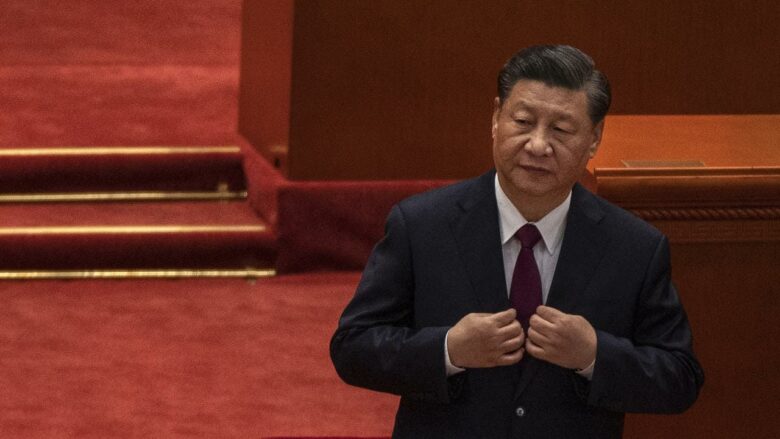

Xi is turning to traditional Chinese economic medicine

In today’s roundup of regional news headlines, Chinese President Xi Jinping plans an infrastructure push to spur economic growth, the Hong Kong stock exchange’s profit drops amid an IPO drought, and a Good Class Bungalow on Singapore’s Olive Road finds a buyer.

Xi Says China Will Step Up Infrastructure Construction to Boost Growth

China will step up infrastructure construction to boost domestic demand and drive economic growth going forward, state TV reported on Tuesday, citing a top economics meeting chaired by President Xi Jinping.

The world’s second-biggest economy is at risk of a sharp slowdown as COVID-19 restrictions across a large swathe of the country hit consumer spending, the property market remains mired in a downturn and exports look set to slow further. Read more>>

Hong Kong Bourse Sees 31% Profit Drop as IPOs, Trading Slump

Hong Kong’s stock exchange reported a 31 percent drop in profit in the first quarter, the biggest decline in almost six years, amid a drought in initial public offerings and plunging stock trading.

Net income at Hong Kong Exchanges & Clearing fell to HK$2.67 billion ($340 million), missing the average of six analyst estimates compiled by Bloomberg. Core business revenue fell 16 percent to HK$4.76 billion while investments turned to a loss. The decline came after a record profit in last year’s first quarter. Read more>>

Bungalow on Singapore’s Olive Road Sells for $36M

A grandson of the late property magnate and hotelier Wee Thiam Siew is buying an old freehold bungalow along Olive Road for nearly S$50.24 million ($36.4 million).

The price paid by Wee Hian Nam for the property, which is part of the Caldecott Hill Good Class Bungalow Area, works out to S$1,800 per square foot on the land area of 27,909 square feet (2,593 square metres). Read more>>

GDS Breaks Ground on 54MW Malaysia Data Centre

GDS Holdings has broken ground on a new data centre campus outside Johor, Malaysia. The company is to invest MYR 1.38 billion ($320 million) developing a campus at the Nusajaya Tech Park in the Iskandar Puteri area of Johor. GDS acquired the land in July 2021.

GDS plans to develop a 22,500 square metre (242,200 square foot), 54-megawatt hyperscale campus on the land. The first 18MW phase of development is expected to go live in 2024. Read more>>

HSBC Warns of China Headwinds, More Real Estate Loan Losses

HSBC, the largest foreign bank in China, warned of further potential hits from the nation’s battered real estate market as defaults continue to climb amid a worsening COVID outbreak.

“It’s a big call to say that we’ve seen the worst,” Ewen Stevenson, HSBC’s chief financial officer, said in an interview with Bloomberg News. “Do I think that there could be further provisions this year? Yes, it’s possible.” Read more>>

Evergrande Gains Six-Month Extension for Onshore Coupon Payment

China Evergrande’s flagship Hengda Real Estate unit said its creditors have approved a six-month extension of a RMB 574 million ($88 million) coupon payment for an onshore bond that was due Wednesday.

It is the latest of several payment extensions for Evergrande’s onshore bonds. Read more>>

Sabana REIT Unitholders Reject Director Appointment at AGM

Unitholders of Singapore-listed Sabana REIT have voted not to endorse the appointment of independent non-executive director Chan Wai Kheong.

Chan, a hedge fund founder and former Credit Suisse trader, was appointed to the board of Sabana REIT last June. Read more>>

Guocoland 3Q Net Profit Tumbles 91%

Guocoland Malaysia Bhd’s net profit fell by 90.81 percent to MYR 6.73 million (now $1.5 million) for the third quarter ended 31 March 2022 compared with the year-earlier period, when the group had gained from the disposal of a piece of land in Jasin, Melaka.

Earnings per share declined to 1 sen from 10.93 sen, the group’s Bursa Malaysia filing showed. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply