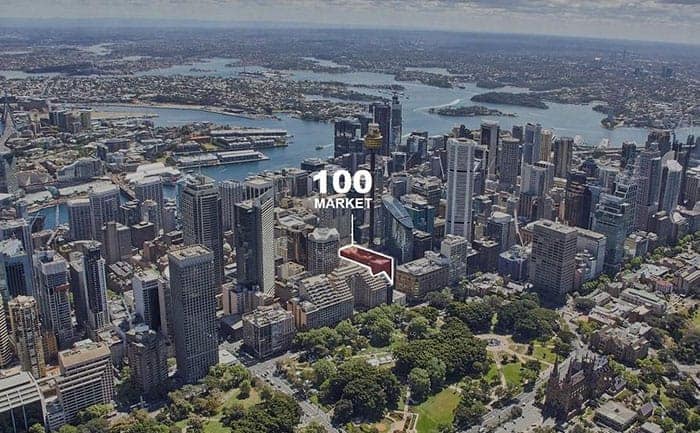

100 Market Street is located near Hyde Park in central Sydney (Image: JLL)

Asia’s largest real estate investment trust is buying its first property outside of Greater China, as the manager of the Link REIT on Thursday confirmed an earlier report by Mingtiandi that it is purchasing 100 Market Street in Sydney, with the final price for property set at A$683 million ($468.9 million).

The Hong Kong-listed REIT is buying the 10-storey office tower from funds managed by Blackstone to both capture the income available from the fully tenanted property near Sydney’s Hyde Park, and to take advantage of the transparency and liquidity of the city’s commercial market, according to George Hongchoy, CEO of Link Asset Management, which manages the trust.

“The acquisition will drive growth in sustainable income and capital value, with limited downside risk,” Hongchoy said in a statement. He added that, “A more diversified portfolio with overseas properties providing new sources of income will help ease our reliance on Hong Kong properties to generate income progression, and contribute to a healthier growth trajectory.”

Venturing into Sydney marks a shift in investment strategy for Link, which now says that, while maintaining the majority of its now HK$224 billion portfolio in Hong Kong, as it expands its holdings in the coming years it will aim to allocate up to 10 percent of its assets into markets outside of Greater China.

Picking Up a Fully Tenanted Sydney Tower

Link REIT’s Sydney prize is the office component of a mixed-use complex that also includes the Westfield retail centre along the Pitt Street Mall and the Sydney Tower, a tourist attraction that includes a tourist lookout and an elevated restaurant.

Link CEO George Hongchoy is now shopping in Sydney, Singapore, Japan and the UK

With an average floorplate of around 3,000 square metres (32,291 square feet) Link REIT’s latest asset covers 28,385 square metres of offices, which are currently leased to three tenants, the Australian Securities and Investment Commission, the Australian Taxation Office and retail deveoper Scentre Group, which formerly owned the complex.

Originally completed in 1978, 100 Market Street completed a makeover in 2011 as part of a redevelopment of the entire Westfield Sydney complex. The property was acquired on a 299 year leasehold basis, with the term having commenced on 27 June this year.

Once the acquisition is completed, which is expected to occur during early 2020, the asset is set to earn annual net property income of A$26.7 million for the trust, with annual rent escalations of approximately 4 percent already built into the existing leases.

At the transaction price, which matches a valuation by Colliers International dated 16 December this year, Link REIT is paying the equivalent of A$24,062 per square metre for its Sydney foothold. The investment is understood to have been made at around a 4 percent yield, with the property carrying a weighted average lease expiry (WALE) period of 8.45 years.

Buying Immediately Accretive Assets on Credit

Link also made clear that its low level of leverage, combined with historically low interest rates in Australia, added to the appeal of the acquisition by making it possible for the trust to fund an investment that will allow it to immediately add to its distributions to unit-holders, based on local borrowing.

In October, the Reserve Bank of Australia, the country’s central bank cut the rate that it charges commercial banks to 0.75 percent – lower than it has ever been – which was followed by the nation’s four largest banks all announcing cuts in the interest they charge their mortgage customers.

Hongchoy noted that Link currently has a low debt to asset ratio, adding that the trust is, “Looking for ways to grow the debt to asset ratio, as it builds a more diversified portfolio.”

The trust manager’s CEO also praised the transparency and liquidity of the Australian market, noting that working under the country’s legal system simplified due diligence and deal structuring.

Link REIT Goes for Global Gateways

With core commercial real estate assets in Hong Kong offering some of the world’s lowest investment yields, and with tight credit policies continuing to rein in activity in China, the trust’s manager explained the Link REIT’s expansion into new geographies as driven by the search for attractive returns.

The entrance to 100 Market Street

“We believe that allowing us to look broadly will allow us to continue on the growth path that we have established,” Hongchoy explained.

Once only holding the commercial assets connected to Hong Kong’s public housing estates, the fifteen-year-old trust will now target opportunities in gateway cities in Australia, Singapore, Japan and the United Kingdom, the REIT manager’s CEO indicated, noting the stability and reliable regulatory environments available in those markets.

By 2025 the trust now aims to have Hong Kong represent 70 to 75 percent of its total assets and mainland China up to 20 percent. At present 87.5 percent of Link REITs assets are in Hong Kong, with the remaining 12.5 percent in mainland China – an allocation which it has been increasing annually.

Learning to Love Australia

In a presentation shared on its website, Link also pointed to the liquidity of the Australian commercial real estate market as reducing potential risks and adding to the asset’s appeal.

Commercial property transactions Down Under have already reached $30 billion during the first three quarters of 2019 and have averaged over that amount annually since 2016, according to figures from Colliers International included in the Link presentation.

“Global Investors continue to be attracted to the deep liquidity, transparency and strong rental growth prospects of the gateway Australian markets,” said Stuart Crow, CEO of Capital Markets for JLL Asia Pacific. “Given the strong fundamentals and continued low interest rate environment in Australia we forecast transaction volumes and interest from foreign investors to remain high into 2020.”

Much of that volume has come from Asian institutions with Singapore-based fund manager SC Capital having agreed earlier this month to buy 2-10 Wentworth Street in the Sydney satellite of Parramatta for A$105.3 million.

Singapore’s sovereign fund, GIC, made its most recent investment in Sydney just over one month ago when it formed a joint venture with Australia’s Charter Hall to acquire another Parramatta asset, the Jessie Street Centre, from Brookfield for A$415 million.

Blackstone Flips Sydney Tower in Six Months

Link REIT acquired the asset from Blackstone through an expression of interest exercise, which is said to have also attracted JP Morgan Asset Management and Singapore’s Keppel REIT among other bidders.

100 Market Street is part of complex that includes the Wesfield retail centre and the Sydney Tower

As Mingtiandi reported earlier this week, Link REIT emerged as the lead bidder for 100 Market following the close of bidding in mid-November, after Blackstone had picked up the property from Scentre Group in June of this year as part of a three building Sydney set acquired for A$1.52 billion.

JLL is understood to have represented Blackstone in the sale, with bidding having been closed last month.

Adding Offices to a Retail-Heavy Portfolio

As Link ventures into new geographic markets with this acquisition, it is also boosting the ratio of office properties within its holdings

100 Market Street now equates to 1.6 percent of Link REIT’s portfolio is only the second office property that the trust has acquired outside of its home city, after it spent RMB 6.6 billion (then $1.063 billion) in 2015 to purchase a pair of office buildings in central Shanghai.

In a presentation accompanying the deal announcement Link now indicates that it aims to have office properties account for 15-20 percent of its assets in the future, up from the current 7.1 percent.

Leave a Reply