Claire Tang, Head of Acquisitions for China, LaSalle Investment Management

LaSalle Investment Management has opened its tenth logistics project in China, a 56,000 square metre warehouse and distribution facility in Beijing. The new launch brings LaSalle’s portfolio of completed logistics warehouse space in the country to 720,000 square metres, as the $58 billion investment manager bets on Chinese demand for modern sheds.

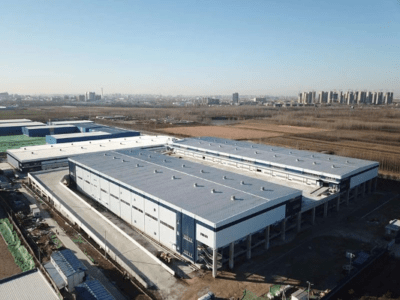

The facility, called Logiport Beijing Tongzhou, is located in the Yongle Economic Development Zone, a municipal-level park in Tongzhou district 50 kilometres southwest of the city centre. The project was developed for one of the funds in the LaSalle Asia Opportunistic Series, Mingtiandi has learned from Alex Li, who heads China leasing as National Director, LaSalle Investment Management.

The company, an independent subsidiary of NYSE-listed Jones Lang LaSalle (JLL), has about $2.6 billion of industrial assets under management across the Asia Pacific region. Just last month, LaSalle completed its first logistics project in South Korea for the LaSalle Asia Opportunity Fund IV (LAOF IV).

New Warehouse Taps Roaring Logistics Demand

LaSalle completed land acquisition for Logiport Beijing Tongzhou in early 2015, and construction commenced in December of that year, Li revealed. Like the company’s other recently completed assets, the facility is 97 percent leased out.

Logiport Beijing Tongzhou has 56,000 sq m of warehouse and distribution space

International brokerage JLL reported a 1.7 percent vacancy rate for industrial space in Beijing last quarter. Active demand from e-commerce and third-party logistics firms outstripped the limited available space in the city, driving transaction activity into surrounding areas including Tianjin’s Wuqing (bordering Tongzhou) and Beichen districts.

The new project, like LaSalle’s Korean facility, shares the same brand name and manager as the LaSalle Logiport REIT, a $1.5 billion real estate investment trust focussed on Japanese logistics assets. The company’s previously completed Logiport assets in China are spread across Shanghai and satellite cities Kunshan and Changshu, as well as Wuhan in central China and Chengdu in the southwest.

LaSalle, which first entered the country’s logistics market in 2007, has five more warehouses in the pipeline across Shanghai, neighbouring Zhejiang province and western China, according to Li.

LaSalle Grows Asian Property Portfolio

“Driven by the strong growth of e-commerce, modern warehouses and logistics facilities, particularly in China, are a bright spot in the Asia Pacific real estate market, and are an attractive investment proposition for investors worldwide,” commented Claire Tang, the company’s Head of Acquisitions for China in a statement.

“Modern logistics facilities have been a key focus for LaSalle in the region, and we plan to further capture land acquisition and development opportunities in this sector in China moving forward,” she added.

The US investment manager has raised a series of funds to capitalise on the demand for high-quality storage and distribution properties in the region. Last November, LaSalle announced it had closed the fourth fund in its Japanese logistics series, JLF IV, with equity of $350 million allowing for a total of over $1 billion in new warehouse investments focussing on the Tokyo and Osaka areas.

The JLF series has completed more than $3 billion of investments and has made $1.5 billion of total equity commitments since it was kicked off in 2004. Besides Japan and China, LaSalle is also targetting future development opportunities in Singapore and Korea via the LaSalle Asia Opportunity Fund IV (LAOF IV). The fund closed in August 2014 with $485 million in total commitments plus $100 million for China logistics deals.

To build on the success of that vehicle, the company launched the LaSalle Asia Opportunity Fund V (LAOF V) in August 2016, which now has a fundraising target of $1 billion in capital. LaSalle has about $58 billion of investments under management worldwide as of the third quarter of 2017, spanning private and public equity and private debt.

Leave a Reply