The Queen Victoria Building is one of Sydney’s top visitor destinations

Hong Kong’s Link REIT has made its second investment in Sydney with the A$532.8 million ($394 million) purchase of stakes in a trio of retail assets, according to an announcement by Asia’s largest listed trust late Sunday.

In Sydney’s biggest retail purchase since the dawn of the pandemic, the HKEX-listed giant is buying half-stakes in the Queen Victoria Building, The Galeries and The Strand Arcade, all in Sydney’s CBD, from the real estate division of Singapore’s GIC, with Link REIT’s leadership citing the opportunity to continue diversifying its holdings beyond its home base in Greater China.

“The acquisition of this prime retail portfolio is part of our Vision 2025 growth strategy to diversify and improve our portfolio mix,” said Link REIT chairman Nicholas Allen. “We are excited to have captured an opportune moment to invest in these iconic Australian retail assets.”

In a presentation explaining the acquisition, Link REIT noted the portfolio’s 97 percent occupancy rate, the potential for a rebound in shopping as pandemic restrictions ease and “evidence of capital ‘returning’ to retail in recent months in Australia, as spurring it to make the purchase now.

Linking with the Locals

Link REIT’s first retail acquisition in Australia makes it landlord to brands such as Vans, Coach, Kate Spade New York and other mid-market brands, as it adapts its retail approach to fit the Sydney opportunity.

Nicholas Allen of Link REIT

“Given the high occupancy rate filled with leading Australian and international brands, the portfolio is well-positioned to capture the retail rebound with the improving consumption sentiment in the country,” said Link REIT chief executive George Hongchoy.

Hongchoy’s decision to take over GIC’s Australian retail holdings puts the manager of $26.7 billion in assets into a partnership with Vicinity Centres, the Victoria-based developer which managed 61 retail assets across Australia as of 31 December last year, which Link REIT sees as adding value as it learns the Australian retail game.

“Coupled with the strategic partnership with a leading retail asset manager in Australia, we believe both parties will jointly enhance the portfolio to ensure these landmark assets will deliver the best retail experience to all shoppers and unlock their long-term growth potential,” Hongchoy said.

Sticking to the Centre

Link REIT’s Sydney portfolio will give it half-ownership of 34,748 square metres (374,024 square feet) of prime retail space along Sydney’s original shopping thoroughfare, George Street, as the capital of New South Wales province strives to return to normal after lockdowns and closed borders restricted retail traffic.

The Galeries at 500 George Street

At the consideration declared, Link REIT is paying the equivalent of A$15,333 per square metre for the portfolio, which has a weighted average term to lease expiry of 2.6 years.

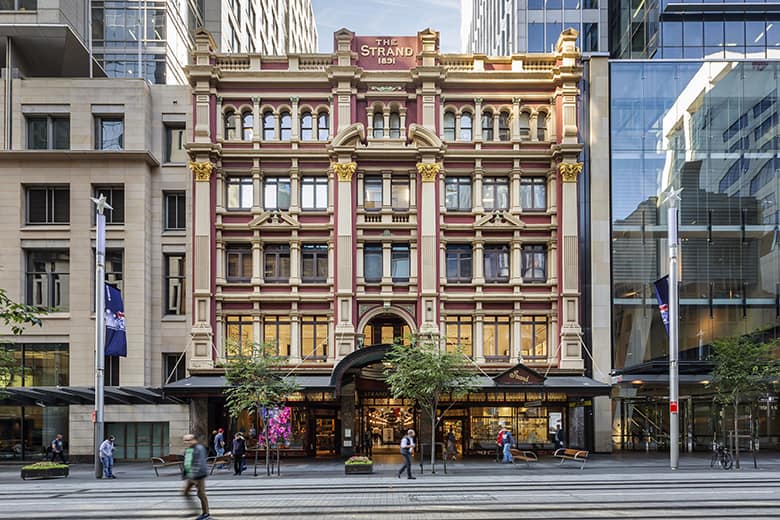

Despite the recent hardships, the Strand Arcade, a 5,738 square metre freehold asset at 412-414A George Street was 89.3 percent occupied as of 25 October. With the property generating net passing income of A$11.0 million, Link REIT agreed to pay A$111.2 million for its share of the 1891-vintage property.

A few steps up the road, Link REIT has picked up an interest in another historic landmark – the 1898-built Queen Victoria Building. Spanning 14,016 square metres, the Sydney retail icon generates net passing income of A$31.3 million and Link REIT paid A$277.1 million for its share of the leasehold asset. Link noted that while the entire portfolio benefited from heavy foot traffic on George Street, the Queen Victoria Building stood out as the second most visited location in Sydney after the city’s opera house.

Further up the road at 500 George Street, but closer to the modern era, the final asset in Link REIT’s Sydney retail set is The Galeries, which was completed in 2000. The 14,994 square metre property earns net passing income of A$17.2 million and the listed trust paid A$149.9 million for the freehold asset.

Management Intensive

The Strand Arcade was ranked tops in Moving Annual Turnover per square metre last year by Australian retail publication Shopping Centre News, with the Queen Victoria Building placing second and The Galeries taking the fourth spot in that battle. Vicinity, which has managed the portfolio since 2018, will continue to fulfill that role following the transaction.

The Strand Arcade was completed in 1891

At the end of March this year, EG Funds Management said that it had agreed to provide asset management services to Link REIT tenants and customers as well as assisting in acquisitions. The Australian reported that the Sydney-based asset manager was involved in this latest transaction with CBRE and Colliers International brokering the sale on behalf of GIC.

GIC had acquired the retail assets in 2003 when it acquired local property investment firm Ipoh, and had sold half stakes in the three properties to Vicinity in 2017 for A$556 million.

Third 2021 Retail Deal

Coming just less than two years after Link REIT entered the Australian market with its A$683 million acquisition of an office tower at 100 Market Street in Sydney, the deal announced today shows the trust continuing its pursuit of retail assets with the pandemic providing opportunities for bargain deals.

George Hongchoy of Link REIT

In its statement to the stock exchange, Link REIT called the portfolio a desirable entry point into the Australian market, and pointed to expectations of “a strong post-Delta economic rebound,” as a factor in its acquisition decision.

In June the REIT agreed to acquire a shopping mall in Guangzhou for $501 million from a property management firm linked to Warburg Pincus. That Guangdong buy came after Link REIT signed up for a half-stake in Shanghai Qibao Vanke Plaza, with the trust also picking up its half-share of that Vanke property from GIC.

Great looking assets