Joy City didn’t mention the ferris wheel on their Shanghai mall in announcing the deal

Mainland commercial developer Joy City has agreed to sell a 49 percent stake in six mixed-use projects in China to an investment fund to be controlled by Singapore’s GIC and mainland insurer China Life for RMB 9.29 billion ($1.4 billion).

The real estate development subsidiary of Chinese state-owned food conglomerate COFCO announced the transaction late Thursday to the Hong Kong stock exchange, with the fund acquiring shares in three mainland companies that control the six projects in Beijing, Shanghai and Tianjin. Joy City will retain a 51 percent stake in the project companies.

The deal appears to be part of the trend toward an “asset-light” development model in China, as commercial property firms look to share the financial burdens and rewards of new projects amidst pressures from rising land costs and fierce competition from online retailers.

Joy City Selling Off Stake in Most of Retail Portfolio

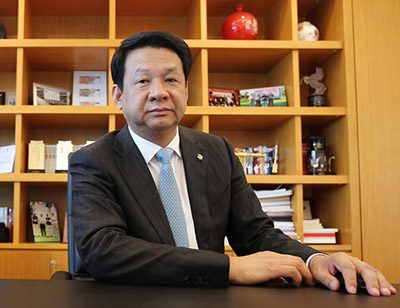

Joy City chairman Zhou Zheng is selling off a a stake in most of the developer’s retail-led portfolio

Joy City, which was known as COFCO Land Holdings until January of last year, is conducting the transaction by first establishing an investment fund which owns the three holding companies, and then selling shares in the newly established vehicle to GIC subsidiary Reco Joycore Pte and Glorious Fortune Forever Ltd, a unit of China Life Insurance.

The newly signed deal is scheduled to go before Joy City’s shareholders at a special general meeting which is expected to be announced this coming week, according to the company’s announcement to the stock exchange.

The six properties to be controlled through the new fund include Beijing Xidan Joy City, Beijing Chaoyang Joy City, Shanghai Joy City, Tianjin Joy City, Beijing COFCO Plaza, and Beijing COFCO Landmark Tower (formerly known as Beijing Andingmen Joy City), which is still in the early stages of construction.

With the deal, Joy City will be divesting a major stake in the retail-led portion of its portfolio, including four of its six Joy City-branded projects, and all of its mall-dominated projects in China’s first-tier cities. The only mixed-use projects from Joy City’s portfolio to be excluded from the fund were developments in the second-tier cities of Yantai, in Shandong province and Chengdu in Sichuan.

In all, the developer has 26 properties in its portfolio, including four hotels and several residential projects. In its announcement, Joy City said that it plans to use the proceeds from the disposal to repay debt and for working capital.

Joy City Joins Wanda in Asset-Light Club

Beijing COFCO Plaza is one of Joy City’s early, less design-intensive projects

The blockbuster sale fits Joy City’s decision, which was announced earlier this year, to look for financial partners as it continues to expand its portfolio. This “asset-light” approach to development puts the state-run firm in step with larger rivals such as Wang Jianlin’s Dalian Wanda Commercial Properties, and should help to free up cash for further projects.

“Now we can speed up because the company is entering maturity,” Joy City chairman Zhou Zheng said in an interview with the South China Morning Post last month. “We are eyeing asset-light projects to realise faster growth.”

Calling in partners to help fund new projects resembles similar deals done by other commercial developers in China, including Wanda Commercial, which raised RMB 24 billion in January of last year from China Everbright, Harvest Capital Management, Sichuan Trust and KuaiQian Payment and Settlement Service. At the time of that transaction, Wanda explained that the new fund would be used to fund 20 new shopping malls in China.

The decision by Joy City and Wanda to raise money by bringing in investment partners may also be an admission of the new realities of Chinese retail property development. China’s retail sales grew 10.3 percent in the first six months of 2016, but much of that upswing came from ecommerce, which grew by 28.2 percent during the period, according to official government figures.

For China’s top 50 retailers, which make up the core tenants of properties such as Joy City’s shopping malls, sales were down by 3.1 percent in the period from January until June. This struggle is already having an impact on retail rents even in major economic hubs such as Shanghai, where shopping mall rents have flattened out, with more projects underway in the pipeline.

Leave a Reply