Cityplaza One is Hong Kong’s most expensive building to change hands this year

An investment consortium led by fund managers Gaw Capital Partners and Schroders Pamfleet have agreed to buy the CityPlaza One office building in Hong Kong from Swire Properties, braving declining office leasing activity to make the city’s largest acquisition of a completed property asset this year.

The consortium has agreed to buy the 21-storey commercial tower in Hong Kong island’s eastern district at a valuation of just over HK$9.84 billion ($1.27 billion) in a move that leaders from Gaw and Schroders linked to optimism regarding the city’s future.

“CityPlaza One is a well-located, well-managed property that represents an opportunity to participate in the long-term favourable economic outlook for Hong Kong,” said Allan Lee, head of Asia (excluding China) for Schroder Pamfleet.

Swire Properties, which has sold off assets in Hong Kong and the United States in the second half of this year as it develops a pair of new office developments in its home city, indicated that the proceeds of the asset disposal would be applied to its general working capital requirements.

Marked Down to Sell in Island East

“There are many reasons to be optimistic about Hong Kong’s prospects, including the 60 or 70 IPOs in the pipeline and the real work that is being done on integration with the Greater Bay Area,” said Schroder Pamfleet head Andrew Moore in explaining the rationale for the acquisition.

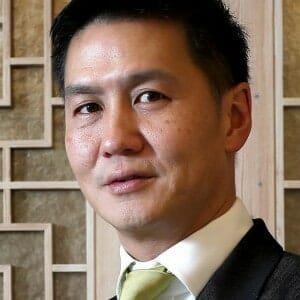

Schroder Pamfleet boss Andrew Moore is staying bullish on Hong Kong

Under the terms of a sale and purchase agreement signed between the parties, Moore and his partners will be purchasing 100 percent of the equity in the company holding the 628,785 square foot (58,416 square metre) tower through a deal with flexible payment terms that values CityPlaza One at the equivalent of HK$15,609 per square foot.

That rate is around 18 percent less than the price per square foot that Swire Properties had achieved when it sold CityPlaza Three and Four to Gaw Capital and China’s Hengli Investments Holding in late 2018.

According to a Swire statement, the agreement specifies that, after making a 9.95 percent down payment upon signing, the Gaw-Schroder Pamfleet group will pay at least 83.4 percent of the total consideration in cash, with the option to provide the remainder to Swire in the form of shares in the company holding the 1997-vintage tower. A remaining stake of just over 5 percent will be deferred for three years following completion of the sale and purchase.

Swire had announced in late October that it had entered into discussions to sell CityPlaza One, which is one of the older properties in the developer’s Hong Kong portfolio.

In July, Swire Properties had sold off a pair of office buildings in Miami for $163 million and in October the company unveiled a plan to sell a set of parking spaces in Hong Kong as part of what the developer termed a “strategy to dispose of certain non-core assets.”

Gaw Doubles Down in Island East

After taking a 49 percent stake in the $1.9 billion purchase of the CityPlaza Three and CityPlaza Four officer towers from Swire in 2018, Gaw Capital sees the purchase of this latest asset as a bet on an emerging commercial district which is attracting companies fleeing the world-leading rents in Hong Kong’s traditional city centre.

Goodwin Gaw is adding to his collection of Island East real estate

“Following the purchase of portions of CityPlaza Three and CityPlaza Four in 2018 and 625 King’s Road in 2019, we are delighted to have signed the sale and purchase agreement today for the purchase of CityPlaza One,” said Gaw Capital Partners chairman and managing principal Goodwin Gaw.

A joint venture between Swire Properties and China Motor Bus Company had sold 625 King’s Road, a 26-storey commercial tower in Hong Kong’s North Point area, to a Gaw Capital-managed fund last year for HK$4.75 billion.

That office building is located just over 1.6 kilometres (1 mile) west of the CityPlaza complex in an area that has has avoided the sharpest edge of Hong Kong’s office market decline this year.

CityPlaza One is currently fully occupied, according to records from Swire, with office vacancy in the Island East area estimated to be just 4.3 percent at the end of September, according to JLL.

That level of empty offices is the lowest of any commercial centre in Hong Kong as the city averaged 8.3 vacancy last month. In the first half of 2020 rents in Island East declined by 8.1 percent from the end of last year, compared to a 13.2 percent drop city-wide.

Leave a Reply