Media reports released late last week revealed that subsidiaries of embattled real estate investment firm Treasury Holdings which were suddenly sold off for 2.263 million euros to a company controlled by one of its directors are believed to have been valued at more than 31.8 million euros earlier this year in a report by Goldman Sachs.

The surprise sale of the subsidiaries came as Treasury Holdings is being pursued by creditors in Europe for unpaid debts and the company’s founders have been struggling to maintain control of assets.

On August 28th, Treasury Holdings Real Estate PTE and Treasury Holdings (Shanghai) Property Co Ltd, were sold to Oriental Management Services Ltd. an offshore firm controlled by the property group’s own part-owner Richard Barrett.

In a statement at the time of the abrupt transaction, Barrett stated that the 2.263 million euros his firm paid for the two subsidiaries was the higher of two independent valuations obtained from accountancy firms. Treasury declined to cite which accountancy firms were involved.

However, according to a report in the Irish Times on Friday, the two subsidiaries are said to have been valued at more than 31.8 million euros earlier this year in the Goldman Sachs report which was submitted on July 23rd to the board of Treasury China Trust (TCT), a Singapore-listed company connected with the two companies acquired by Mr Barrett last week.

Three days after the Goldman report was presented, Treasury China Trust dismissed its board, and replaced it with a new one. Of the original board, only Mr Barrett, TCT CEO Richard David and the company’s legal counsel and non-executive director Rory Williams were re-appointed.

No direct relationship was stated between the dismissal of the board and the recent asset sales, however, when contacted about the report by the Irish Times, non-executive director Stuart Leckie who was dismissed with the other board members in July said: “The Goldman Sachs valuation is a very material multiple of the €2.3 million.”

Furthermore, according to a report in The Independent, Barrett’s asset purchase is on the installment plan. In an announcement to the Singapore Stock Exchange, documents filed show that Barrett will pay the €2.26m price of the units in installments.

If Barrett fails to make good on his Euros 2.26m, Treasury will get its subsidiaries back, but there is no indication that the company has any other recourse or collateral.

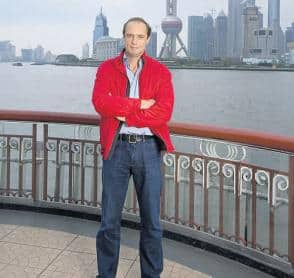

According to unconfirmed reports, in the midst of the legal action and asset sales, Barrett and Ronan have relocated to China.

Ireland’s High Court has already asked Treasury Holdings to provide a detailed report into the circumstances of the Chinese asset sale and that report is due this week.

The day after the sale of the two subsidiaries, the deal was brought to the attention of Ireland’s courts where KBC Bank Ireland and the country’s National Asset Management Agency (NAMA). The court is hearing a winding-up petition filed by KBC against Treasury Holdings and following the sale of the China assets, NAMA decided to join KBC in the litigation.

Of the two subsidiaries, THRE acts as treasury manager to TCT, a commercial property developer in China that is listed in Singapore. THSPM provides property management services to TCT, which is 30 per cent owned by Mr Barrett and his business partner Johnny Ronan.

Leave a Reply