Beijing-based real estate company Soho China announced on Friday that it is selling two commercial projects in Shanghai for RMB 5.23 billion ($851 million). The sale price is well below what the developer asked for, as the market for commercial real estate outside of Shanghai’s core downtown areas becomes more challenging.

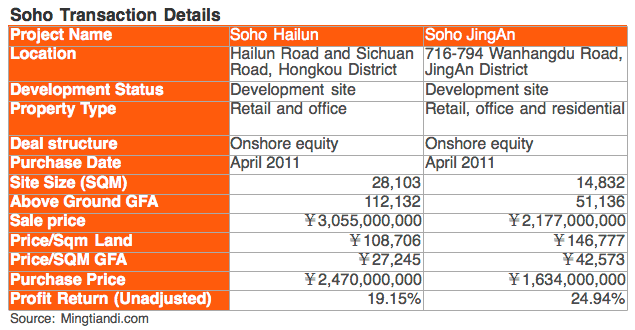

The sale of Soho Hailun Plaza in Hongkou district for a reported RMB 3.06 billion, and Soho Jingan Plaza for RMB 2.18 billion to state-run Financial Street Holdings includes equity in the projects as well as associated loans. Soho had originally put the two projects, along with an additional site in Hongkou district, up for sale for a total asking price of RMB 10 billion during November of last year.

The real estate firm owned by China glamour couple Pan Shiyi and Zhang Xin originally acquired both sites in April 2011 during an aggressive buying Shanghai buying spree. The acquisition price at the time for the Hailun location was RMB 2.47 billion, and the JingAn project in the Caojiadu area near Putuo district was acquired for RMB 1.6 billion.

The combined sale price of RMB 5.23 billion for the two assets that Soho acquired nearly three years ago for RMB 4.07 billion means a fairly pedestrian 22 percent unadjusted return for a developer that had made its name by achieving high margins selling office space on a strata (floor-by-floor) basis in Beijing.

Selling Unfinished Assets for Below New Land Prices

In terms of accommodation value, or the price of the total site divided by the future GFA of the project, the 14,832 square metre Soho Jing’An site seems to have brought good value for Soho at RMB59,743 per square metre for a project which remains largely in the same hole in the ground condition as when the developer purchased it.

By comparison, American cosmetics company Mary Kay last month agreed to acquire The Point Jing’An for RMB 30,454.97 ($5,018.95) per square metre for a finished and occupied building in a less central part of the same district.

However, the accommodation value received for the 28,103.3 square metre Hailun Plaza project in Hongkou was only RMB27,245 per square metre, compared to data from real estate information provider CRIC cited in the South China Morning Post which values land in the area at RMB 32,491.

At the time that Soho put the two assets up for sale in November last year, the Hailun project had achieved no above ground construction, and the Jing’An project had not yet moved beyond the piling stage. There have been no reports of a buyer for the third site made available, a 16,426 square metre site at 10 Hainan Road, Hongkou District which Soho acquired in 2012 for RMB 1.5 billion.

Need to Price Assets by District and Street

While Soho charged into the Shanghai market during the financial downturn by snapping up sites in non-core areas from distressed developers, recent data on sales and rentals for office space in Shanghai show growing differences in the returns for projects in core areas compared to outlying districts.

A report on Shanghai’s office market published last week by real estate consultancy Jones Lang LaSalle, rents in Puxi dropped 2.3 percent in the fourth quarter of 2013, while Pudong rents, driven by strong demand in the Lujiazui financial district were up 2.4 percent.

Hong Kong billionaire Li Ka-shing demonstrated the benefits of investing in the right Shanghai location in October last year, when he sold the soon to be completed Oriental Financial Centre in Lujiazui to China’s Bank of Communications for US$1.155 billion. The accommodation value which Li’s Hutchison Whampoa and Cheung Kong Holdings received in that sale amounted to RMB 64,533 per square metre of gross floor area.

The result of the two asset sales by Soho, with the Jing’An site providing a much stronger return than the Hongkou project, only helps to illustrate the disaparity in fortunes for projects only about 15 minutes drive from each other in Shanghai traffic.

Leave a Reply