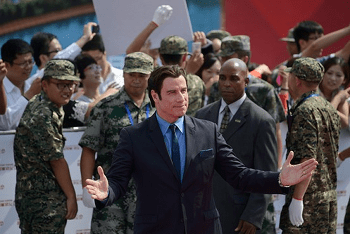

John Travolta was among the celebrities at the announcement of Wang’s Qingdao studio

China’s cross-border giants continue to dominate the headlines today as news breaks of Wang Jianlin selling off his dreams of Hollywood by the East China Sea. Not to be pushed from the spotlight, HNA also grabs reader attention with the revelation that its alleged largest shareholder doesn’t exist yet. Meanwhile, Hong Kong’s Link REIT goes about its business of dealing in Hong Kong retail real estate. Read on for all these stories and more.

Wang Jianlin’s Movie Studio Dreams Turn to Dust

Chinese billionaire Wang Jianlin was on the verge last year of becoming the entertainment industry’s newest mogul, snapping up prime media assets and setting his sights on a major Hollywood studio.

But that breakthrough now seems remote with the $13 billion sale of assets by Mr. Wang’s majority-owned company Dalian Wanda Group to Sunac China Holdings Ltd. Read more>>

HNA’s Biggest Shareholder Doesn’t Really Exist – But Might Soon

Who owns HNA Group, a multi-billion dollar Chinese conglomerate that holds a quarter of Hilton Worldwide Holdings Inc. HLT 0.06% and is trying to buy an investment firm from White House communications director Anthony Scaramucci?

The answer, it turns out, is a work in progress. Read more>>

Link REIT May Sell Off 20 HK Shopping Centres

Link Reit, Hong Kong’s first real estate investment trust, is considering a plan to sell more than 20 retail shopping centres around the city, the latest landlord to put its property portfolio on the market, after a crucial land sale in May established a new benchmark for commercial prices in the world’s most expensive market.

The sale, which would be Link Reit’s largest asset disposal since its 2004 establishment, could raise between HK$15 billion and up to HK$20 billion (US$2.57 billion), according to valuers familiar with the plan. Read more>>

CapitaLand Retail China Trust to Beijing Mall for S$232M

CapitaLand Retail China Trust announced on Thursday that it will sell off CapitaMall Anzhen in Beijing to Beijing Hualian Anzhen Business Development Company for about S$232 million. The mall is currently master leased to BHG (Beijing) Department Ltd.

The divestment “will boost our financial flexibility to seize new growth opportunities”, said Mr Tan Tze Wooi, CEO of the trust’s manager. Read more>>

Greenland Joins With Aussie Senior Care Provider for Mainland Plan

One of China’s largest real estate developers Greenland HK has penned a deal with Australian aged care group, Provectus Care, headed by Shane Moran of the famed nursing home family, to help build aged care facilities in China where there is an acute shortage of beds.

The intensely private Mr Moran talked exclusively to The Australian Financial Review Magazine, breaking his silence since his family’s legal infighting and subsequent reconciliation, and about taking his aged care model to China, where senior care is seen as a major growth opportunity given the large ageing population. Read more>>

CDL Hospitality Trusts Reports 11.4 Income Jump

CDL Hospitality Trusts reported an increase of 11.4 per cent year on year increase in net property income in the second quarter of 2017 to S$34.9 million, boosted by a strong performance from its hotels in New Zealand and the United Kingdom.

The Trusts, which comprise CDL Hospitality Real Estate Investment Trust and CDL Hospitality Business Trust, said the increase in NPI was underpinned by inorganic contribution from The Lowry Hotel in Manchester, as well as higher variable rental income from the robust underlying hotel performance in Auckland. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply