Blackstone European real estate chief Anthony Myers

Ending days of speculation and months of negotiations, Blackstone Group on Friday confirmed an agreement to sell its Logicor European logistics platform to China Investment Corporation (CIC) for €12.25 billion ($13.82 billion).

The sale by a set of funds controlled by Stephen Schwarzman’s alternative investment giant is the largest real estate transaction in history and caps nearly $35 billion in Blackstone sales of assets and equity to Chinese buyers in less than four years.

The sale agreement followed reports early in the week that Blackstone had locked into talks with the Chinese sovereign wealth fund for the 147 million square foot (13.7 million square metre) warehouse provider, after earlier considering bids from Singapore’s Global Logistic Properties as well as from a joint venture between the city’s state’s Temasek Holdings and real estate investment house Mapletree.

CIC Picks Up Pan-European Warehouse Portfolio

Hard at work in a Logicor facility in Europe

The purchase gives CIC a fleet of investment grade warehouses across 17 European countries, with over 70 percent concentrated in the UK, after Blackstone had stitched together a number of logistics space providers into a united platform.

“We built Logicor through over 50 acquisitions to be a premier pan European logistics real estate company,” Anthony Myers, Blackstone’s head of real estate for Europe said in a statement. Eastdil Secured and Goldman Sachs were lead advisors to Blackstone on the transaction, which is expected to close later this year. UBS acted as the financial advisor to CIC with Clifford Chance providing legal assistance to the Chinese fund.

Nearer to its home base in Asia, CIC is competing with Blackstone and global private equity player Warburg Pincus to buy out $10.3 billion Singapore-listed logistics platform Global Logistic Properties. CIC already owns a substantial stake in GLP’s mainland operation.

Even prior to these warehouse discussion, Blackstone and CIC have been well acquainted for at least a decade. The Chinese state-level fund, which is charged with investing the country’s foreign reserves, spent $3 billion for 9.99 percent stake in Blackstone at its IPO in 2007. CIC later upped that stake to 12.5 percent in 2008.

China Has Been Good to Blackstone

For Blackstone, its top level relationships in China has brought the investment manager much more than just that early equity stake.

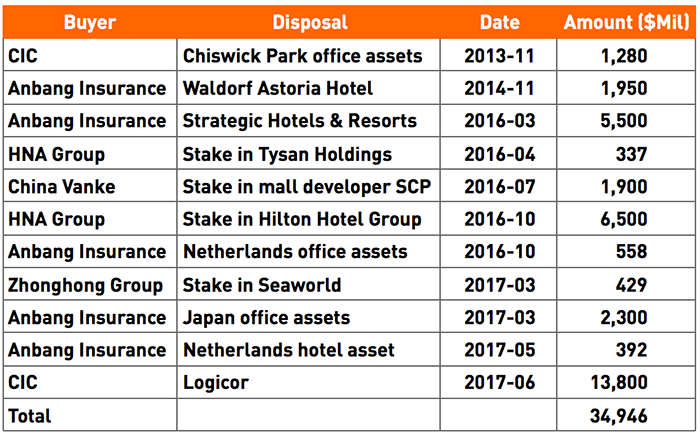

Major sales of assets and equity to Chinese firms by Blackstone since 2013. Source: Mingtiandi, various

The Logicor deal is the latest in a series of sales of assets and equity to Chinese investors that have brought in over $34.9 billion for the investment manager and its funds since they sold an office park near London to CIC for GBP 800 million (then $1.28 billion) in November 2013.

Since that time Schwarzman and his team of investment managers have made an art of selling real estate and other assets to mainland Chinese entities including more than $10 billion in deals with Beijing-based Anbang Insurance. Blackstone has also been involved in more than $2 billion in transactions with the mainland’s second-largest property developer by sales, China Vanke.

Among the best known Blackstone to China sales was the $1.95 billion 2014 sale of the Waldorf Astoria Hotel to Anbang by Hilton Hotels Worldwide. Blackstone is the controlling shareholder in the hotel chain, and later brought in $6.5 billion selling a stake in Hilton to China’s HNA Group.

Leave a Reply