Fraser Residence River Promenade opened in September (Image: Booking.com)

Frasers Property is selling a serviced apartment complex along the Singapore River to SGX-listed developer Tuan Sing Holdings for nearly S$140 million ($103.47 million), as the company struggles with an 82 percent drop in earnings in the six months ending 31 March.

The developer controlled by Thai billionaire Charoen Sirivadhanabhakdi is divesting Fraser Residence River Promenade, a 72-unit serviced apartment opened just eight months ago, along with a trio of conserved warehouses adjacent to the property on Jiak Kim Street in Robertson Quay, according to sources familiar with the transaction.

The sources told Mingtiandi on Friday that the parties have recently concluded due diligence and are now finalising a sale and purchase agreement, with the transaction having been reported earlier by the Business Times.

The deal puts Frasers on track for its second disposal of a hospitality asset in less than two months after the company in March agreed to sell a serviced residence near Changi airport to a joint venture led by TPG Angelo Gordon. Late Friday the developer announced that its revenue for the October through March period fell 20 percent compared to a year earlier, while profit dropped to S$35.8 million ($26.4 million) from S$197.2 million ($146 million) for the same period in 2023.

Exiting Riverside Complex

Located on the banks of the Singapore River, Fraser Residence River Promenade opened in September as the company’s sixth serviced residence in the city-state and achieved 15 percent occupancy in its first month of operation, according to the company’s annual report for the 12 months ending 30 September.

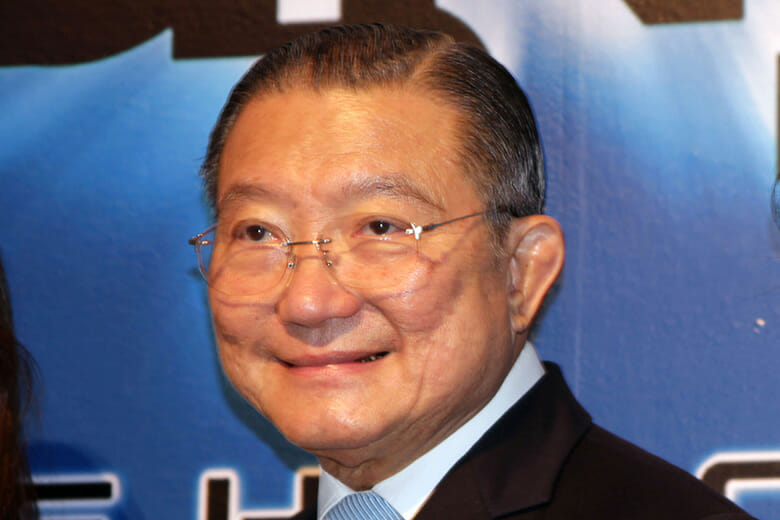

Charoen Sirivadhanabhakdi’s Frasers Property reported an 82% drop in earnings on Friday

(Getty Images)

At the reported compensation, Frasers is selling the Frasers Residence River Promenade for the equivalent of S$1.94 million per key, with the property having been valued at S$88 million as of 30 September, or S$1.22 million per key. The serviced residence and warehouses form part of Frasers’ integrated riverside complex on Robertson Quay, which also features its sold-out 455-unit Rivière luxury residential development.

Built in 1919, the three go-downs were originally used as storage for the city-state’s entrepot trade, before gaining fame as the home of the Zouk nightclub from 1991 to 2016. Frasers paid S$955.4 million, or S$1,733 per square foot of allowable buildable area, to acquire the project site in a government land sale in December 2017.

A Frasers spokesman declined to comment on the sale, saying it does not respond to market speculation. Savills reportedly brokered the deal, but a representative of the property consultancy also declined to comment.

Tuan Sing Checks into Singapore Hospitality

Acquiring the serviced residence would give Tuan Sing its first hospitality asset in Singapore, adding to a S$2.62 billion portfolio of commercial, hospitality and residential projects spanning Southeast Asia, China and Australia.

Based on the company’s annual report, the firm owns the 550-unit Grand Hyatt Melbourne hotel and the 367-key Hyatt Regency Perth in Australia, with the two properties having contributed 30 percent of its revenue in 2023.

While Tuan Sing had not responded to inquires from Mingtiandi regarding the potential acquisition by the time of publication, the company’s has been diversifying its portfolio across markets and asset classes.

In a business update last October the company said it plans to convert the Oxley Building in District 9, which serves as its headquarters, into either a hotel or serviced residence, and indicated that it is considering redeveloping 870 Dunearn Road and the adjacent Link@896 commercial property in Bukit Timah for similar purposes.

Hotel deals in Singapore more than tripled to S$556 million in the first quarter from the preceding three months, defying an across the market 35 percent slump in real estate investment in the city-state during the period, according to Colliers.

Leave a Reply