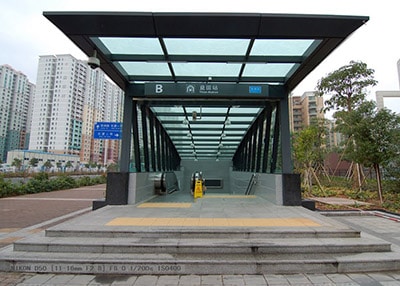

Vanke will gain access to some of Shenzhen’s 4.5 million sqm of sites above metro stations through the deal

The mainland’s largest real estate developer is assured to continue under its current leadership after China Vanke finalised a RMB 45.6 billion ($6.9 billion) agreement to trade shares for sites with the operator of Shenzhen’s subway system.

The agreement, which was outlined in a series of announcements to the Hong Kong stock exchange, calls for Vanke to swap new shares in the company with Shenzhen Metro Group, the operator of the metro transit system in the southern Chinese metropolis, in exchange for sites located above subway stations in the city of 10 million people.

The agreement paves the way for Shenzhen Metro Group to be the single-largest shareholder in Vanke, holding 20.65 percent of the total shares, and Baoneng Group appears to have been frustrated in a rare hostile takeover attempt of the Shenzhen-based homebuilder.

Vanke Shares to Resume Trading on Monday

Vanke boss Wang Shi is seen to be using the deal to fight off a hostile takeover

This transaction will help improve the company’s financial position, enhance the company’s continued profitability, and poses no undue risk to the company,” Zhu Xu, secretary to the Vanke board said in a statement.

The proposed transaction, which must still be approved by Vanke’s shareholders, allows Vanke to acquire Shenzhen Metro’s wholly owned SZMC Qianhai International Development subsidiary, and its assets, in return for 2.87 billion newly issued shares valued at RMB 15.88 each.

While a complete list of Shenzhen Metro’s project sites to be included in the deal has not yet been revealed, the company operated 131 metro stations at the end of 2015, and has plans to grow that network to a total of 371 stations by 2030, according to Credit Suisse analyst Jinsong Du. The statement to the stock exchange noted in particular the importance of sites in Shenzhen’s Qianhai area, a special economic zone just across the border from Hong Kong.

The price for the new shares is a 35 percent discount over Vanke’s average trading price over the 60 days before trading in its stock was halted in December last year. The company’s shares, which Vanke says will resume trading on Monday, are expected to drop significantly on news of the agreement.

Fending Off a Rare Hostile Takeover

The swap of shares for assets was originally proposed in March of this year after Baoneng, a Shenzhen-based conglomerate involved in real estate, finance and other sectors bought up a 24 percent stake in Vanke during late 2015, displacing state-owned China Resources Holdings as the developer’s single largest shareholder.

Vanke saw Baoneng’s move as a hostile takeover attempt and the developer, which has long enjoyed a positive relationship with its hometown government in the southern megacity, apparently sought out Shenzhen Metro as a white knight.

In its statement, Vanke’s board pointed out the company’s ongoing independence, noting that, “Upon completion of the transaction, Metro Group will become one of the major shareholders of the company, but the company will not have a single controlling shareholder.”

While the agreement with Shenzhen Metro may be good news for Vanke chairman Wang Shi and CEO Yu Liang, not all of the company’s shareholders were enthusiastic about the deal.

Three board members representing China Resources voted against the agreement, with the statement indicating concerns over risks of buying assets in Shenzhen’s property market and the impact of the deal on the company’s profits. Home prices in the southern Chinese have shot up by more than 62 percent in the last year, according to independent surveys, bringing land prices up with them.

With many observers predicting new policy moves by the government to cool down the Shenzhen market, China Resources appears to be raising the prospect that Vanke could be buying sites when prices have peaked.

Leave a Reply