Blackstone’s latest Hong Kong acquisition is ready to make way for something 20% bigger

A busy deal-making period in Asia continued for Blackstone this week, as the US private equity giant became the latest investment group to acquire a building in Hong Kong’s redevelopment hotbed of Kowloon East.

Emperor International Holdings, the property division of local conglomerate Emperor Group, on Wednesday announced the sale of the 10-storey industrial building at 82 Hung To Road in Kwun Tong district for HK$508 million ($65.5 million). A filing with the Hong Kong stock exchange lists the purchaser as STRG Holdings II Ltd, a Cayman Islands-registered company that Mingtiandi has come to understand is controlled by Blackstone.

The 1970-vintage building, known as New Media Tower, has a gross floor area of 89,500 square feet (8,315 square metres), meaning Blackstone paid HK$5,676 ($731) per square foot for the property.

The transaction, brokered by Cushman & Wakefield, was agreed and completed on Wednesday. Blackstone representatives declined to comment on the deal.

Everything at Once

Since the Hong Kong government reactivated a previous revitalisation scheme a few years ago, traditionally industrial Kowloon East has become a magnet for investors looking to convert workshops into commercial real estate.

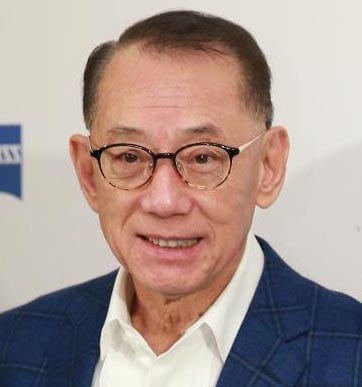

Cushman & Wakefield executive director Tom Ko

Tom Ko, Cushman & Wakefield’s executive director for capital markets in Hong Kong, said Blackstone was fortunate to pick up 100 percent of an asset in a single swoop.

“This is one of the few en bloc transactions in Kowloon East over the last 15 months,” Ko said.

Emperor International, which is controlled by tycoon Albert Yeung, last year had applied to the Town Planning Board to boost the plot ratio on the property by 20 percent in order to develop a 29-storey industrial building on the site, according to local media reports. Should the application be approved, Blackstone would be able to develop a new property on the site that would measure up to 144,000 square feet.

Last month, to give its urban renewal incentives an added boost, Hong Kong’s Development Bureau introduced a pilot scheme to charge land premiums on lease modifications at standardised rates, giving investors greater clarity regarding the costs of revising land use rights on industrial properties.

Industrial Property Revolution

In a strata-title deal more typical of Kowloon East, Australian developer Goodman in February bought the lower half of the Seapower Industrial Centre at 177 Hoi Bun Road in Kwun Tong for HK$570 million from local firm Samson Paper. Market sources noted that the ownership of the upper floors was heavily fragmented, making the building difficult to unify.

Albert Yeung of Emperor Group has signed another deal with Blackstone

The Seapower property and New Media Tower sit on a strip primed for revival as Kwun Tong transitions from an industrial zone to a new business district. Emblematic of the shift is The Quayside, a joint venture development by Link REIT and Nan Fung consisting of two connected office buildings at 77 Hoi Bun Road.

US financial services giant JP Morgan now occupies nine floors in one of the towers, and flexible office provider IWG in February took over 50,000 square feet of space at The Quayside once occupied by rival WeWork.

“We are glad to see the market start picking up in Hong Kong with deep-pocketed institutional investors actively exploring real estate investment opportunities,” Ko said. “Looking ahead, we expect to see more positive market sentiment prevail in the upcoming quarters.”

Asian Hunting Ground

Private equity major Blackstone is showing no signs of a slowdown as it continues to scour Asia for yield-producing assets.

The word on the street is that the group led by Stephen Schwarzman is inching closer to clinching a long-awaited deal to buy a 22 million square foot logistics joint venture, Embassy Industrial Parks, from US rival Warburg Pincus and India’s Embassy Group.

The purchase would make Blackstone, already India’s biggest office landlord, the country’s biggest warehouse owner as well.

In Singapore, Blackstone announced Wednesday that funds managed by the group had completed the acquisition of an office building nicknamed the Sandcrawler from Disney-controlled Lucas Real Estate for S$176 million.

Blackstone had previous dealings with Emperor International in Hong Kong, selling a 32,727 square foot commercial property at 151 Hollywood Road to the local group for HK$595 million in June 2019.

Leave a Reply