China saw its second commercial bond default within a month on Friday when a Jiangsu construction company failed to make an interest payment on a RMB 180 million (US$29 million) bond, and the country’s financial markets reacted by climbing during the first two days of this week. And some of the biggest climbers on the Shenzhen and Shanghai exchanges were real estate developers.

Just a few weeks ago, the country’s stock markets plunged when Shanghai-based Chaori Solar Energy Science and Technology failed to make interest payments on a RMB 1 billion bond, as investors worried over the government’s new reluctance to bail out bad deals. On the first business day following that default, the Shanghai composite index was off by 2.86 percent and the Shenzhen composite fell by 3.47 percent. In Hong Kong, the Hang Seng Properties Index of real estate stocks slid 1.69 percent.

The government’s willingness to let bond investors lose money was reconfirmed on March 28th when, according to a report in Reuters, Xuzhou Zhongsen Tonghao New Board Co Ltd missed an interest payment on high-yield bonds issued last year.

Zhongsen Tonghao’s default was estimated to amount to RMB 18 million, based on a coupon rate of 10 percent, and would be the first for China’s high-yield bond market.

Markets Get Accustomed to Failure

While Friday’s default was much smaller than the Chaori Solar episode, the chance that it might signify ongoing weakness in China’s financial markets, and could confirm widespread reports of a credit crisis, might be expected to make investors react with fright. However, since closing time on Thursday, most measures of market value in China have climbed, particularly in the real estate sector.

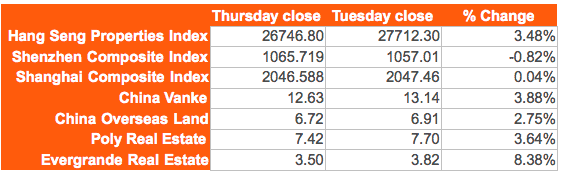

Since last closing time last Thursday, the Hang Seng Properties Index has climbed 3.48 percent, and the Shanghai Composite Index is up 0.04 percent. While the Shenzhen Composite slid, it was by less than a full percentage point at -0.82 percent.

Developer Stocks Climb By Up to

For China’s biggest real estate stocks, the results have been much more positive, with the country’s largest developer in terms of sales, China Vanke climbing 3.88 percent since Thursday, China Overseas Land going up by 2.75 percent and Poly Real Estate getting a lift of 3.64 percent.

And Evergrande Real Estate, which has been widely criticised for its aggressive approach to its balance sheet, rose by 8.38 percent in the same interval. The surge for the Guangzhou-based developer owned by billionaire Hui Ka-yan was due at least in part to an announcement that its 2013 earnings rose 66 percent compared to a year earlier.

This willingness to ignore financial bad news is a contrast to the situation when Chaori Solar failed, causing the country’s biggest real estate firms to slide nearly across the board.

It could be that the failure by Xuzhou Zhongsen Tonghao New Board Co Ltd simply wasn’t big enough to cause a panic, but it’s also apparent that the markets are no longer shocked by the prospect of bond defaults.

While widespread failures of real estate developers still have the potential to cause a panic, it’s beginning to appear that investor faith in China’s financial system may be stronger than many observers realised.

Leave a Reply