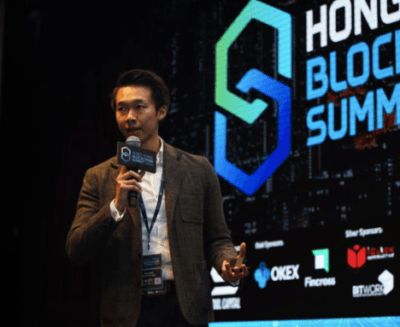

Stan Tang aims to make it easy for blockchain investors to buy into his real estate empire

The scion of Hong Kong’s best known empire of shopfronts, industrial projects and mini-hotels is taking the family business high tech with an announcement this week of a blockchain initiative that aims to tokenise real estate in the world’s priciest property market.

The financial services unit of family owned property firm Stan Group, chaired by 32-year-old Stan Tang, has signed an MOU with Hong Kong-based financial technology startup Liquefy agreeing to work together to set up a blockchain-based exchange for Hong Kong investors seeking access to property investment opportunities, according to an announcement this week by the real estate firm.

The blockchain investment deal is set up to give participants a chance to invest in properties owned by Stan Group, which has been established by the youngest son of Hong Kong “shop king” Tang Shing-bor and operates both Stan Group Properties and self-storage provider 168 Storage.

Gunning for a Digital Property Ecosystem 2.0

“In taking this bold first step towards the future of the real estate sector in Hong Kong, we envision far better access and greater liquidity in the real estate market due to the fractional ownership that will be attained with tokenization and our real estate exchange under development,” Stan Tang said in the announcement.

Adrian Lai, CEO of Liquefy, was selected for Stan Group’s incubator programme

The newly launched online investment project, named “STAN by Hong Kong” aims to build a digital real estate ecosystem that will usher Hong Kong into what the group calls “a new era of digitized real estate.”

Stan Group is entering the joint venture through its STILE social innovation strategy, which includes an incubator for new businesses. Liquefy itself is a graduate of the STILE Initiative, and was among the first batch to pass through the four-month long investment-backed incubation program launched at the end of last year.

The initiative, which has been recruiting startups in the region in a wide range of sectors including real estate and financial services, offers entrepreneurs accommodation and investment, as well as a follow-up funding scheme for selected incubatees.

“We see our partnership with Stan Group as an incredible opportunity to drive Hong Kong as a whole towards being a smart city with security token ownership and paperless ownership systems,” said Adrian Lai, chief executive officer of Liquefy.

Tokenizing Uncle Bor’s Real Estate Assets

The proposed tokenization of real estate could provide another avenue for the Tang family to cash in on the property portfolio of “Uncle Bor,” as the veteran retail property investor is known. The Tang’s have added 14 hotels and two residential developments to it holdings in recent times, bring the hospitality segment of its holdings to 4,000 rooms of hotel and serviced apartment space.

Just five months ago, the group spent HK$1.1 billion ($140 million) on a hotel property in Hong Kong’s Yau Ma Tei district, adding another asset to its suite of properties.

This transaction followed a sale-and-leaseback deal struck in September with CNT Group, which saw Stan Group exchange an 80-room hotel in Wanchai for a potential housing site in Sai Kung.

Regarded as the successor to his father’s $2 billion retail shop business, Stan Tang has ventured into other sectors including hotels, restaurants and flexible offices.

In 2016, Tang set up co-working space The Wave in Kwun Tong, while the group’s hospitality subsidiary Tang’s Living owns 11 hotels across the city.

Leave a Reply