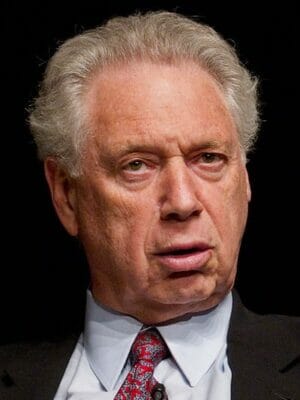

Aecon’s John Beck is selling his firm to a Chinese state-owned giant

China’s much-hyped One Belt, One Road initiative seems to be stretching across the Pacific, as a mainland construction giant buys one of Canada’s biggest builders for C$1.51 billion ($1.18 billion). The cross-border infrastructure acquisition comes after Chinese authorities put real estate trophy deals off limits, and follows just one week after the belt and road was added to China’s constitution.

Toronto-based Aecon Group agreed to be acquired by CCCC International Holding Limited (CCCI), the overseas investment platform of state-owned China Communications Construction Company Limited (CCCC), at a 42 percent premium to Aecon’s share price on August 24, according to a statement by the Canadian firm.

Aecon’s board of directors has unanimously recommended the transaction, which concludes a sale process that began this past August. Expected to close by March, the deal would mark the ninth-biggest Chinese purchase of a Canadian firm, according to data cited by Reuters. The transaction still requires regulatory approval in both countries.

Aecon will continue to use its brand name in Canada and will retain its Canada-based employees and management team, the company said. The Toronto-listed group, Canada’s third-largest construction contractor by revenue last year, helped build the city’s landmark CN Tower and the Vancouver Sky Train.

Chinese Investment Poised to Boost Canadian Builder

Aecon Group is Canada’s third-largest construction firm by revenue

“This transaction creates significant and immediate value for Aecon shareholders, strengthens our competitive position in Canada and abroad with enhanced capabilities and financial resources, and provides expanded opportunities for our people,” commented John Beck, Aecon’s president and CEO in the statement. “We look forward to partnering with a global leader while retaining Aecon’s Canadian headquarters and values.”

Beck added that he is working with the Aecon management team and CCCI on CEO succession planning, a process that began last year. The statement also noted that the acquisition would give Aecon greater access to capital, allowing the firm to bid on larger and more complex projects in Canada along with more international projects.

“We will continue to rely on John’s experience and leadership as we together take Aecon to a new level,” commented CCCI president Lu Jianzhong.

Mainland Construction Behemoth Lumbers Abroad

Through the deal, CCCC will establish a major foothold in Canada’s construction market, which is poised for growth driven by the government’s push for infrastructure investment, the Hong Kong-listed firm noted in a stock exchange filing.

Ranked third in Engineering News-Record’s list of the world’s top international contractors last year, CCCC has been expanding abroad as both an infrastructure builder and real estate developer. The group has invested or committed over $1.9 billion on major overseas projects in recent years, from a $1.4 billion Sri Lanka port facility to a $290 million investment in Related’s mixed-use Grand Avenue complex in Los Angeles.

The mainland giant has also been adding overseas construction firms to its shopping cart, buying Houston-based offshore engineering company Friede & Goldman in 2010 and scooping up Aussie engineering and construction firm John Holland in 2015. Since it acquired the latter for $879 million, CCCC has been expanding the business of the Melbourne-based firm into property development.

In early 2016, John Holland announced a A$1.1 billion ($779 million) CCCC-funded budget for development and investment focussed on residential and hotel projects. The company purchased the former ANZ Bank Building, an office tower in downtown Sydney which is approved for redevelopment, in a deal worth A$80 million ($60 million) this past June.

The real value of Aecon is much much more than what the chineese are offering. I thinks shareholders must refuse the offer and the gouvernement of canada must act to stop such a deal.