Savills research from earlier this year shows Asian investors are warming up to UK student housing

GIC, Singapore’s sovereign wealth fund, is partnering with Dubai-based Global Student Accommodation Group (GSA) to buy a portfolio of UK student housing projects from funds managed by Oaktree Capital Management which are expected to be worth £700 million ($900 million) when completed.

None of the parties involved released figures on the value of the transaction, but earlier reports had indicated that the assets were expected to trade for £430 million ($559 million).

The purchase marks the second time a state-owned Singapore investment fund has bought into the UK student-housing sector this year. Mapletree, a real estate investment and development subsidiary of investment firm Temasek Holdings had acquired a portfolio of 25 buildings and more than 5,500 beds from Mansion Student Accommodation Fund’s Ardent Portfolio for £417 million ($594 million) in March.

Student housing has been rising in popularity with investors globally and Oaktree had reportedly been seeking a buyer for the UK portfolio since last year.

Asian Funds Head Back To School

GIC’s Madeleine Cosgrave believes student accommodation is a good bet in a low-yield environment

“As a long-term value investor, we believe student accommodation will be a sector that continues to deliver steady rental growth and resilient income returns amidst a challenging, low-yield environment,” Madeleine Cosgrave, head of Europe for GIC Real Estate said in a prepared statement.

The portfolio includes 7,150 beds in 11 cities, according to GIC. Of this total, 3,634 beds in Liverpool, Bristol, London, Edinburgh, Cardiff and Southampton are currently operational. An additional 3,516 beds in five cities are currently being built and will come online during the next two and a half year.

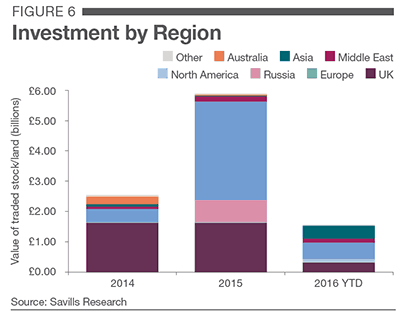

Long dominated by UK and North American institutional investors, the acquisitions by GIC and Mapletree are part of a migration of Asian investors into the student housing market as a growing surge of liquidity compresses yields in traditional target sectors such as core office assets. In 2014 and 2015, Asian investors had purchased a total of just £102 million ($131 million) in student housing assets, research from Savills showed, with that number jumping to £437 million already this year.

This activity comes one year after investors poured a record £5.9 billion ($7.5 billion) into the UK student-housing sector. While the Brexit aftermath is expected to bring down total investment in the student-housing market this year, JLL estimated that a total of £3.5 billion ($4.5 billion) will still still find its way into the lucrative niche in 2016.

Student Housing A Brexit-Proof Investment

While Brexit and the corresponding fall of the pound has hit the UK’s residential and commercial sectors hard, the impact on the student-housing sector is expected to be more limited.

A report from JLL noted the UK’s educational institutions are unlikely to be affected by the Brexit since only six percent of full-time students come from the EU. The firm also pointed to the sector’s resilient performance during the global financial crisis as another reason investors are high on student housing.

Rental growth in the sector last year was 3.65 percent with student numbers continuing to grow and supply unable to meet demand, Knight Frank research revealed.

Leave a Reply