Did Wang Shi get gonged by Shenzhen’s state-owned powers that be?

Wang Shi will step down as Chairman of China Vanke, the residential real estate company he formed in 1984 and built into the mainland’s largest developer by value, according to an announcement today by the celebrity entrepreneur.

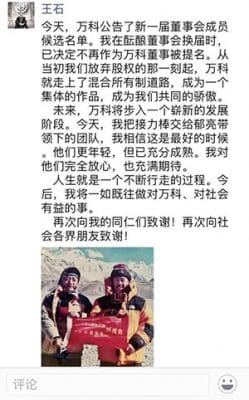

“After considering the restructuring of the board of directors, I have decided not to be nominated as a board member,” the 66-year-old Wang wrote on his WeChat account. “Today, I transfer the baton to Yu Liang and his team. They are much younger but mature enough. I have complete confidence in them.”

The announcement and the handover to Vanke’s long-time president followed a protracted battle for boardroom power with previously little-known financial conglomerate Baoneng, which had sought to oust Vanke’s management. Wang’s statement came on the same day that Vanke announced a new slate of directors, with the company’s founder not among the nominees.

The hostile takeover attempt ended earlier this month when Vanke, which is valued at $34 billion, announced a deal worth RMB 45.6 billion ($6.9 billion) with Shenzhen Metro Group, swapping sites above Shenzhen subway stations for shares. The deal gave Shenzhen Metro a 29 percent stake in Vanke, making the government-owned utility its largest single shareholder.

Can the Victor Be Sent into Exile?

Wang announced the decision today on his WeChat

While Wang appears to have triumphed in his battle against Baoneng and Evergrande, the price of that victory may have been his own departure from Vanke.

During the early stages of the takeover drama, Vanke’s former controlling shareholder, China Resources, which had been the developer’s long-time government-backed sponsor, had raised doubts over whether Wang, who held just 0.069 percent of Vanke shares at the end of 2015, was faithfully serving the company’s ownership. Statements by China Resources, which is one of the mainland’s largest conglomerates and among Shenzhen’s largest enterprises, claimed that Vanke had been taken over by “insider control,” and was being operated by management for its own ends.

Wang, who became a celebrity for his mountain climbing exploits and business philosophy, may have also made himself expendable by ceding day to day control of operations to company president Yu Liang in recent years.

In an article published in Reuters, David Hong, head of research at CRIC Hong Kong, said, “The Wang Shi era has officially come to an end, but he stopped managing the company years ago so his departure will have no impact [on] the company’s operation.” Vanke shares in Hong Kong and Shenzhen moved up 0.72 percent and 0.05 percent respectively today following the news.

Wrapping Up a Corporate Takeover with Chinese Characteristics

While Wang’s abrupt departure may not have come as a shock, the Vanke takeover saga shook China’s real estate and finance sectors.

The 18-month war put Baoneng and its affiliate, Foresea Life Insurance, under fire. Baoneng had financed its stake in Vanke through sales of high-yield “universal insurance” policies and has since been hit with penalties including an indefinite freeze on selling some insurance products and a 10-year ban from the insurance industry for its chairman.

Meanwhile, China Evergrande, which had accumulated a 15 percent stake in Vanke, lost $1 billion after being ordered to sell those shares in its rival to Shenzhen Metro. The developer’s newly acquired life insurance division – which was used to finance the share acquisition – also got slapped with a ban on trading from the CIRC.

Although Baoneng remains a Vanke shareholder and Wang – who once referred to the corporate raider as “barbarians” – has departed, the insurer faces a potentially hostile board. As part of a reshuffle announced to the Hong Kong stock exchange three Shenzhen Metro executives were announced as nominees to the Vanke board as non-executive directors, including the state-run firm’s chairman, Lin Maode. Another are from companies affiliated with Shenzhen’s state-owned assets supervisor which controls Shenzhen metro.

Leave a Reply