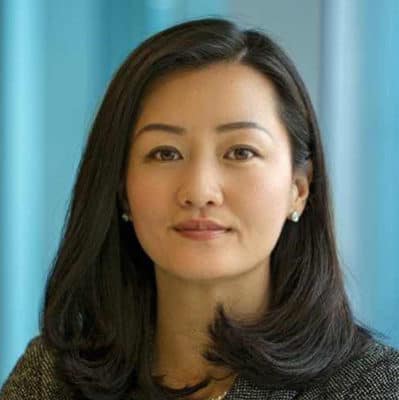

Claire Tang, LaSalle Investment Management head of Greater China, brings 5 more high-spec sheds to the mainland

LaSalle Investment Management has broken ground on five new logistics developments that will deliver 359,000 square metres of new warehouse space to China by July next year, according to an announcement by the company.

The set of high-spec sheds will bring the investment manager’s portfolio of completed “Logiport” brand facilities to over one million square metres (10.8 million square feet) of gross floor area in the mainland, as the US real estate investment manager moves to capitalise on China’s e-commerce-fueled demand for new warehouses.

“The market fundamentals for China logistics remain compelling,” said Claire Tang, LaSalle Investment Management head of Greater China. “Consumer purchasing driven by technology and e-commerce has been rapidly pushing up the demand for modern logistics facilities located in top tier markets.”

The company, an independent subsidiary of NYSE-listed Jones Lang LaSalle (JLL), currently manages approximately $3 billion of industrial assets under management across the Asia Pacific region.

Staying Close to China’s Big Cities

The five new Lasalle Logiports are located around the cities of Shanghai, Chongqing and Xi’an, with completion staggered between the months of April and July 2020.

The company is developing a trio of two-storey ramp-up facilities spanning 194,000 square metres near Shanghai, including one at Jiaxing Pinghu Dushan Port in Zhejiang, with all three located within 90 kilometres of the city’s central business district.

LaSalle is also constructing a 97,000 square metre single-storey warehouse with cross-docking facilities 15 kilometres from the centre of Chongqing in southwestern China, while a 68,000 square metre shed, also with cross-docking, is being built on a site four kilometres from Xi’an Airport in the capital of Shaanxi province.

Maintaining the Logistics Momentum

The launch of the new developments comes two months after LaSalle opened the 296,780 square metre Logiport Kawasaki Bay, the largest logistics facility ever in Japan, which it developed in partnership with Mitsubishi Estate and Nippo.

LaSalle’s Logiport Beijing Tongzhou opened in January last year

In August of last year, LaSalle also joined forces with a local partner to expand its warehouse footprint on the mainland when it entered into a $300 million logistics joint venture with JD.com-backed developer China Logistics Property Holdings. The company said that the deal further demonstrated its commitment to investing in the country’s logistics sector, as well as its wish to capitalise on growing demand from online retail and other end-users in the mainland.

The company’s most recent Logiport launch in China came in January last year when it opened a 56,000 square metre warehouse and distribution facility in Beijing, which brought its portfolio to ten in the country.

“We look to continue expanding our logistics portfolio footprint in China,” Tang said in this week’s announcement. “Investing in modern logistics facilities has been a key focus for LaSalle in the region, and we plan to further capture acquisition and development opportunities in this sector in China moving forward.”

Fighting for Spoils in A More Competitive Market

Lasalle’s senior vice president of logistics leasing and business development, Alex Li, said that the company has seen significant pre-leasing activity on its development portfolio.

But logistics sector data for the first quarter of 2019 indicates that there may be challenges ahead as large e-commerce tenants surrender space ahead of relocations to self-owned facilities.

Around 830,000 square metres of new high-standard warehouse space was completed between January and March 2019 in China, with overall vacancy in tier 1 cities flat at 6.8 percent, though it rose by 2.2 percentage points to 12.4 percent in tier 2 cities.

According to CBRE, rental growth has also slowed compared to 2018, with leasing rates in tier one cities and major logistics hubs such as Suzhou and Tianjin climbing at a pace ranging from 0.8 percent to 2.6 percent, while rents in the western China centres of Chengdu and Chongqing fell slightly.

With 3.6 million square metres of new space added across the mainland from April until December last year, the impact of the recent sharp decline in online retail sales on logistics demand could have an effect on the market, according to CBRE.

Leave a Reply