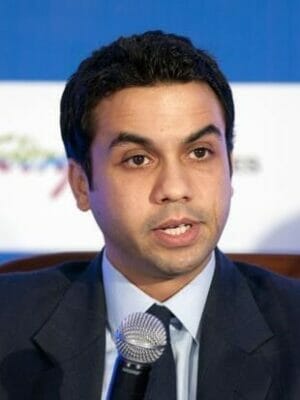

Pirojsha Godrej, executive chairman of Godrej Properties

GIC is ramping up its exposure to Indian real estate, with an investment firm managed by the Singaporean sovereign wealth fund buying a stake in Mumbai-based developer Godrej Properties Ltd for about Rs 1,000 crore ($150 million).

Godrej Properties said in a filing to the Bombay Stock Exchange on Friday that it will raise the funds from Ganmat Pre Ltd through the issuance of equity shares in the company. Ganmat is a GIC-managed firm, according to a Godrej Properties statement cited by India’s Business Standard.

The deal gives the GIC affiliate a five percent stake in one of India’s largest listed builders, after GIC picked up a stake in DLF, the country’s most valuable developer, for $1.4 billion last August.

Leading Developer Raises $150M for New Projects

Godrej Properties, the real estate arm of Indian conglomerate Godrej Group, has around 14 million square metres of residential, commercial and township projects across 12 cities. Established in 1990, the company based in western India went public in 2010, and in financial year 2016 was the country’s largest listed developer by sales.

“We will utilise Rs 10 billion for business development and add new projects in the geographies where the company is present,” said the company’s executive chairman Pirojsha Godrej in a statement quoted by local media. Godrej said the company had acquired 12 new projects over the past year with saleable area of 23.5 million square feet, about 83 percent of which was added in partnership with other developers.

The developer’s Planet Godrej, a residential project in south Mumbai, is one of India’s tallest buildings at 181 m

The developer said its consolidated net profit in the first quarter of 2018 doubled year-on-year to Rs 141.51 crore ($21.2 million), tracking an upturn in India’s real estate market which saw home sales rise by 12 percent in seven major cities during the same period, according to property consultancy Anarock.

Home purchases in India dropped to a seven-year low in 2017, according to data from international brokerage Knight Frank, with a variety of taxes and regulations weighing down on a sector that has not fully recovered from the global financial crisis of a decade ago.

GIC Builds on India Track Record

GIC, a longtime investor in the Indian real estate sector, has notched a series of major deals in recent years, partnering with property developer Vatika Group to build residential projects in Gurgaon, a satellite city of New Delhi, in December 2014. The Singaporean giant agreed in the same month to buy a controlling stake in Mumbai-based property firm Nirlon for about $200 million.

GIC made its biggest-ever investment in the market when an affiliate bought a one-third stake in DLF Cyber City Developers (DCCDL), a Gurgaon-based commercial development and rental subsidiary of DLF for $1.4 billion.

The sovereign wealth fund with an estimated $359 billion of assets under management struck a deal with another top Indian developer this past February, when it reportedly picked up a $200 million stake in the office division of Prestige Estates Projects, giving it control of just over 40 percent of the Bangalore-centred office portfolio.

Leave a Reply