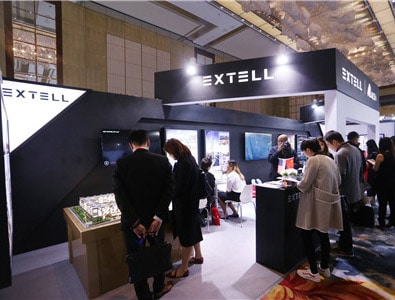

Ausin China was appointed as agent for New York’s Extell earlier this year

Australian real estate brokerage Ausin has removed references to 17 of its group offices in China from its website and says that it has reported the head of its Chinese affiliate to authorites after the company’s mainland operation collapsed without accounting for deposits and other payments owed to Ausin’s mainland customers which affect A$100 million ($73.1 million) in Australian property projects.

The business failure has led to claims of fraud and bad faith by Chinese clients of the off-the-plan real estate project marketing specialist, while the management of the Sydney-based parent company attempts to distance itself from a Chinese unit that until this month comprised 65 percent of its total number of offices globally.

Nearly two weeks after the controversy first surfaced in the Australian press, Ausin’s mainland offices are shuttered, the whereabouts of its chief representative for China remain unclear, and the Australian parent company is recommending that its Chinese customers whose payments for homes in Australia, North America and Europe went missing “to report their case to the Economic Crime Investigation Department (ECID) on China,” while clarifying that the company which once marketed the strength of its Chinese connections, “operates exclusively in Australia.”

Clients Accuse Ausin of Fraud

Dissatisfied customers took out their frustrations on Ausin China’s front door

By August 15th a video posted on Chinese social media site Weibo showed angry customers scrawling graffiti on the door of Ausin’s Shenzhen office with half-metre-high characters spelling out “Australian money laundering”, “Australian fraud group”, and “black brokerage”.

A report in the Australian Financial Review on August 16th, citing sources at Ausin, said that due to alleged misappropriation of “tens and millions of dollars”, by company managers, Ausin clients in China had lost home purchase deposits and other payments through the collapse.

“Although Ausin China didn’t announce the closure of its business in China, its offices in Shenzhen, Beijing, and Shanghai have already shut down,” a senior official of Ausin China was quoted as telling mainland business site Yicai last week on condition of anonymity.

Prior to the shutdown of the brokerage, which offered Australian properties, financing, and even immigration visas for Chinese clients, the company had operated offices in Beijing, Shanghai, Guangzhou, Nanjing, Hangzhou, Wuxi, Suzhou, Ningbo, Kunming, Changsha, and Xi’an in addition to its mainland headquarters in Shenzhen.

Ausin China Rep Vows to Make Clients Whole

In response to Ausin client protests, the company’s China representative Harry Jin wrote a public letter, as posted online by Weibo account Shaoshuai-Shawn, saying that the Shenzhen agency which sold 8,000 Australian properties in the past 10 years is in dire financial straits and unable to refund customer payments at present, without specifying what happened to the monies.

“I will not approach the future pessimistically,” Jin proclaimed, adding that, “if all of you can give me two to three years, I’m confident that I can make up to your losses.” According to Australian media The Urban Developer, approximately 130 transactions across 15 developments in Australia were affected by the collapse and brought a potential impact on the Australian property sector of around $100 million.

Jin’s company formerly represented some of Australia’s biggest developers and in February of this year was appointed as sales agent for New York’s Extell, which developed the One57 project in Manhattan.

Ausin Group Throws Blame on Rogue China Unit

Ausin China representative Harry Jin has vowed to put everything back together again (Image: Ausin China)

One day after Jin’s letter went public, the Australian brokerage announced that it had terminated its relationship with its China unit and said that the Shenzhen company and Jin had violated company procedure and misappropriated client funds.

“Recently, allegations surfaced from overseas Chinese buyers that monies related to property exchange and settlements were paid directly to Mr. Jin. This behavior was directly in breach of Ausin Group (Australia)’s agreement with Shenzhen Ausin Investment Consulting, which expressly prohibited the collection of any funds,” said the Australian group said in a statement published on its website on August 16th.

The Sydney head office characterised its relationship with the Shenzhen-based firm as a licensing agreement with the Chinese operation having no direct ties to the Australian parent, which chief executive Joseph Zaja insisted is still operating normally.

Although the Australian company was eager to distance itself from the China controversy, according to company registration data accessed via Chinese corporate research service Tianyancha, Shenzhen Ausin Investment Consulting is a direct subsidiary of Ausin Australia. The Shenzhen company was set up in 2008, with a registered capital of RMB 8.2 million.

The company, which sells more than 3,000 apartments and houses every year to Asian buyers, said in a statement on its website dated August 22nd that, “The group is currently working with each affected buyer to understand their position and determine the options available to them.” However, the company also declared that “Ausin Group (Australia) does not, and has never, collected funds on behalf of any purchaser,” while adding that, “Ausin Group (Australia) Pty Ltd is a licensed real estate agent that operates exclusively in Australia; selling properties on behalf of client vendors.”

Since the report of Ausin China’s collapse first appeared in the Australian Financial Review, Sydney-based Ausin has removed references to its 17 offices in China from its corporate website.

Ausin Group Runs Aground After Financing Cut Off

Ausin Group financial distress can be traced back to 2016 rules on mortgage lending to non-residents passed in Australia that have made it more difficult for Chinese buyers to pay for Australian homes. Since those rules were introduced, leading Australian developers Mirvac and Lendlease terminated their marketing relationships with Ausin Group, and during 2017, Ausin Group attempted unsuccessfully to negotiate with Blackstone,to provide $5 billion in alternative financing to support foreign home purchases in Australia.

However, in early June, the Australian Financial Review reported that Australian financial services firm Westpac ended a $600 million mortgage facility to support Ausin customers, although Ausin’s Zaja denied the account at the time.

Leave a Reply