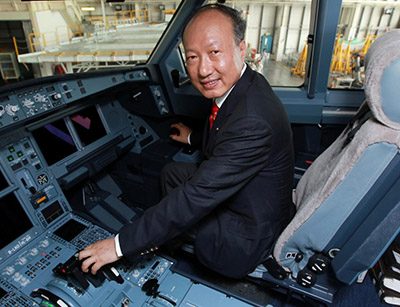

HNA chairman Chen Feng may need a faster plane to keep ahead of trust company debt collectors

HNA Group defaulted on a RMB 300 million ($43.82 million) principal of a loan on September 10, Hunan Trust announced on its website. The financial failure is the latest blow for the indebted conglomerate, which sold more than $17 billion in assets in the first half of 2018 in its ongoing struggle to dig out of debts said to have reached $100 billion.

The loan was taken out by HNA subsidiary HNA Innovation. Asset seizures at the company’s Jiulong Mountain development had resulted in low liquidity, according to a company statement filed to the Shanghai Stock Exchange. The development was the subject of two lawsuits in April seeking a total of RMB 413.5 million in compensation.

The company is currently negotiating with Hunan Trust to resolve the dispute, but the delayed payment would result in liquidated damages and higher interest rates for HNA, according to the filing.

Hunan Trust initially made the two-year loan to HNA Innovation on September 7, 2016 at an 8.3 percent annual interest rate. Now the shadow lender has appointed personnel to collect property on site and seeks to freeze the company’s assets with a court order, according to the company announcement.

Default Signifies a “New Stage” in HNA’s Struggle

Zhejiang’s Jiulong mountains are the scene of HNA’s latest crash

Brock Silvers, managing director of China-based investment advisory firm Kaiyuan Capital, said the default itself is less important than what it appears to signify. “In one sense HNA’s ‘default’ isn’t terribly significant,” he said. “[It is] a short-term delay of a $44 million debt principal payment from a now defunct subsidiary to a regional trust company. But it may be significant in what it reveals about the company.”

The company is now “toying with default” after offloading properties HNA had previously identified as “core” assets, and it has sought to borrow money from its own executives, Silvers said. In light of this, the missed payment “seems to indicate a new stage in HNA’s struggle to rebalance its books.”

HNA also missed a payment in August on a 270-day, RMB 1 billion bond issued by HNA subsidiary Haikou Meilan International Airport. After the Shanghai Clearing House said it hadn’t received the payment, HNA blamed the delayed transfer on a technical glitch. That same month, the company deferred payments on P2P products, worrying retail investors who lent the firm money through 11 different platforms.

HNA Forced to Refocus on Its ‘Core’ Airlines Business

As debt payments come due, HNA has been rapidly selling off assets or, as was recently the case, getting out of lease agreements. It was revealed last week that HNA is breaking the lease agreement it has for eight floors in Three Exchange Square in Hong Kong’s Central district. HNA never wound up using the office space, and at HK$140 ($17.8) per square foot per month, it was a monthly liability of HK$12 million that the company couldn’t afford.

The most recent assets HNA has sought to sell off include its remaining 7.6 percent stake in German lender Deutsche Bank, according to the Wall Street Journal. The company’s stake is worth about 1.5 billion euros ($1.8 billion), and interested buyers include the sovereign wealth fund China Investment Corp. and state-owned financial institutions Citic Group, China Merchants Group and China Everbright Group.

“With the sale of its Deutsche Bank stake, financial services is no longer one of the firm’s four operational ‘pillars,’” Silvers said.

HNA is under pressure from Chinese regulators to get rid of assets not related to its airlines business. When asked about this, a company spokesman told the Wall Street Journal, “We are committed to streamlining our strategy to focus on our core aviation, tourism and logistics businesses, improve our operations and strengthen our balance sheet.”

Holy Nonperforming Asset! ‘Committed to strengthening our balance sheet’ – does that mean they were previously committed to weakening it?

Looks like they need someone with hard-won China property and operational experience to take this mess over. Sadly the business will probably end up in the hands of a big four administrator who will just milk the carcass for max fee value.