The Dalian Wanda Group, which made headlines earlier this year when it purchased US theatre chain AMC Entertainment, is going after more American assets – this time in the hotel sector.

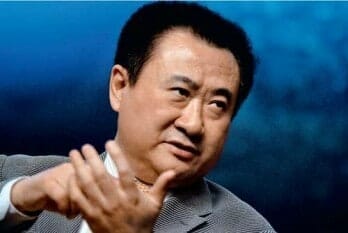

Last week, the company’s chairman, Wang Jianlin, announced that Wanda Group is in talk with “well-known” hotel chains concerning acquisitions in the US.

Wanda, which started out in real estate in China, and has since branched out into tourism and retail reportedly plans to invest US$10 billion in the US in the next ten years, and is targetting famous brand hotels in New York, Los Angeles, and the Washington, DC area.

Wanda bought AMC for US$2.6 billion in September of this year, and is also said to be near an agreement with movie studio Fox to co-produce films in China.

In an interview with Reuters last week, Wang said,

“We are in discussions with hotel management companies in the United States and are seeking opportunities for mergers and acquisitions; and we are in negotiations with the city governments of Washington D.C., New York City and other American cities for the construction of hotels, department stores and commercial properties.”

As returns on US Treasury bonds and other government securities decrease, and as Chinese investors increase in sophistication, many large Chinese firms are looking for opportunities to invest directly in foreign countries.

In November of this year, China’s commerce minister, Chen Deming, predicted that Chinese outgoing investment would be equal to inward investment into China within 10 years.

According to Forbes magazine’s annual Rich List, Wang is China’s third-richest man.

[…] Wanda Group, which has recently been in the news for buying theatre chain AMC and shopping for hotels in the US, inked a deal on Friday which will make it the first mainland Chinese developer to invest in […]