Mitsui reported higher-than-expected yield from 50 Hudson Yards in New York

Mitsui Fudosan achieved a record-high attributable profit of JPY 166.4 billion ($1.1 billion), up 13.1 percent year-on-year, in the fiscal nine months to December, according to an update from Japan’s largest developer.

Operating revenue, operating income and ordinary income also reached all-time highs in the fiscal first three quarters, Mitsui Fudosan said in financial results released late last week.

The Tokyo-based company revised its full-year profit forecast to JPY 220 billion, up from a previous view of JPY 215 billion, as hotel operations and overseas leasing surpassed expectations.

Mitsui’s 50 Hudson Yards office tower in Manhattan, completed in late 2022, “started operation with performance far exceeding original plan”, with its net operating income yield of 7.3 percent beating the expected NOI yield of 5.5 percent, according to the financial report.

Activist Investor Pounces

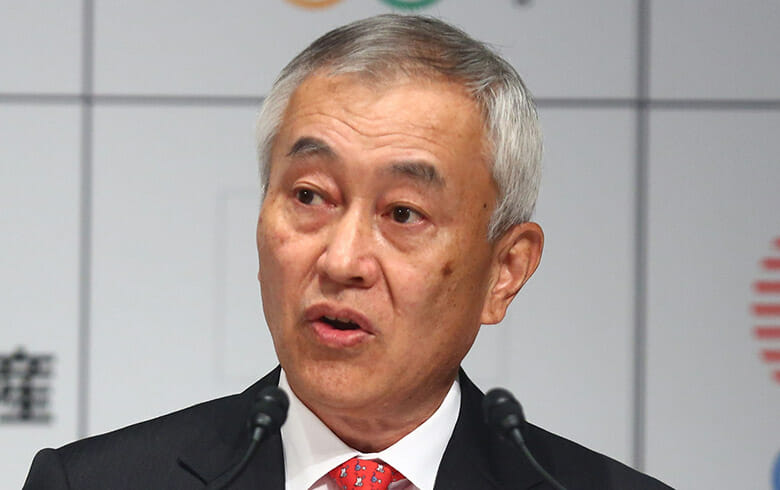

The developer chaired by Masanobu Komoda came under fire earlier this month by US-based Elliott Management over claims that Mitsui’s TSE-listed shares were undervalued.

Mitsui Fudosan chairman Masanobu Komoda (Getty Images)

The activist investor urged Mitsui to launch a JPY 1 trillion share buyback and sell down its $3.6 billion stake in the firm that owns Tokyo Disneyland to help boost the lagging stock price, according to an account in the Financial Times.

Elliott built up a stake of at least 2.5 percent in Mitsui Fudosan over the past year, the FT reported, citing people familiar with the situation. News of the potential repurchase briefly lifted the stock to a record-high price of JPY 4,100 ($27) before shares retreated in recent weeks.

“In order to strengthen shareholder returns, Mitsui Fudosan undertakes the stable payment of dividends while flexibly repurchasing its own shares in a bid to enhance capital efficiency,” the developer said in its financial report.

Based on the outlook for full-year results, Mitsui revised its year-end dividend forecast to JPY 72 a share, up sharply from JPY 62 a year earlier.

Aussie Expansion

The global-minded Mitsui Fudosan is expanding its Australia residential joint venture with Singapore’s Frasers Property to A$797 million ($509 million) in investment value under a deal announced last September.

The Japanese developer will back three additional projects in Frasers’ Midtown MacPark development in northwest Sydney, bringing the MAC Residences joint venture to a total of 1,145 homes under development across four buildings.

Closer to home, Mitsui’s sponsored Nippon Building Fund REIT has agreed to sell the sixth through ninth floors at its GranTokyo South Tower to Goldman Sachs Asset Management for JPY 41.2 billion ($281 million).

In a statement earlier this month, the US-based finance giant highlighted the office tower’s direct connection to Tokyo Station — the capital’s primary transport hub — and its location in the bustling Marunouchi business district as key to the asset’s appeal.

Leave a Reply