Prime Minister David Cameron seems to think that China will invest more if he acts friendly

Chinese president Xi Jinping is staying at Buckingham Palace and having lunch with Queen Elizabeth II on Tuesday, but China’s recent investment behavior indicates that the UK might not derive the economic benefits it’s looking for by rolling out the red carpet for the visiting Chinese leader.

While Beijing seems keen to further burnish the stature it built with Xi’s trip to the US last month, David Cameron’s government is betting on becoming China’s “best partner in the west,” by opening its doors to Chinese investment in critical sectors such as airports, telecommunications and nuclear power.

Despite criticism from the US and other western countries for overlooking China’s island building campaign in the South China Sea, and a fierce crackdown on dissent, Cameron’s Chancellor of the Exchequer has said that the UK wants to “create a golden decade” for relations between the two countries.

However, if this year’s real estate investment figures are any guide, Cameron’s all out push to curry favor with Beijing may fail to bring in the deals sought.

Despite the bowing and scraping so far this year, large-scale Chinese investment in UK real estate has dropped nearly 50 percent compared to last year. Significantly, China’s sovereign wealth funds, which led the way into the UK market in 2012, have ignored UK projects in favor of deals in continental Europe, Australia, and even Japan in 2015.

Cameron Courts the Middle Kingdom

During his visit to Shanghai last month Chancellor George Osborne endorsed China’s financial markets

During Xi’s weeklong visit to the UK, Prime Minister Cameron will lead the Chinese head of state on a tour to the northern England city of Manchester, where mainland companies are leading the development of a new airport. Xi will also address UK lawmakers at the House of Parliament in Westminster.

This warm reception for the Chinese leader comes after the UK pushed aside objections from the US earlier this year to become the first major Western nation to sign up for Beijing’s Asian Infrastructure Investment Bank (AIIB).

And just last month, in a warmup trip before Xi’s visit, Osborne led a delegation of Chinese government and business leaders to China to promote trade between the two countries. During that visit, Osborne pointed to Britain’s success in attracting Chinese investment in recent years as proof that its romance was bringing dividends back home.

According to Osborne, the UK has attracted more Chinese investment since 2010 than Germany, France and Italy combined. In terms of major real estate deals, counting transactions of $50 million and up, the UK has also seen some success, with the country bringing in nearly $8 billion in such deals since the beginning of 2012, to rank second only to the US globally (which brought in over $10 billion in such transactions over the same period).

What If You Run to China and It Doesn’t Run to You?

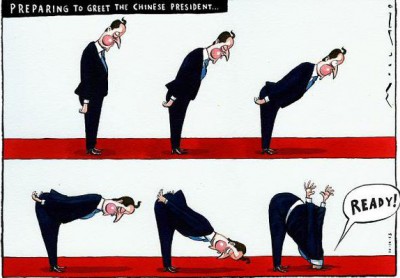

A cartoon in the Times of London this week gave its own interpretation of preparations for the visit.

While there is no disputing Britain’s record in attracting Chinese investment in the past, it’s easy to question to what extent these deals are due to friendly visits.

Despite the efforts of the Cameron government this year, at least in the real estate sector, all of the good will gestures and kind words have yet to translate into deals.

Major Chinese purchases (transactions of $50 million or more) of UK real estate totalled just $1.48 billion over the first three quarters of this year, compared to $2.93 billion over the same period last year, according to figures compiled by Mingtiandi.

By contrast, although the US has butted heads repeatedly with China this year over everything from Beijing’s island building campaign to cyberattacks, Chinese purchases of US real estate climbed to $3.75 billion in the first three quarters of this year, already surpassing 2014’s full year total of $3.69 million in large scale deals.

Chinese Investments Driven By Self-Interest Not By Friendly Gestures

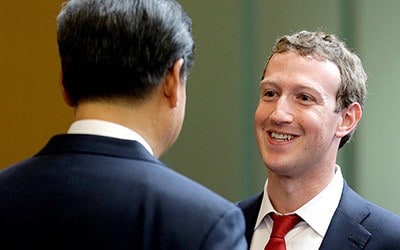

When Xi visited the US last month, Mark Zuckerberg asked the Chinese leader to name his baby. Facebook is still blocked in China, as it has been since 2009.

To further underline the degree to which Beijing disregards kind words and friendly gestures in its business decisions, some of the biggest deals in the US this year were driven by Chinese state-owned enterprises, including the Bank of China buying an office building in New York for $600 million, and Anbang Insurance acquiring its second New York building for $415 million, after spending $1.95 billion on the Waldorf Astoria last year.

Adding to Cameron’s frustrations could be that even after displays of friendship, such as joining the AIIB, China’s sovereign funds – which have blazed the trail for investments by Chinese corporates and institutions – purchased just $292 million in UK real estate assets so far this year, compared to more than $1.54 billion last year. In 2013, when the memory of Cameron’s 2012 visit with the Dalai Lama – whom Beijing views as a dangerous separatist – was still fresh, China’s sovereign funds purchased $1.86 billion in UK real estate, more than they bought in all other countries combined.

In 2015, however, despite state visits and kind words, China’s sovereign funds have instead headed to where exchange rates and quantitative easing have created the sort of welcome they truly appreciate. This year the managers of China’s sovereign wealth have opted to invest $1.79 billion into real estate in Australia, $532 million into France, and another $495 million into Belgian property.

And despite ongoing disputes with Japan over islands claimed by the two countries, and a propaganda campaign that centred on celebrating the 70th anniversary of the Chinese communist party’s victory over Japan in World War II, China’s largest sovereign wealth fund still bought $1.2 billion in Japanese real estate this year – about four times what Britain received.

So during 2015, at least in the real estate sector, China’s biggest investors have warmed to countries that demonstrate the opportunity for an economic upswing, and where assets appear to undervalued. This economic approach to investment decisions makes it likely that the biggest beneficiary of the warm welcome for Xi and his entourage will be the Chinese regime itself, which appears happy to burnish its reputation with the honours and receptions, and then do its property shopping elsewhere.

Leave a Reply