Hyatt heir John Prtizker is joining forces with a Hangzhou car part maker for some upscale hotels

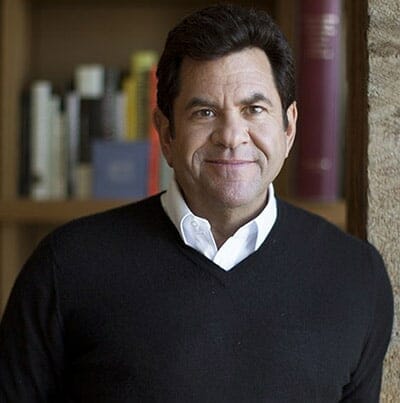

Geolo Capital, the private equity firm controlled by Hyatt heir John Pritzker has announced a partnership with Wanxiang America to invest up to $1 billion in US hotels.

Wanxiang America, the US branch of Hangzhou’s Wanxiang Group, is already one of the leading Chinese investors in US real estate, having acquired more than 60 properties nationwide since 2010.

Now the Chinese firm, whose main business is auto parts, is teaming with Pritzker, whose personal fortune is estimated at $2.2 billion, to search for investment opportunities in the US.

The deal confirms the ongoing interest among mainland investors in buying hospitality properties, after Chinese companies and institutions acquired more than $3.3 billion in hotels last year.

Two Deals Down, More to Come

Wanxiang already bought a minority stake in Geolo’s Carmel Valley Ranch in northern California

Out of the $1 billion that Geolo and Wangxiang have ear-marked for acquisitions, $400 million has already been spent, according to a statement from Geolo.

The two partners recently joined in buying the 60-room Ventana Inn & Spa in Big Sur, California, and from from Walton Street Capital and OakTree Capital Management, and Wanxiang acquired a minority stake in Geolo’s Carmel Valley Ranch resort in Carmel, California.

“We are honoured and excited to join with Wanxiang to leverage our individual strengths and capital to expand our portfolio with investments in iconic properties in world-class destinations,” said John Pritzker, who founded the real estate private equity firm.

Geolo, which owns the high-end boutique hotel chains Thompson Hotels and Joie de Vivre through its Commune Hotels & Resorts division, will manage the two properties through Commune.

Targetting Calfornia, Texas and Illinois

With these initial deals completed, Geolo and Wanxiang say they are searching for more hotel opportunities.

“We look forward to expanding our relationship with Geolo and investing in additional value-add and irreplaceable hospitality assets nationwide,” said Larry Krueger, managing director of Wanxiang America Real Estate Group.

According to the statement from Geolo, the new partnership is looking for up to $600 million in additional properties in California, Texas and Illinois.

Wanxiang Discovers Hotels

Although Wanxiang’s core business is in automotive, in the company has also become perhaps the most prolific Chinese purchaser of US real estate.

Even before the deal with Geolo, the Hangzhou-based firm had, by its own account, bought more than 60 properties in the US, with at least 17 of these deals costing the company $2.5 million or above.

The company is new to hotels, however, having previously purchased office towers, shopping centers, warehouses, homes, medical buildings and student housing, primarily in the midwest.

In opting for hotels, Wanxiang is joining a number of other Chinese investors, both corporate and institutional, in looking for ways to profit from an expected rise in tourism globally.

So far this year, not counting Wanxiang’s partnership with Geolo, Chinese investors have acquired more than $705 million in overseas hotels, according to Mingtiandi’s database of Chinese cross-border deals, with the US being one of the biggest investment targets.

Earlier this year, China’s Sunshine Insurance bought the Baccarat Hotel in New York for $230 million, paying more than $2 million per room for the boutique property. Then in March, Shanghai’s Fosun Group said that it was drawing up a list of 50 hotels globally that it would target for its own acquisition spree.

Leave a Reply