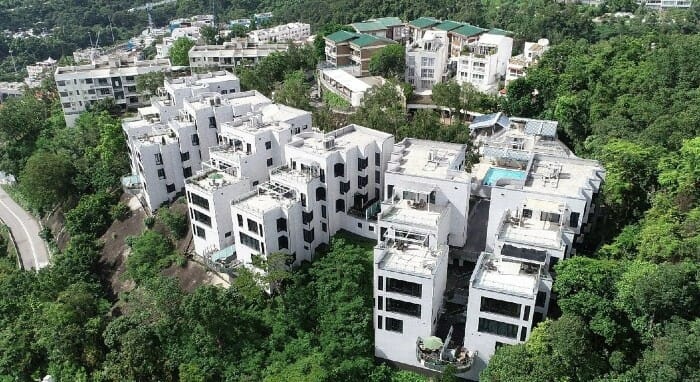

Hang Lung’s new site is in one of Hong Kong’s most exclusive neighbourhoods

Under a cloud of sanctions and suspended trade privileges, the US government sold a set of consular residences in Hong Kong’s southern District to Hang Lung Properties for HK$2.6 billion ($331 million), the developer said in an email to Mingtiandi on 10 September.

Under its current permits, the nearly 95,000 square foot (8,800 square metre) site can yield up to 47,397 square feet of gross floor area, bringing the Hong Kong-listed builder’s purchase to around HK$54,138 per square foot. That price is 37 percent less than China Resources Land paid to acquire a neighbouring project in 2018.

A Hang Lung spokesperson referred to the price for the “rare and premium land lot”, as “reasonable,” arguing the purchase was a vote of confidence in Hong Kong’s future. “The land will be redeveloped into luxurious detached houses, targeted for completion by 2024,” Hang Lung said, with the company estimating that its total investment in the project will be approximately HK$4 billion.

Conflict and COVID Drive Down Prices

At the time it was put on the market in June via a public tender managed by CBRE, Vincorn Consulting and Appraisal estimated the site’s value at from HK$3.1 to HK$3.5 billion, although industry analysts theorised at the time that Hong Kong’s muted luxury market could shave up to 25 percent off the final price.

Hang Lung chairman Ronnie Chan has enough street cred in Beijing to buy a controversial site

Luxury property is having a rough go of it in 2020. In their latest report, Knight Frank attributed falling asset values and declining transaction volumes in Hong Kong to COVID-19, adding that prices were likely to drop another 5 percent this year on top of the 10 percent that they have slipped since 2019.

Both Knight Frank and Savills also attributed waning demand from mainland buyers to the sector’s softening, with Savills adding that political uncertainty was pushing some investors to consider overseas destinations.

‘Hot Potato’ Property

Although the State Department had slated 37 Shouson Hill for sale as part of its global reinvestment programme before the US’ termination of a set of three bilateral agreements and stripping Hong Kong of its “special status” in August, following imposition of Hong Kong’s national security law, has made transactions more sensitive in the SAR.

Back in June when the property hit the market, CBRE expected a strong show of interest from both mainland and Hong Kong developers, but only CK Asset Holdings was alleged to have submitted an offer for the property by the tender’s 31 July closing date.

According to a survey by the South China Morning Post soon after the tender began, many of the city’s biggest developers — including New World Development, Wheelock, Swire Properties, Nan Fung Group, Henderson Land, Kerry Properties and Chinachem — steered clear of what became viewed as a controversial sale.

Other factors said to deter local developers were the site’s current planning permits, which restrict construction to below three storeys and coverage of no more than 25 percent of the plot.

Luxury Homes for Hong Kong’s Elite

The sale was completed with vacant possession and without a leaseback agreement, making way for Hang Lung to develop up to 47,000 square feet of homes on the site without further delay. The developer controlled by billionaire Ronnie Chan offered no details on how many homes might be built on the site or if the company would be seeking to ease the existing restrictions.

The buildings occupy a plot purchased by the US government in 1948, and have been used as consular staff housing since 1983. Situated at the peak of Hong Kong’s exclusive Shouson Hill, the current cluster of six low-density buildings comprises 26 apartments and 52 car park spaces, and an outdoor pool.

The lot orientation can potentially provide a view of Deep Water Bay and standalone addresses, should the site be redeveloped.

Hang Lung’s portfolio includes office, retail and industrial development in Hong Kong and China; the Shouson Hill project will be its first luxury residential project since it built an 18-unit townhouse development on Blue Pool Road in Happy Valley in 2015. Among Hang Lung’s other upmarket projects are the 75-storey, triple tower The HarbourSide in West Kowloon, and the single tower The Summit in Mid-Levels.

Ronnie needs a house for each chin?