Airbnb could use CIC’s cash to build out its mainland listings

China Investment Corp has clicked Like on a US sharing economy powerhouse with a $100 million investment in Airbnb. The capital commitment by China’s sovereign wealth fund comes as the US room-sharing unicorn is reportedly in talks to buy out a local player in the battle for the shared housing segment of the mainland’s booming ecommerce sector.

According to a report in Sky News citing a US securities filing, CIC took a roughly 10 percent stake in a $1 billion fundraising round which values Airbnb at $31 billion.

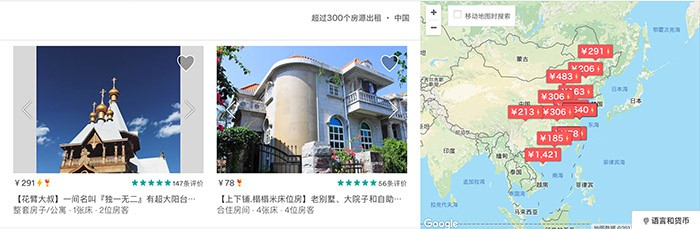

The Silicon Valley-based startup has been quietly building up its mainland platform after hiring former Blackstone CFO Laurence Tosi in 2015 to serve as the startup’s CFO. Now the provider of spare bedrooms and vacation homes plans to increase its staff from 30 to 300 over the next two years, while building on its base of 75,000 mainland listings, according to a report in Bloomberg.

A thorn in the side of hoteliers the world over, Airbnb boasts more than 3,000,000 locations worldwide, and China’s vastly expanding overseas traveller market makes the online marketplace particularly appetizing to the company’s Chinese investors, which already included Li Ka-shing’s Horizons Ventures and Zhang Lei’s Hillhouse Capital Group before CIC signed on.

Airbnb Gets Ready to Battle for the Mainland Market

Airbnb is likely to need both the capital and the government relationships that CIC can provide as it battles local rivals in a mainland ecommerce market that has historically been inhospitable to outside players.

Currently king of the room-sharing hill in China is Tujia, which boasts 450,000 listings in the mainland’s still nascent shared economy sector. Airbnb has reportedly been in discussions since last year to acquire smaller rival Xiaozhu, which has a reported 100,000 listings and 10 million active users in China.

A thorn in the side of hoteliers the world over, Airbnb boasts more than 3,000,000 locations worldwide, and China’s vastly expanding overseas traveller market makes the online marketplace particularly appetizing to Chinese investors, which so far include Horizons Ventures, Hillhouse Capital Group, and GGV Capital.

With renewed interest in the Chinese mainland, Airbnb is a force to be reckoned with in the sharing industry, a facet of China’s economy said to be worth a tenth of the nation’s GDP by 2020 according to the National Information Center and China Internet Association. The report also stated that China had 50 million sharing marketplace providers and 500 million customers.

Trying Not to Get “Ubered”

After announcing the opening of Airbnb China in late 2016, the company claimed to have already had “more than 3.5 million guest arrivals by Chinese travellers all over the world.”

While room-sharing marketplaces are very much in a legal grey area in many places around the world, little regulation has thus far stood in the way of China’s domestic room sharing apps. Airbnb and other room sharing marketplaces – and indeed any home not on the Home Affair’s Department’s list of licensed guest houses – are illegal in Hong Kong but there are nearly 2,500 to choose from in Mong Kok alone.

Other aspects of the sharing economy in China have not been so amenable to international competitors. After spending billions of dollars to build a China operation, ride-sharing platform Uber sold out its mainland business to local rival Didi Chuxing after getting locked into a money-losing battle for market share.

Leave a Reply