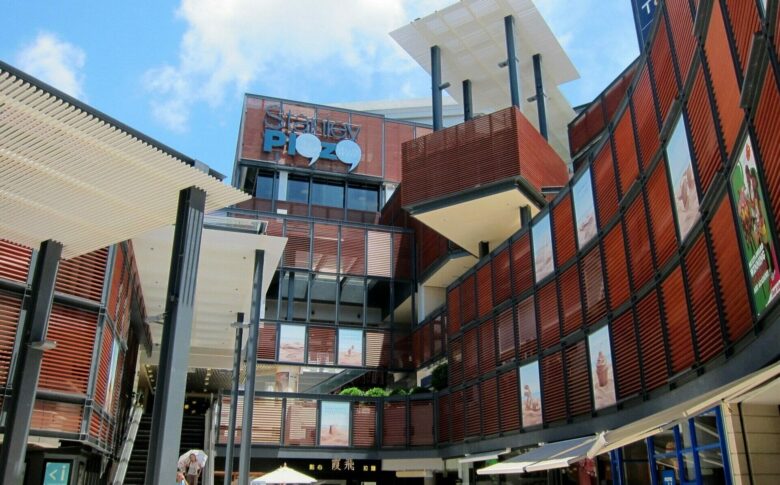

The waterfront mall has attracted the interest of a potential buyer

Link REIT has put its Stanley Plaza shopping centre up for sale, even as an unprecedented surge in COVID-19 cases clouds the retail outlook in Hong Kong.

Asia’s largest real estate investment trust received an unsolicited expression of interest from a potential buyer and decided to invite interest from the market in order to maximise value for unitholders, the REIT’s manager said in a voluntary announcement to the Hong Kong stock exchange.

The waterfront mall in the upscale Stanley area of southern Hong Kong Island had a valuation of HK$1.415 billion ($180 million) as of 30 September 2021, accounting for 0.7 percent of Link REIT’s gross asset value of more than HK$200 billion at that date.

After a process to shortlist potential purchasers, Savills Hong Kong will serve as the sole agent for the disposal of the property, said the trust’s manager, which is led by executive director and chief executive George Hongchoy.

Above-Market Yield

Completed in 1999 and 2000, Stanley Plaza is on a 50-year lease with 37 years remaining. The property at 23 and 33 Carmel Road consists of retail space and car parks at the Village Square shopping arcade and at the Murray House heritage building (relocated from Central in 1998), as well as car parks and shops in the nearby Ma Hang public housing estate.

George Hongchoy of Link REIT

According to Link REIT’s annual report for 2020-21, the property spans an internal floor area of 98,382 square feet (9,140 square metres) and provides 411 car parking spaces.

With the valuation of HK$1.415 billion and corresponding annual rental income of HK$71 million, the initial yield is close to 5 percent, noted Vincent Cheung, managing director at local brokerage Vincorn Consulting.

“The total floor area of Stanley Plaza and Murray House is circa 190,000 square feet,” Cheung told Mingtiandi. “The initial yield of 5 percent is far above the market norm, and we anticipate that the market yield should be 2.8 to 3 percent and the total value can be up to HK$2.54 billion or HK$13,346 per square foot, based on the total floor area of 190,000 square feet.”

Trust Casts Wider Net

Link REIT has looked beyond its traditional mainstay of Hong Kong retail in recent months, with Hongchoy saying last November that the trust was gradually adding other asset classes “to improve our portfolio mix and strengthen our portfolio resilience and productivity”.

Around that time, Link REIT acquired a trio of retail properties in Sydney, a pair of car facilities in Hong Kong and the trust’s first-ever logistics assets — 75 percent stakes in a pair of distribution centres in the cities of Dongguan and Foshan in Guangdong province — for nearly $1.26 billion combined.

Earlier this month, the trust announced that it would pay A$596 million ($428.2 million) for a 49.9 percent stake in a portfolio of office assets in Sydney and Melbourne.

Given the rapidly deteriorating COVID situation in Hong Kong, property consultancy JLL has warned of “exceptional uncertainty” dimming hopes for a short-term retail recovery.

The reimposition of strict containment measures during the latest surge has severely dampened consumer sentiment and will take a heavy toll on the retail sector, the agency said in its just-released monthly report on the city.

“We believe that the latest round of measures under the Anti-epidemic Fund will provide some timely relief to retailers,” JLL said, referring to the extension of fee waivers and subsidies. “Moreover, major landlords such as MTR, Link REIT and Swire Properties are going to offer rental subsidies to help tenants of premises affected by the pandemic.”

But retailers remain in dire straits and potential tenants lack the confidence to open new stores, the agency said, adding that landlords and tenants should work together to find mutually beneficial solutions.

Leave a Reply