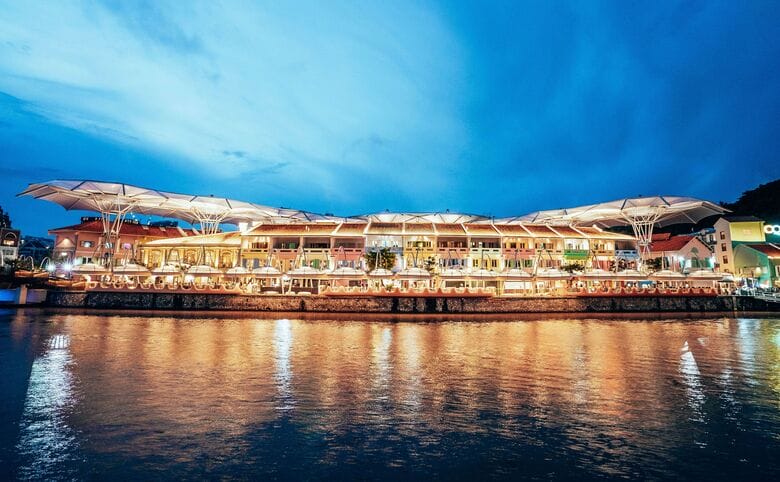

CICT is putting the finishing touches on CQ @ Clarke Quay after value-add works (Image: CapitaLand)

CapitaLand Integrated Commercial Trust posted second-half distributable income of S$362.5 million, up 2.1 percent year-on-year, bringing the REIT’s full-year payout to S$715.7 million ($532 million), up 1.9 percent.

Singapore-listed CICT’s distribution per unit for 2023 was 10.75 Singapore cents, up 1.6 percent, with price appreciation boosting total return to 6.3 percent, the trust’s manager said Tuesday in a release.

Challenging market conditions prompted CICT to adopt a conservative approach based on proactive management of the 26-asset portfolio, prudent cost management and discipline in capital management, said Teo Swee Lian, chairman of the manager, which is owned by Temasek-controlled CapitaLand Investment.

“This strategy has yielded positive results,” Teo said. “Despite the external circumstances, CICT’s financial performance in 2H 2023 remained stable, highlighting the resilience and effective management of the portfolio.”

Full Force of New Assets

Gross revenue for CICT properties in 2023 rose 8.2 percent to S$1.56 billion, driven by full-year contributions from 2022’s Sydney acquisitions including 66 Goulburn Street, 100 Arthur Street and a 50 percent interest in 101-103 Miller Street and its associated Greenwood Plaza. In Singapore, the REIT enjoyed a full-year contribution from CapitaSky (formerly 79 Robinson Road) and improved performance from existing properties.

Teo Swee Lian, chairman of CICT’s manager

Property operating expenses for 2023 jumped 11.4 percent to S$444 million on the impact from the 2022 acquisitions and higher costs for utilities, maintenance and marketing, with net property income increasing 7 percent.

The $18 billion trust’s committed portfolio occupancy reached 97.3 percent at the end of 2023, up 1.5 percentage points from a year earlier, the manager said. CICT signed 1.7 million square feet (157,935 square metres) of new leases and renewals, comprising 700,000 square feet of retail space and 1 million square feet of office space.

In Singapore, which accounts for 93 percent of the portfolio by value, tenant retention rates reached 82.8 percent for retail leases and 86.5 percent for office leases. Rent reversions based on average committed rents achieved 8.5 percent for retail and 9 percent for office.

“The limited new supply of retail and office spaces in Singapore over the medium term will contribute to the sustained demand for our properties,” said Tony Tan, CEO of the manager.

Enhancements Scheduled

CICT is nearing completion of the S$62 million overhaul of its CQ @ Clarke Quay nightlife complex along the Singapore River. The value-add project features restored warehouses providing space for new concepts in a “conserved heritage setting”, as well as refreshed outdoor dining and community areas.

“We are in the final stage of the asset enhancement works, and store fit-outs are progressing rapidly targeting to be in operations by 2Q 2024,” Tan said.

Other properties set for upgrades this year include the 1991-vintage IMM mall in Singapore’s Jurong East, which will undergo S$48 million in improvements aimed at sharpening the tenant mix; the Gallileo skyscraper in Germany, which will target a minimum green rating of LEED Gold at a cost of up to €215 million ($231.2 million); and Sydney’s 101 Miller Street, which will undertake a A$9 million ($5.9 million) revamp of the office building’s lobby.

Leave a Reply