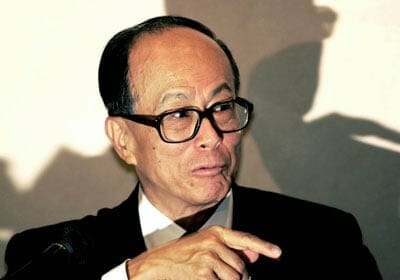

Li Ka-shing appears to be continuing to sell off his China real estate assets, as a recent report has Asia’s richest man selling an office building in Shanghai for around RMB 1.54 billion ($250 million).

According to a story on Friday in the Wall Street Journal, Li’s ARA Asset Management plans to sell Shanghai International Capital Plaza in Shanghai’s Hongkou district to a Singapore-based real estate private equity fund managed by Alpha Investment Partners. The Journal report cited sources close to the deal as indicating that Alpha would be paying approximately RMB 27,000 ($4,382) per square metre for the 31-storey, 56,859 square metre building.

Shanghai International Capital Plaza is located next to the North Sichuan Road metro station in Shanghai, in a district north of the Bund and across the river from Pudong’s Lujiazui financial district. The price that Alpha is said to be paying for the building – which was completed in 2010 – is roughly the same as what SOHO China received for its Hailun Road project approximately 1.2 kilometres north of the Capital Plaza, in a transaction announced in March of this year.

ARA Asset Management acquired the building in 2011 for RMB 1.16 billion ($188 million).

Li and Son Continue to Sell China Real Estate

If ARA Asset Management follows through on the sale of the Hongkou office tower, it will be the fifth time that a company or fund controlled by Li Ka-shing has sold real estate assets in Greater China in the last year, bringing in more than RMB 14.1 billion for Asia’s richest man.

In February, Li’s ARA Asia Dragon Fund completed the sale of Nanjing International Finance Center to SanPower Group for a total transaction value of RMB 2.48 billion. Also, in October last year China’s Bank of Communications agreed to purchase the Oriental Financial Center in Shanghai’s Pudong district from Li’s Hutchison Whampoa and Cheung Kong Holdings for a total consideration of US$1.15 billion.

During September of 2013, Hutchison and Cheung Kong announced that they were selling the Metropolitan Plaza in Guangzhou’s Liwan district for US$390.7 million. And the Guangzhou deal was preceded at the end of July with the sale of Cheung Kong’s Kingswood Ginza shopping mall in Hong Kong for US$754 million to a REIT controlled by the company.

Also, during January, Li’s son Richard agreed to sell Pacific Century Place in Beijing to Gaw Capital for US$928 million.

Leave a Reply