Hong Kong’s minibus king, Ma Ah-muk, is getting 13 floors in the Center

Nearly six months after Li Ka-shing’s CK Asset Holdings sold Hong Kong’s The Center skyscraper to a consortium of investors for HK$40.2 billion ($5.15 billion), the world’s most expensive office building is poised to be divvied up among its new owners on a floor-by-floor basis.

According to local media reports, the members of the consortium that bought the landmark tower on Queen’s Road in Central will convert their respective stakes in the venture into ownership of individual floors early next month. The acquisition last November gave the new owners control of 47 floors within the 73-storey tower, after CK Asset had previously sold off a number of floors in the building on an individual basis.

The decision to sell off the prime building on a strata-title basis comes as the city’s space speculators compete to set new price records for office floors in a bet that rents and capital values will continue to rise.

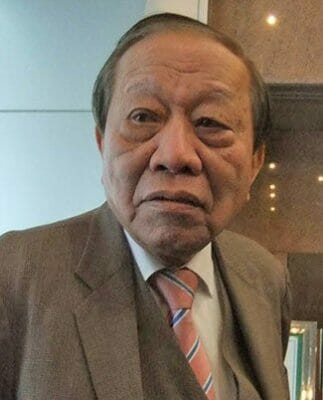

Minibus King to Take the Most Space

Ma Ah-muk, owner of Hong Kong’s largest minibus operator Koon Wing Motors, will take 13 floors in The Center , the most among the new buyers. Ma is estimated to be acquiring his baker’s dozen of floors, which include the high-zone 68th, 69th and 78th floors, for around HK$11 billion.

In September of last year Tai United Holdings sold the 79th and top floor in the Center to an unidentified investor for HK$738 ($94.5 million) which constituted a then record-breaking HK$55,854 per square foot.

Shimao Property chairman Xu Rongmao and Hong Kong businesswoman Pollyanna Chu, who joined the buyer consortium in February following the withdrawal of Beijing-based China Energy Reserve & Chemicals Group Properties (CERCG), are buying nine floors and seven floors respectively.

The Center changed hands for HK$40.2 billion ($5.15 billion) last November

Five floors in the Center go into the hands of Lo Man-tuen, chairman of Wing Li Group, while the remaining 13 floors are taken by a consortium comprising veteran investors Chan Ping-che, Cheung Shun-yee and Tsoi Chi-chung.

Cheung Shun-yee, who holds four floors, said that he is negotiating with multiple potential buyers for the 49th and 50th floors with an asking price of HK$55,000 ($7,007) per square foot, 67 percent higher than the price paid to CK Assets last year, according to a Ming Pao account.

CERCG led the investor consortium that scooped up The Center from CK Asset last November. Given the rents prevailing at the time, the overall price implied a gross rental yield of just 2.2 percent, according to the Wall Street Journal.

Demand for Strata Assets on the Rise

Despite the scant potential for rental returns, strata-titled floors are fetching record prices in Hong Kong’s supercharged office market. Another city price record for office space was said to be shattered last week, when the 34th floor of the Central office tower 9 Queen’s Road Central was reportedly sold for an all-time high of HK$60,000 ($7,643) per square foot.

In another strata title deal this month, the 11th floor of World-Wide House, a dilapidated commercial complex at 19 Des Voeux Rd Central, was sold for approximately HK$735 million ($94 million) according to media reports. The World-Wide House seller made gross profit of HK$134 million on that deal in only ten months, after having purchased the floor in July last year for HK$601 million ($77 million).

Central Office Demand Buoys Strata Prices

As the Center’s new owners rush to divvy up their prize, some of the building’s best-known occupants are already hurrying toward the exits. Two weeks ago, Goldman Sachs was reported to be planning to move out of The Center, where it currently occupies four floors, after its seven-year lease expires in December.

The investment banking giant will relocate its back office staff to Lee Garden Three in Causeway Bay, according to the account. Despite that particular move, demand for commercial space in Hong Kong’s downtown business hub continues to rise, as grade A office rents in Central grew 4.6 percent year-on-year as of end-March, according to data from JLL.

Leave a Reply