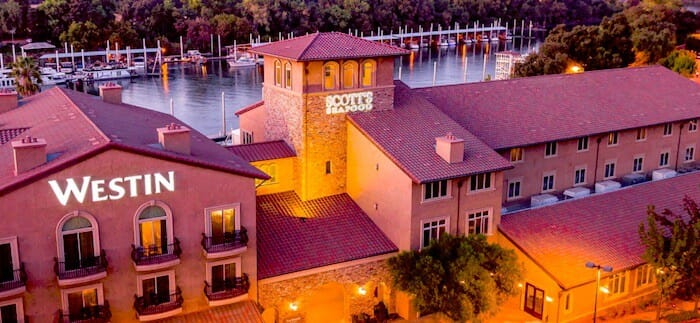

Eagle Hospitality Trust’s 18-hotel portfolio includes the Westin Sacramento

Eagle Hospitality Trust on Tuesday informed its investors that it has shelved a distribution payment due to security holders, after defaulting on a $341 million loan facility.

The managers of the SGX-listed real estate investment trust announced to the stock exchange yesterday that Bank of America had issued a notice of default and acceleration on 20 March, making the $341 million that the trust had borrowed immediately payable.

The default was triggered by non-payment of rent owed to Eagle Hospitality Trust under master lease agreements for hotels in the trust’s portfolio, the managers said, while stressing that the REIT had been meeting its own obligations on the loan from the US banking giant.

Selling Assets to Raise Cash

The announcement comes five days after Eagle Hospitality Trust managers halted trading in its securities to “protect the interests” of security holders amid turmoil in the markets.

On the same day, the managers had announced a planned sell-off of selected assets to increase liquidity “in the face of unprecedented circumstances related to COVID-19 and the significant impact on the United States hotel market”.

When trading was suspended on 19 March, the REIT had been priced at $0.14 per stapled security – a 73 percent drop from its price of $0.52 one month before.

Eagle Trust Hospitality non-executive chairman Howard Wu is facing a liquidity crisis

The REIT, which was listed last May and comprises 18 US hotel properties worth $1.27 billion at their latest valuation, is now, under the terms of its loan agreement with Bank of America, restricted from paying the $0.03478 per stapled security distribution payment due on 30 March to security holders.

The REIT’s 5,420-bed portfolio of upper mid-scale to luxury hotels are spread across 11 metropolitan areas in nine US states, and are operated under brands including Hilton, Sheraton, Holiday Inn, and Westin.

Looming Liquidity Crunch

While reassuring investors that there are sufficient funds in the trust’s bank accounts to pay out the distribution in full, the managers said that the payment had been deferred “pending further discussions and negotiations with the lenders and pending overall assessment of the financial implications of the notice”.

Blaming the situation on the impact of the COVID-19 pandemic, the managers had told investors last week that the REIT was facing liquidity problems as a result of missed third-party payments to master lessees, which in turn pay rent to the trust.

To cover the shortfall, they had proposed to raise cash by drawing down security deposits related to master lease agreements on properties in the trust’s portfolio.

However, with Bank of America having issued a default and acceleration notice, the managers noted any further drawdowns on security deposits could not take place.

“The hospitality market globally and in the United States of America continues to deteriorate at an accelerated pace with steep and unprecedented declines in national occupancy levels due to the global COVID-19 pandemic,” the managers said.

They added that the operating landscape had been changing on an almost daily basis and they were continuing to “work to address developments arising from this fast changing landscape”.

Plunging Occupancy Across US Hotels

Eagle Hospitality Trust’s liquidity crunch comes as the COVID-19 outbreak has triggered a collapse in hotel bookings in the US.

Data analytics company STR last week released its latest figures on the US hotel market, showing that occupancy from 8 to 14 March had dropped more than 24 percent compared to a year earlier, with just 53 percent of hotel rooms full in mid-March.

Average revenue per available room – a significant metric for the hotel industry – was $63.74 — down 33 percent from the year before.

STR had reported earlier this month that, for the month of February, prior to feeling the full impact of COVID-19, occupancy in US hotels stood at 62 percent, while average revenue per available room was $81.33.

“The questions we are hearing the most right now are around how far occupancy will drop and how long this will last,” said STR’s senior VP of lodging insights, Jan Freitag.

Freitag added that, through a comparative analysis of occupancy trends in China and Italy, STR believed that “we are not yet close to the bottom in the US”.

Leave a Reply