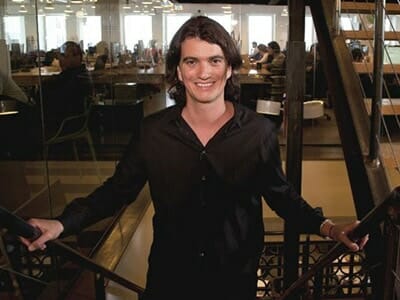

WeWork’s Adam Neumann dares to think outside of the corporate governance box

WeWork lost $723 million in the first half of 2018, but the company’s largest shareholder still found a way to profit from the shared office firm’s business of signing long-term leases with landlords and subleasing rooms, desks and sofas to co-workers, according to an account today in the Wall Street Journal.

The Softbank-backed giant, which had a portfolio of over 5.3 million square feet by the middle of last year, leased some of that space in buildings owned in part by its own CEO, Adam Neumann. WeWork, which is now valued at $36 billion, has signed leases with companies “partially owned by its officers” which will pay those officers some $110 million over the terms of the contracts, according to the Journal account.

These related-party transactions have all been reviewed and approved either by WeWork’s board, or by an independent committee, according to WeWork spokespeople cited in the media account. However, the practice raises questions regarding potential conflicts of interest at a time when a recently restructured investment plan has disrupted the company’s aura of invincibility.

Buying, Renovating, Leasing Out, Refinancing

In one case in New York, Neumann and a group of investors led by fashion designer Elie Tahari in 2015 paid $70 million to purchase 88 University Place, an 84,000 square foot (7,800 square metre) property in New York. After borrowing another $70 million to renovate the Manhattan building, Neumann’s group leased the 10-storey block to WeWork, which then sublet 70,000 square feet of the property to IBM in 2017.

Neumann owns a 50 percent stake in 88 University Place, and terms of the lease by WeWork from Neumann’s group, or the price at which the building was sublet to IBM, were not released.

With 88 University Place now fully leased, Neumann and his partners were able to refinance the property by taking out a $77.5 million loan in late 2018, according to the Journal account.

Questions Raised on Chicago Investment

Neumann is said to have backed a $34 million deal for the Bank of Italy building in San Jose

Neumann’s practice of investing in buildings which could later be leased to WeWork may run back as far as 2013, when the company founder and one-time kibbutz dweller tried to buy a stake of as much as five percent in a building in Chicago where WeWork was negotiating a lease.

At that time, Neumann still owned less than a controlling stake in WeWork and the investment was called off after WeWork’s board raised concerns over a potential of conflict of interest, according to the Journal account.

By 2014, Neumann had gained a controlling stake in the company after a new investment round which involved the CEO being granted Class B shares that carried 10 votes per share. Since that time, Neumann has invested in several buildings that have since been leased to WeWork. According to a prospectus for a 2018 debt offering, during 2016 and 2017 WeWork paid more than $12 million in rent on properties where its officers held an ownership stake.

Searching for Gold in San Jose

During 2017 and 2018 an investor group where Neumann plays a primary role bought up properties in San Jose, California that the group plans to lease to WeWork for a new multi-building campus.

In late 2017, without disclosing Neumann’s involvement, a consortium paid $33.8 million through a series of transactions for the 90-year-old Bank of Italy office building in San Jose, along with an adjoining parking lot and nightclub.

During the second quarter of last year investors led by Neumann are said to have backed the $40 million acquisition of St James Plaza in San Jose. The nine-storey 138,100 square foot office building in the Silicon Valley tech hub has already been leased to WeWork.

Tough Times for Shared Office Giant

The Journal account, which cites experts questioning WeWork’s corporate governance, comes at a time when other questions have arisen regarding WeWork’s stratospheric valuation.

Early this month WeWork revealed that Japan’s Softbank has agreed to invest $2 billion in the company, after reports had been spread late last year that the venture capital giant would be buying a majority stake in the firm for $16 billion.

That financial setback for WeWork is said to also have involved a significant adjustment in the company’s valuation, with the shared space phenomenon seeing its valuation slide from over $42 billion in November last year to a “blended valuation” of $36 billion in this latest investment.

Adam looks like Eve