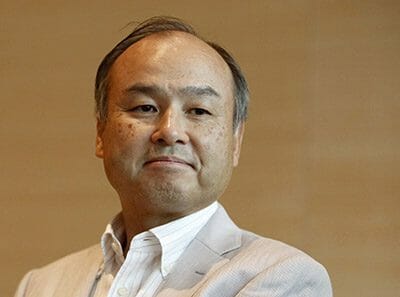

SoftBank CEO Masayoshi Son remains a steadfast supporter of WeWork

Tech investor Softbank has agreed to invest a fresh $2 billion in the shared space giant formerly known as WeWork, according to an announcement on Tuesday by the co-working pioneer.

The new investment represents around 12 percent of the $16 billion that Softbank was earlier said to be committing to the New York-based real estate firm, as market turbulence and reported opposition from among Softbank’s investment partners apparently scuttled a deal which would have given Softbank and its Vision Fund a controlling, majority stake in WeWork and valued the company at over $42 billion,

The down-sized transaction was announced by The We Company, as WeWork is now known, on the same day that it revealed its new branding, with the firm presenting the deal as a $6 billion investment, including $4 billion in cash that had already been committed by Softbank last year.

New Deal Values We at $36B

The $2 billion is said to be divided evenly between $1 billion to buy shares from WeWork employees and investors, at a valuation of around $23 billion, according to an account in the Wall Street Journal, with the remaining $1 billion to be used as capital for growing the company, which is rapidly expanding into residential real estate, education and other activities..

“WeWork is disrupting a multi-trillion-dollar industry with a technology platform that provides a complete solution for space needs. WeWork has already experienced unparalleled growth and we are confident that with Adam’s vision and this growth capital the company will be able to aggressively pursue the enormous market opportunity ahead of them,” Masayoshi Son, chairman and CEO of SoftBank Group said in a statement.

The down-sized deal is said to be moving forward without the participation of Softbank’s Vision Fund, which had been a major backer of Softbank’s previous investments in WeWork, which totalled $8 billion before this latest agreement. The new $2 billion investment puts The We Company at a blended valuation of $36 billion, according to the Journal account, more than 14 percent the $42 billion valuation that had been expected from Softbank’s early plan.

We Work, We Live, We Grow

In a separate blog post on the WeWork.com site, co-founders AdamNeumann, Miguel McKelvey and Rebekah Neumann revealed The We Company branding, with a link to the new We.co web site, which promotes the company’s office space division alongside its WeLive co-living venture and its WeGrow educational division.

“Through the extended WeWork network and the Meetup community, The We Company now touches approximately 5 million people around the world, with the funding to reach millions more,” WeWork CEO Adam Neumann said in the statement. “We’re driven by the impact we know we can have when we all work together with a shared intention. I am grateful to our employees, members, and our incredible partner in SoftBank for their commitment to our mission.”

Since pioneering the co-working shared office flavour in 2010, WeWork has evolved into a major supplier to corporate tenants, and now is expanding its efforts to use its sharing economy approach to win customers in other sectors.

Vision Fund Backers Balk at WeWork Deal

Despite the expanding vision, The We Company and Softbank have had less success in winning investor cash than was expected when word of Softbank’s $16 billion investment was leaked last November.

The planned Softbank and Vision Fund investment in WeWork is said to have included $10 billion to buy out existing investors and would have provided an additional $6 billion in new capital over the next three years.

The investment would have been the largest ever in a tech start-up, however, key investors in Vision Fund, which is said to get the majority of its backing from Saudi Arabia’s Public Investment Fund (PIF) and Abu Dhabi’s Mubadala Investment Co reportedly balked at making that level of commitment to a company that many see as real estate play.

Softbank Keeps the Faith

WeWork launched LKF Tower in Hong Kong’s Central in December

The pared-back investment means SoftBank will no longer be able to gain a majority stake in the shared-office provider. The Japanese venture funding titan currently holds about 20 percent of WeWork, and after this latest deal will have committed $10 billion into the company.

The $6 billion figure cited in We’s statement includes a $1 billion convertible note investment by Softbank in August, which was followed in December by a commitment to invest $3 billion in the company in an equity warrant.

WeWork Plans to Stay the Course

SoftBank’s decision to pull its planned buyout will not affect WeWork’s overall strategy, according to the FT, as companies continue to gravitate to the industrial-chic workspaces and short-term leases that made WeWork one of the world’s hottest startups.

However, without the $6 billion previously ear-marked for expansion WeWork may need to find new sources of cash if it wishes to keep expanding at its current pace.

WeWork began 2019 with more than 400,000 members at 425 locations in 100 cities across 27 countries, according to its statement yesterday. Enterprise customers from companies of over 1,000 employees accounted for over 30 percent of its membership base, and as of September 2018, 30 percent of the Global Fortune 500 are said to be doing business with WeWork.

The New York-based firm’s losses in the first nine months of 2018 nearly quadrupled from a year earlier to $1.2 billion, according to the FT, citing an investor presentation by WeWork. The company’s sales climbed to $1.5 billion during the same period.

Complications to negotiations with SoftBank could also prompt WeWork to hasten planning for a public offering similar to other tech unicorns including ride-hailing providers Uber and Lyft.

Shares in Softbank itself have fallen by 33 percent in the past three months amid a broader sell-off in tech shares which has also hit giants such as Apple, Microsoft and Alphabet.

Leave a Reply