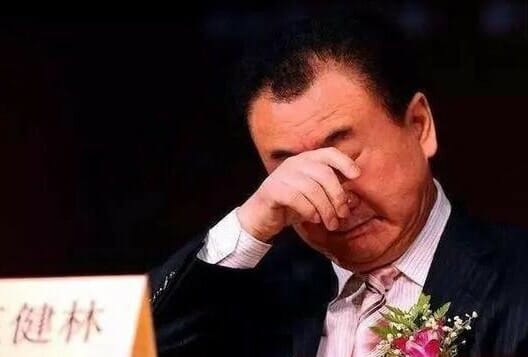

Wang Jianlin’s Hollywood dreams aren’t working out as planned

The company also pointed out that some of its competitors have decided to re-close their theatres due to the pandemic and revealed that it has adjusted its operating hours at its own venues to control operating costs.

As of 30 June AMC had $498 million in cash or cash equivalents on hand against current liabilities of $1.71 billion, according to its latest financial statement. In July the company had reached a debt agreement with Silver Lake Group, under which the investment bank would purchase $100 million in first lien notes which AMC made available in hopes of tiding it through the coronavirus crisis.

In its statement on Tuesday, AMC said it needed new liquidity sources or a boost in cinema attendance to meet its financial obligations beyond early next year, with the Kansas-based exhibitor indicating that it is considering raising fresh debt and equity financing to assure its viability beyond that time.

The company said that it is also investigating potential rent renegotiation with its landlords, asset sales, joint ventures with business partners and minority stake sales, while noting that these possible liquidity sources may not be realised, and if available may not be adequate to meet its cash requirements.

AMC has reopened 83 percent of its US cinemas since COVID-19 forced closures in April, but noted that some of its most productive theatres remain closed and that a program of intensified cleaning to assure hygiene had added to costs.

Rise and Fall of the Wanda Empire

Until 2017 Wanda was among China’s highest profile and most aggressive investors in international assets, picking up European football clubs, a yacht manufacturer, and real estate assets including hotels, offices and residential projects in the US, the UK, France, Spain and Australia.

After its initial purchase of AMC, Wanda retained an 80 percent stake in the theatre chain following its $1.7 billion 2013 IPO. AMC later went on to acquire rival chain Carmike Cinemas for $1.1 billion, and London-based Odeon and UCI Cinema groups for $1.2 billion, to create an 11,000 screen platform that ranks as the world’s largest.

Wang’s international ambitions came to a screeching halt in 2016 when China’s central government began cracking down on debt-fuelled cross-border investment in an effort to squelch outbound cashflow.

In 2017 the developer, which had scooped up $35 billion in overseas assets between 2012 and 2017, started selling off its empire.

During that year Wanda agreed to sell its mainland movie studio assets to Hong Kong-listed Sunac China Holding, in a deal which included its Tianjin-based rival also taking over a 91 percent stake in Wanda’s theme park developments.

In 2018 Wanda sold off its Beverly Hills mixed-use site for $420 million and also disposed of its One Nine Elms site in London at a £30 billion loss.

The asset sales continued this year with the company selling its interest in the Ironman triathlon series for $730 million after that company’s stock price fell by half. Then in August, Wanda sold its 90 percent stake in the 101-storey Vista Tower in Chicago for $290 million, rendering AMC the last of Wanda’s overseas trophies.

COVID Lays Waste to Cinemas

But the COVID-19 pandemic has disrupted traditional cinema consumption. Since April, film studios have been shifting high profile movie titles onto the 2021 calendar, or to premium video on demand (PVOD) platforms. According to analysts at 7Park Data, Mulan’s Disney+ premiere earned the House of Mouse a respectable $250 million; Pixar’s big ticket Soul is planned for December.

Things were grim in April when AMC shares tanked and S&P rated the company as “default imminent, with little prospect for recovery.”

On 8 October, AMC’s primary US rival, Cineworld’s Regal Cinemas, announced that it would be closing its US and UK venues for the rest of the year.

That’s entertainment.

Cue: loud applause!