The family of William Cheng Kai Man has just picked up another hotel

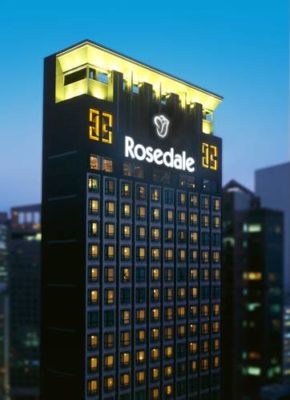

Hong Kong’s hotel investment market continues to heat up, with the Rosedale hotel in Causeway Bay reportedly selling to a director of Hong Kong’s Shun Ho Property Investments for HK$1.65 billion ($211.4 million).

Jonathan Cheng (鄭啟俊), a director of Shun Ho Property Investments and brother of Shun Ho chairman William Cheng Kai Man is said to be paying an average price per room of HK$5.52 million (over $707,300) for the 299-key property at 8 Shelter Street, according to an account in the Hong Kong Economic Times.

The seller, said to be the Bank of China, put the hotel on the market at the beginning of the year and is said to have received a number of bids before finally disposing of the newly renovated property for nearly double the HK$833 million that the hotel sold for in the depths of the financial crisis in 2009.

Shun Ho is a listed hotel operator and investor with a portfolio of more than 2,600 rooms in Hong Kong and Shanghai, including five properties under the Best Western brand. William Cheng, a son-in-law of Henderson Land Development chairman Lee Shau Kee, also controls Magnificent Hotel Investments, Shun Ho Resources Holdings and Shun Ho Tech Holdings.

Shun Ho Grows Its Portfolio

The Rosedale Hotel in Causeway Bay sold for HK$1.65 billion (over $211 million)

The deal for the Rosedale Hotel follows Shun Ho Property’s February acquisition of the 317-room Newton Inn on Chun Yeung Street in North Point from Henderson. Shun Ho paid HK$1 billion ($129 million), or approximately HK$6,900 per square foot for the 143,342 square foot property, with plans to convert the three-star hotel into a retail building.

In July 2016, Cheng made his first British venture by snapping up a Travelodge hotel on King’s Cross Road in London for £70,300,000 ($92.9 million).

Hotels Are Becoming a Hot Property

Shun Ho’s enthusiasm for hotel deals comes as Hong Kong recovers from a hospitality slump. Visitors to the city grew by 1.9 percent in the first eight months of 2017, while average hotel occupancy was up by 0.5 percent year-on-year to 86.6 percent in September.

Investors are taking note of the improved prospects for the sector. Hong Kong saw three hotel purchases of over $100 million in the first quarter of the year. More recently, Hong Kong’s billionaire “shop king” Tang Shing-bor bought up the Hotel Bonaparte in Wan Chai for $450 million ($57.5 million).

The Mandarin Oriental Hotels group put the Excelsior Hotel on the market earlier this year but scrapped the sale last month after bids failed to meet its expectations, despite reports that the landmark waterfront property in Causeway Bay had received offers of up to $3.8 billion.

Leave a Reply