25-26 A&B Lugard Road comes with a $107 million view (Image: Savills)

A luxury house in Hong Kong’s prestigious Peak area was sold to a Chinese buyer for HK$838 million ($107 million) in a rare purchase of a super-luxury property by a mainlander amid the city’s protracted property slump.

The mansion at 25-26 A&B Lugard Road was acquired by Huashengjia Co Ltd, an entity under the directorship of Gu Fang, according to Hong Kong Companies Registry records. The buyer’s name matches that of the wife of Xu Hang, the billionaire co-founder of Shenzhen-listed medical device maker Mindray Medical.

The detached home sold at a price of HK$71,703 per square foot, representing a 30 percent discount to the height of the market, according to consultancy Savills, which brokered the transaction.

“Luxury residential sites on The Peak with stunning Victoria Harbour views can reach over HK$100,000 per square foot during peak periods,” said Raymond Lee, CEO of Greater China at Savills. “This transaction was completed at a price approximately 30 percent below the peak.”

Peak of Luxury

With unobstructed views of Victoria Harbour, the two-storey property has a maximum gross floor area of 11,687 square feet (1,086 square metres) occupying a 23,374-square-foot registered site, with another 8,170 square feet under a short term tenancy agreement.

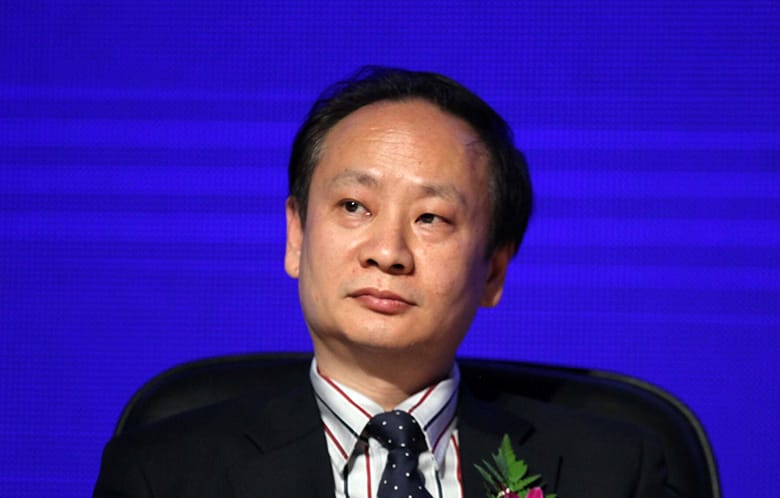

Mindray Medical boss Xu Hang may have a new place to stay when he’s in Hong Kong

Accessible via Mount Austin Road, the 12-bedroom house once owned by the late Hong Kong entrepreneur and Hongkong Land director Sir Robert Hotung is situated a three-minute drive from Hang Lung Properties’ The Peak Galleria shopping complex, as well as The Peak Tower, which houses the upper terminal of the Peak tram.

“Lugard Road stands as one of Hong Kong’s most prestigious locations, boasting a mere 11 residential single lots, and among them, only four (including two currently sold) provide captivating views of Victoria Harbour,” said Jason Wo, deputy senior director of investment at Savills in Hong Kong. “It epitomises the rarity and desirability found within the ultra-luxury residential market. These exceptional attributes have enticed the buyer to proceed with the transaction.”

The property was sold by the family of Tsim Wing Kong, chairman and founder of toymaker Weina Group, who put the property on the market in October 2023 for HK$1.3 billion ($166 million), or HK$111,235 per square foot. The family had purchased the property in 1999 for HK$145 million, according to local media accounts.

Gu, whose husband has a net worth of $12.1 billion according to the Bloomberg Billionaire Index, will pay a 15 percent tax equivalent to HK$125.7 million on the purchase, including a 7.5 percent buyer’s stamp duty and 7.5 percent new residential stamp duty.

In addition to Mindray Medical, which ranks among China’s largest medical device manufacturers, Xu also controls property developer and investment firm Shenzhen Parkland Group, best known for its One Shenzhen Bay commercial and residential complex. Gu is the vice chairman of a charitable foundation under Parkland Group.

Signs of Life

The sale comes despite Hong Kong’s ongoing housing slump, which has seen prices of super-luxury residences sliding 25 to 30 percent over the past 18 months, according to a November 2023 report by Savills, which defines super luxury as a minimum price of HK$200 million.

Wealthy mainlanders, who had previously been a major source of demand for Hong Kong’s luxury properties, have retreated from the market in recent years, with buyer sentiment dented by a sluggish mainland economy and high interest rates in Hong Kong.

The proportion of mainland buyers of luxury properties valued above HK$100 million in the Peak, Mid-Levels and Southside areas reached 29 percent in 2022, the lowest level since 2016, according to Savills.

“Despite the challenges in the global economic environment, end-users and investors remain relatively cautious,” Lee said. “However, the success of this transaction signifies that it is now a golden opportunity for buyers to acquire top-quality properties, following the impact of the pandemic and interest rate hikes in previous years.”

In September 2023, a luxury apartment in Mid-Levels seized from Shenzhen tycoon Chen Hongtian reportedly sold for HK$420 million ($53.5 million), representing a 38 percent discount to the property’s market value.

In July 2023, a pair of mansions on the Peak sold for a combined HK$560 million ($71.5 million), about HK$200 million less than the asking price, according to local media accounts.

Leave a Reply