Blackstone Chairman and CEO Stephen Schwarzman

Over the last two years, US private equity giant Blackstone has already sold more than $17 billion in US properties to Asian investors. Now America’s biggest landlord is putting €13 billion ($14.1 billion) in European warehouses on the block, and buyers from China and Singapore are said to be among the leading bidders.

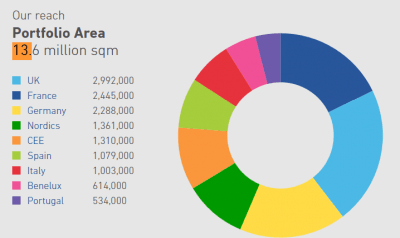

Stephen Schwarzman’s alternative investment firm is shopping Logicor, a logistics real estate platform with around 12.7 million square meters (137 million square feet) of warehouses across Europe, to institutional investors as an alternative to an IPO.

According to a report this week in the Financial Times which cited sources close to the sale, Chinese sovereign wealth fund China Investment Corporation (CIC), Singaporean warehouse group Global Logistic Properties (GLP), and a joint venture between Singapore’s Mapletree and Temasek, are said to be on a shortlist to acquire Logicor in a private deal. If completed the sale of Logicor would be the largest logistics real estate deal in history.

Blackstone is reportedly looking for bids of $13 billion or more for Logicor, a number that includes the company’s debts, which make up 40 percent of its enterprise value. Logicor counts Amazon amongst its clients, is being brokered for sale by real estate investment brokerage Eastdil Secured.

GLP Contest Reflected in Logicor Deal

For CIC and GLP, the European investment opportunity comes at the same time that the two parties are discussing a similar logistics deal in Asia.

CIC is said to be among three bidders vying to acquire GLP and its $8.9 billion in warehouses spread across China, Japan and the America’s. Among the other potential buyers said to be shortlisted in the GLP sales process is Blackstone.

And GLP’s largest shareholder, Singaporean sovereign wealth fund GIC, has already been active in the European logistics market this year, having closed on the purchase of warehouse platform P3 for $2.7 billion. GIC’s purchase of the 3.3 million square metre portfolio from P3 was one of the largest real estate purchases in Europe in 2016.

Logicor IPO Still a Possibility in Growing Logistics Market

Logicor’s 13.6 million-square-metre portfolio

While a bidding between these three Asian powerhouses for Logicor indicates a sale, an IPO is “still very much in the cards,” according to sources cited by the Financial Times. Goldman Sachs, Citi, Morgan Stanley and Merrill Lynch were all appointed to help Blackstone’s Logicor to an initial public offering earlier this month. If Blackstone were to list 30 percent of Logicor, according to Bloomberg, it would be one of the largest real estate IPOs in Europe ever.

Leave a Reply