Is CPPIB boss Mark Machin eager to get his hands on some Japanese assets

A statement on Friday by the Canadian Pension Plan Investment Board (CPPIB) reveals that the manager of Canada’s largest pension body has taken an anchor stake in the most recent real estate fund assembled by Hong Kong-based private equity shop PAG.

The report released by the manager of the C$298 billion ($228 billion) CPP Fund, which ranks as the eighth largest pension pool globally, showed that CPPIB had committed $375 million to PAG’s Secured Capital Real Estate Partners VI (SCREP VI) fund. The document added that CPPIB’s investment represents an approximate 25 percent stake in the investment vehicle. Contacted by Mingtiandi, sources at PAG declined to comment on any ongoing fundraising.

Mingtiandi reported in January that PAG’s real estate division had closed on $1.2 billion in funding for the SCREP VI Asia Pacific opportunity fund, with a final closing expected by the end of the first quarter.

CPPIB on the Lookout for Japanese Opportunities

In its statement CPPIB described the fund as a “real estate investment vehicle focused on distressed debt and off-market acquisition opportunities in commercial real estate, primarily in Japan with additional opportunities in South Korea and China.” In its statement, CPPIB mistakenly referred to the fund as “Secured Capital Japan Real Estate Fund VI,” perhaps betraying a strong interest in the Japanese element of the opportunity fund.

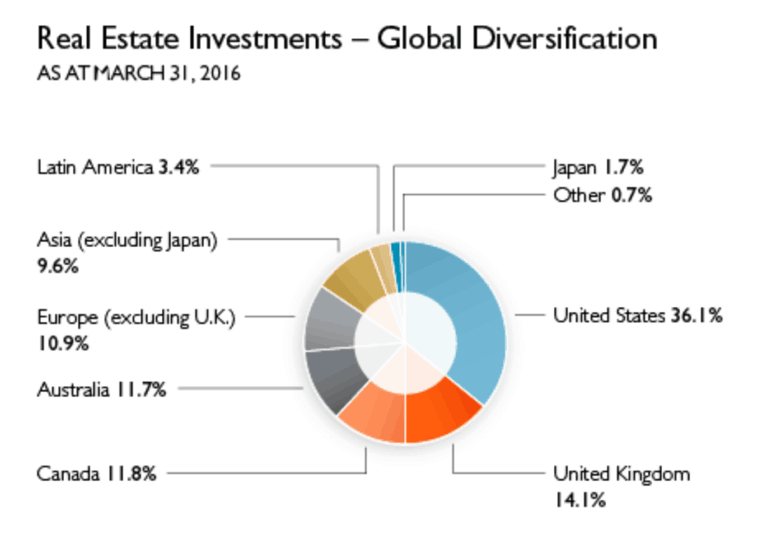

CPPIB real estate investments by region. Source: CPPIB

Funds from the vehicle are understood to have already been invested in distressed situations in Japan. PAG Real Estate, which started life as Secured Capital, has deep roots in the country and last year acquired a $1 billion portfolio of Japanese assets from GE Real Estate.

The focus on Japan follows CPPIB’s decision last year to partner with Singapore’s Global Logistic Properties to invest $873 million into developing warehouses in Japan. That investment is part of a plan to invest $2 billion into Japan’s logistics real estate markets over the next three years.

Canadian Fund Keeps Up Asian Acquisition Pace

In addition to its Japan-focused deals, CPPIB has also shown an interest in opportunities in mainland China, particularly in the retail sector. The fund manager last October invested $375 million in CapitaLand’s third and largest integrated development private investment vehicle in China, Raffles City China Investment Partners III, taking a stake of up to 25 percent in the fund.

That same month, CPPIB committed to its second joint venture with the mainland’s Longfor Properties, investing approximately $147 million for a 49 percent interest in the developer’s Chongqing West Paradise Walk shopping mall in western China. In November the fund manager followed up by spending $162 million to acquire a 40 percent interest in the Pavilion Dalian shopping mall in Liaoning province from mainland developer the Pavilion Group.

Leave a Reply