CCCI bought a 4,000 sqm site on Miami’s North Beach last year for $38.5M

China City Construction (International) Co (CCCI) moved to reassure bond-holders on Friday after control of the Hong Kong-listed construction and real estate firm’s Beijing-based parent company was transferred to a privately managed mainland investment fund.

The transfer in ownership which means that 99 percent of the shares in money-losing China City Construction Co (CCCC) are now owned by privately managed Huinong Fund, was done at the command of the central government, CCCI said in a statement on Friday to the Hong Kong stock exchange. CCCC, which owns CCCI, formerly was owned by a research institute belonging to China’s Ministry of Housing and Urban – Rural Development, but the exact timing of the share transfers involved was not made clear.

CCCI, which is developing over $113 million in projects in Miami, had recently become a cause for concern among bond investors worried over the mainland parent company’s RMB 17 billion ($2.6 billion) in outstanding bonds, and the sudden change in ownership has raised questions about the company’s commitment to its bondholders.

With bond defaults by Chinese companies on the rise in 2016, the Beijing government in March proposed to have financially troubled SOEs sell their liabilities to other firms in debt for equity swaps, and CCC International’s announcement appears to the first publicly acknowledged example of this new approach to avoiding debt default in China.

CCCC Says New Owners Better Able to Pay Debts

Miami resident Dr Shanjie Li was China City Construction’s partner and advisor on its acquisitions in the city

In its Friday statement, CCCI specifically pointed out that a change in control of CCCC, which had been announced to the stock market on April 26, was mandated by China’s central government, and was not done voluntarily by CCCC’s management.

“The Company wishes to hereby specifically explain to the holders of the Bonds that the change of shareholding described in the Company’s announcement on 26 April 2016 was entirely originated from the decisions and requests of the Chinese central government, to which the Company and the Parent Company are only obliged to comply. Therefore, such change of shareholding was entirely beyond the control of the Company and the Parent Company,” CCCI said in its statement.

The statement came after yields on dollar-denominated bonds for CCCI and dim sum bonds issued by CCCC had soared, and analysts had raised concerns over default risk from the two companies.

However, in their announcement on Friday, CCCI’s directors sought to reassure investors that the new ownership of CCCC was good news.

“The Company also wishes to draw the attention of the holders of the Bonds to the fact that compared to the previous controlling entity, the new controlling entity is financially stronger, receives higher credit ratings, has better understandings in corporate operations and management, and can give greater financial support to the development of the Parent Company,” CCCI’s statement went on to clarify.

The company said that both CCCI and CCCC were under normal operation and made no mention of any change in status for its bonds or other financial obligations.

According to an account in the Wall Street Journal last week, CCCC has outstanding bonds totalling RMB 17 billion ($2.6 billion), and its debt rose 67 percent over the past two years to reach RMB 42 billion at the end of September.

State-Invested Private Equity Fund Takes Over Indebted SOE

Central bank governor Zhou Xiaochuan explained the government’s new approach to restructuring debt-laden mainland firms in April

The change in control of CCCC is of interest to investors as concerns mount over the ability of Chinese firms to meet their credit obligations this year as China’s economic growth slows, and more companies fail to make payments to creditors. Already in 2016 at least seven mainland companies have failed to make payments to creditors in a timely fashion, matching the total for all of last year, according to a story by Bloomberg.

And even China’s government-backed enterprises, which were once assumed to have an implicit bailout guarantee from the central authorities, have shown signs of weakness after three state-owned firms missed debt payments in the past three months.

While investors fret over the potential for default and analysts speculate that the market could see larger enterprises acquiring money-losing players, Zhou Xiaochuan, the head of China’s central bank announced recently that the government had an alternative path for resolving financial problems, by encouraging debt for equity swaps.

At an event hosted by the Organization for Economic Cooperation and Development last month, Zhou said that the debt-for-equity swap would benefit large companies plagued with excessive industrial capacity to cut bank debt, according to a report in the Wall Street Journal.

CCCC’s change in control appears to be the first evidence of this approach being put into action, as Huinong Fund, a little-known state-backed financial vehicle whose shareholders include Chinese “bad bank” Huarong Asset Management and Citigroup Global took over a 99 percent shareholding in CCCC from its former owners. The April 26th announcement of the change in beneficial ownership for CCCI made no mention of any cash compensation involved in the transaction.

Among the few facts known about Huinong Fund are that it is under the control of veteran finance executive Wei Lidong, who formerly worked with New Horizon Capital, Unicredit Group and Huarong Asset Management, according to an account in Reuters.

Public records also list a Beijing Huinong Capital Management as active in Chinese financial management, with former Huarong executive Guixin Dong being a partner in the private equity firm. Although the relationship between Huinong Capital Management and Huinong Fund is not clear, the private equity firm has previously entered into agreements with CCCC and CCCI.

Huinong More Family Friend Than White Knight

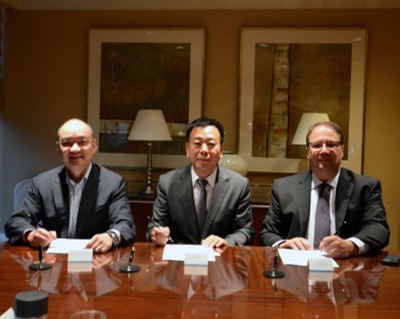

Officials from Chun Wo, CCC and AECOM signed an MOU to cooperate on projects funded by Huinong last year

What is evident from statements to the Hong Kong stock exchange and other public records is that Huinong and CCCC have a long record of interaction, with CCCC at one time having held a substantial stake in the fund, and companies controlled by Huinong having gradually bought up affiliates and assets belonging to CCCC over the past two years.

Societe Generale fixed income analysts Tang Yue and Wei Ping recently noted that CCCC held a 20 percent stake in Huinong in September 2014, but had disposed of part of those shares by December 25th last year, according to an account in the mainland media.

An affiliate of CCCC also joined Huinong Fund in investing in China New Way Investment Ltd (中國新維投資有限公司) in 2014, with China New Way later acquiring Hong Kong-listed builder Chun Wo Development Holdings Ltd in March 2015. In March of this year, Chun Wo officially changed its name to China City Construction Group Holdings, according to an announcement by the company to the Hong Kong stock exchange.

With Huinong’s backing, Chun Wo, now China City Construction Group Holdings, has also been active in buying up assets from CCCC. In November of last year, Chun Wo bought the entire issued share capital of CCCC affiliate China CCCC Development Limited, for HK$660 million ($85 million), and in March of this year, Chun Wo acquired a development project in Zhuhai from CCCC for RMB315 million ($48.5 million).

Huinong and CCCC Partnered on Miami Projects

Huinong has also been an active partner for CCCC in the mainland developer’s $113 million foray into the Miami property market.

CCCC first reached the attention of the international community when CCCI was revealed as the buyer of a $74.7 million site on South Miami Ave in Miami’s Brickell area in December 2014. Chun Wo then bought a 45 percent stake in that project from CCCI for $40 million in October of last year, according to a report to the Hong Kong stock exchange.

Just two days after Huinong-controlled Chun Wo invested in CCCI’s first Miami project, the Hong Kong-listed vehicle went on to acquire a second Miami site, this one a 4,000 square metre (43,000 square foot) plot on the city’s Collins Avenue which had previously been pronounced to small for development, for $38.5 million.

The two companies signed a framework agreement for further cooperation in the US in November of last year in the form of an MOU with international engineering firm AECOM to work together on US projects which would be jointly funded by Beijing Huinong Capital Management, CCCC and Chun Wo, according to a statement from Chun Wo.

Leave a Reply