Wang Jianlin’s sleight of hand made a ten-acre project disappear

Dalian Wanda Group today said that it no longer has possession of a £470 million London housing project, with sources familiar with the newly transferred property indicating that the Chinese developer has transferred the Nine Elms Square site to a pair of Hong Kong-listed, Chinese developers.

The reports come just one day after one of the project’s sellers, St. Modwen Properties of London, announced to the London stock exchange the successful completion of a sales and purchase agreement signed with Wanda two months ago.

The mainland developer, which has been taking flak from Chinese authorities over its outbound deals, is said to have transferred the 1,821-unit project to Guangzhou R&F Properties and Chongqing-based CC Land, marking the latest effort by Wang Jianlin’s troubled conglomerate to offload its overseas projects.

Wanda Denies Done Deal

The confusing nature of a transaction that looked clear and completed yesterday was reflected in news stories based on Wanda sources today. In statements to local and international media, Wanda rejected the idea that it owned the site, telling news agency Bloomberg that its International Real Estate Center is “no longer in pursuit” of the Nine Elms Square land, while Reuters reported that the same entity “no longer has ownership” of the site. The International Real Estate Center is a department of Wanda in charge of overseas mergers and acquisitions. Requests from Mingtiandi to Wanda for clarification of its earlier statements went unanswered at the time of publication.

The divergent reports came a day after St. Modwen – half of a joint venture with French construction firm Vinci that had owned the property – had announced to the London Stock Exchange that the sale had been completed “following an exchange of contracts announced on 21 June 2017.” While leaving the buyer unnamed, the statement points back to St. Modwen’s announcement on June 21 that it had exchanged contracts for the sale of the same project with Wanda Commercial Properties (Hong Kong), an unlisted Hong Kong unit of Dalian Wanda Group.

However, a report from London’s Estates Gazette this afternoon, citing sources familiar with the property, confirmed that Wanda had completed its acquisition of the Nine Elms Square site, before transferring the property to R&F. Later, Michael Lee, R&F’s corporate finance director told Bloomberg in an interview that his company was buying the site in London’s Battersea area together with CC Land, which first landed in London with its $1.42 billion purchase of the “Cheesegrater” office building in March of this year.

R&F Rides to Wanda’s Rescue Again

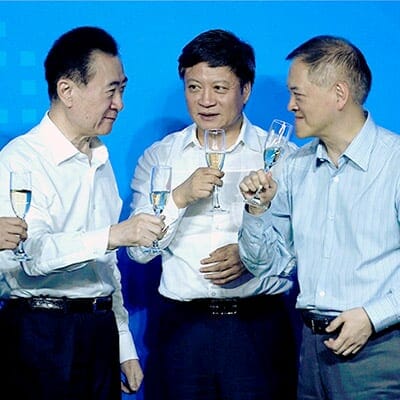

From left to right, Wanda’s Wang Jianlin, Sunac’s Sun Hongbin, and R&F’s Li Sze-Lim, toasting a mega-deal

R&F’s unexpected purchase of Wanda’s London site, which has not been formally announced, echoes last month’s blockbuster deal in which R&F suddenly agreed to buy a horde of 77 hotels from Wanda for RMB 19.9 billion ($2.9 billion) – at a discount of 40 percent over what another developer, Sunac China, had already agreed to pay for the portfolio the week before.

Wanda is seeking to unload real estate assets under pressure from Chinese regulators, which have cracked down on the firm’s debt-fueled acquisition spree. Less than two weeks ago, the group’s Hong Kong-listed unit Wanda Hotel Development announced a plan to sell its stakes in nearly $4.5 billion in real estate projects across Britain, the US, China and Australia to a privately held company controlled by Wang and his family.

The confusion over the fate of Nine Elms Square is not the first time that Wanda’s statements about its overseas ventures have induced whiplash. Among the assets that Wanda Hotel Development proposes to transfer are a 60 percent stake in a pair of Australian flagship projects totalling $1.5 billion in Sydney and the Gold Coast. The previous day, Wanda had denied reports that those projects were for sale.

New Deal Builds R&F’s British Footprint

After this week’s close and flip, Nine Elms Square might be better named Hot Potato Plaza

It’s probably no coincidence that Nine Elms Square is next door to an R&F project, Vauxhall Square, which the developer bought from CLS Holdings for £157.7 million ($196 million) this past April. The 3.4 acre site has planning permission for development of a residential-led, mixed-use complex totalling 1.5 million square feet (139,000 square metres). R&F Properties is expected to invest about £1 billion ($1.24 billion) to deliver the project.

The acquisition came two weeks after R&F made its first bet on London real estate by purchasing a pair of residential sites in south London’s Croydon for £60 million ($74.8 million). Adding Nine Elms Square to its British property portfolio gives R&F ownership of two large developments on the Vauxhall side of the London regeneration zone.

When Wanda agreed to pick up the Nine Elms Square project in June, plans called for a residential-led complex featuring three towers with 1,821 units. The project was envisioned to complement Wanda’s adjacent property, One Nine Elms, which is slated to be a 1.14 million square foot (106,000 square metre) residential and hotel complex featuring twin towers if it is ever constructed. The developer scooped up that site for £88.8 million in 2013 in its first British deal, and has since struggled to get its flagship UK property off the ground.

Leave a Reply