Kumar’s former business, Bridge Data Centres, operates this facility in Malaysia’s Cyberjaya

Hong Kong-based private equity firm PAG is marching into Asia’s data centre race with the launch of a digital infrastructure company led by industry veteran Kris Kumar.

The yet-unnamed company will focus on co-location, cloud, hyperscale and enterprise data centres, as well as network and fibre assets, throughout the Asia Pacific region, with Japan and Australia of particular interest, the firm said Tuesday in a press release. PAG’s real estate arm has $2 billion in investments in the digital infrastructure sector and plans to invest $10 billion in the short to medium term.

Kumar will serve as chairman of the new company, having previously served in pioneering roles in Asia with NYSE-listed Digital Realty, Bridge Data Centres and Chindata.

“Kris is an icon in the digital infrastructure industry, and we are very excited to work with him to create this platform company that will serve the infrastructure needs of this new digital era that we live in,” said PAG president Jon-Paul Toppino. “With his experience and PAG’s expertise in development and investment, we are looking forward to building a robust platform that will stand the test of time.”

Pulling Him Back In

After a decade of service as an engineer in India’s Merchant Navy, Kumar in 1992 migrated to Australia, where he joined the facility management team at Singapore-based Keppel Land and spearheaded operational and engineering improvements across the portfolio.

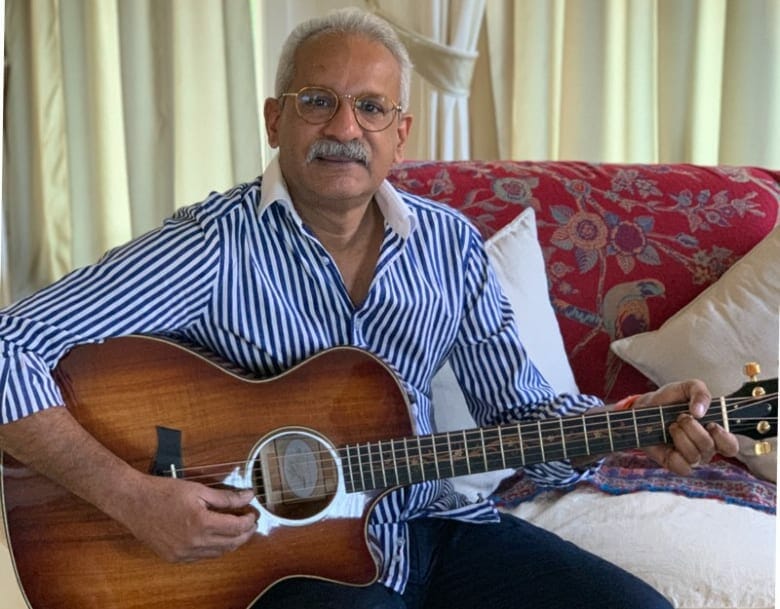

Kris Kumar will have less time for strumming as he helms another bit barn startup

In 1996, Kumar founded real estate advisory CFM Group, which carved out a niche in telecom and data centre properties. He later served as regional head for Asia Pacific at Digital Realty, overseeing acquisition and development of assets for the US data centre REIT.

In 2016, Kumar founded Singapore-based Bridge Data Centres in partnership with Bain Capital Private Equity. He became vice chairman of Chindata Group after its 2019 merger with Bridge. Chindata listed on the NASDAQ exchange last September after a $540 million IPO.

In a May 2020 LinkedIn post, a guitar-strumming Kumar had announced that it was time to “hang up my boots” and “retire from everything data centres” after more than two decades spent in the industry, but the lure of helming PAG’s regional strategy ultimately proved too great.

“With PAG’s entrepreneurial approach, decades of experience, superior investment track record and ready access to a competitive cost of capital, my perennial enthusiasm for the sector quickly resurfaced, to lift me out of my year-long retirement,” Kumar said. “I am looking forward to helping build a platform company on the strong foundation of an already-substantive investment by PAG in the sector over the last four years.”

Several experienced senior executives are expected to join the new company, which will be structured and branded to begin operations in September, PAG said.

Race Heats Up

In addition to PAG’s emerging company, other data centre platforms have sprouted up in Hong Kong and Singapore during the past year with an eye towards building Asia-focused portfolios to tap the red-hot sector.

PAG Real Estate’s Jon-Paul Toppino

Last month, Hong Kong’s Gaw Capital Partners announced the hiring of former Keppel Data Centres strategist Kok-Chye Ong to lead its server-hosting platform in Asia ex-China, aiming to expand on the success of the the family firm’s data centre investments in China, where Gaw has committed $1.3 billion since 2019.

A few weeks after that news, Gaw launched a Singapore-based joint venture company, Data Center First, with a project in the nearby Indonesian city of Batam, marking the firm’s first investment in its Asian data centre platform outside of China.

Also in Singapore, New York-based Stonepeak Infrastructure Partners last August introduced its $1 billion Digital Edge platform, which has quickly amassed a seven-asset portfolio across Japan, South Korea and Indonesia.

Not to be outdone, Macquarie-backed AirTrunk last December made its Asia operational debut as the Australian firm opened hyperscale cloud facilities on the same day in Singapore and Hong Kong.

Leave a Reply