Zendai is best known for Pudong’s Himalayas Center

Dai Zhikang, the founder and legal representative of Shanghai-based property and finance conglomerate Zendai Group, has surrendered to the police after his company was brought under investigation for illegal fund raising with regard to a RMB 10 billion ($1.4 billion) peer to peer lending business.

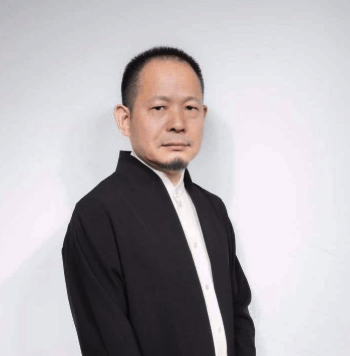

The Pudong branch of Shanghai’s Public Security Bureau announced on its official Weibo social media account on Saturday that Dai, known as “the godfather of Chinese private equity” is said to have confessed to setting up illicit capital pools and embezzlement of funds.

The police are also investigating the developer of Shanghai’s Himalayas Art Center for illegally accepting deposits from individual investors through a pair of unlicensed peer-to-peer funds branded as Laocaibao and operated by Zendai. Dai’s company is said to be unable to repay its depositors.

Fund Shutdown Followed By Founder’s Arrest

Dai’s detention came one week after laocaibao.com, a peer-to-peer lending platform owned by Zendai Group, posted a note on its website from Dai, declaring that the company was not going to “run away.” That note was posted after authorities had forced the closure of Zendai’s Laocaibao funds, which together were valued at RMB 10 billion.

Zendai Group boss Dai Zhikang has surrendered to police

The public security bureau has reportedly arrested 41 suspects in its investigation of the Laocaibao case, including Dai, and has also seized assets held by these individuals.

According to the bureau, Zendai, which has not obtained any state-approved licenses for operating finance businesses, utilized its online platform laocaibao.com together with offline shops to illegally take in deposits from the public.

Police are also asking Laocaibao clients who borrowed from the fund to return any monies received through the scheme to accounts designated by the authorities, and have vowed to pursue any non-complying individuals to recover cash lent through the Zendai business.

P2P Crackdown Continues

The shutdown, which happened alongside staff layoffs, was the result of a government clampdown on the peer to peer lending sector and the termination of Zendai’s partnership with a custodian bank, according to internal Zendai emails which were leaked to the local press.

As Beijing moving to defuse debt bubbles in recent years, it has been cracking down on the shadow lending sector.

A wave of company collapses, including the failure of Shenzhen-based China Create Capital, hit the P2P sector, which was estimated to have outstanding loans of RMB 1.9 trillion ($217.96 billion) last year — an amount far larger than loans made through the sector in the rest of the world combined, according to Reuters.

History of High Profile Projects

A former hedge fund manager, 55-year-old Dai established Zendai in 1992, initially investing in real estate before branching out into finance and cultural businesses.

Dai, a native of eastern China’s Jiangsu province, had established Zendai as one of Shanghai’s most prominent property developers until in 2015 Dai quit the property sector altogether by selling the family’s entire 42 percent stake in Hong Kong-listed subsidiary Shanghai Zendai Property to China Orient Asset Management for HK$1.25 billion, in a strategic shift away from what he saw as the city’s overheated property sector.

Zendai is best-known for developing Shanghai Pudong’s Himalayas Center, which took him more than 10 years to build at a cost of RMB 3 billion. Designed by renowned architect Arata Isozaki, the landmark complex houses a museum and art space as well as the Jumeirah Hotel.

The group was catapulted into the national limelight in 2010 when it agreed to pay a record RMB 9.2 billion for a piece of prime land on Shanghai’s Bund waterfront. When Dai’s group was reportedly unable to pay the full land premium for the trophy plot, it later sold a a partial stake to Guo Guangchang’s Fosun, and later made a controversial deal with Soho China to sell its remaining stake in the project.

In late 2013, Zendai unveiled plans to transform Modderfontein – a suburb in eastern Johannesburg, South Africa – into the “New York of Africa”, making it one of the earliest domestic developers to embark on a “go-global” strategy.

After leaving the real estate industry behind in 2015, Dai singled out culture, financial services and investment among a clutch of sectors including the internet as the new driving forces of the mainland economy. The group’s Ximalaya.com is the biggest audio sharing platform in China with a valuation of about RMB 20 billion, and serves nearly 500 million users.

Leave a Reply