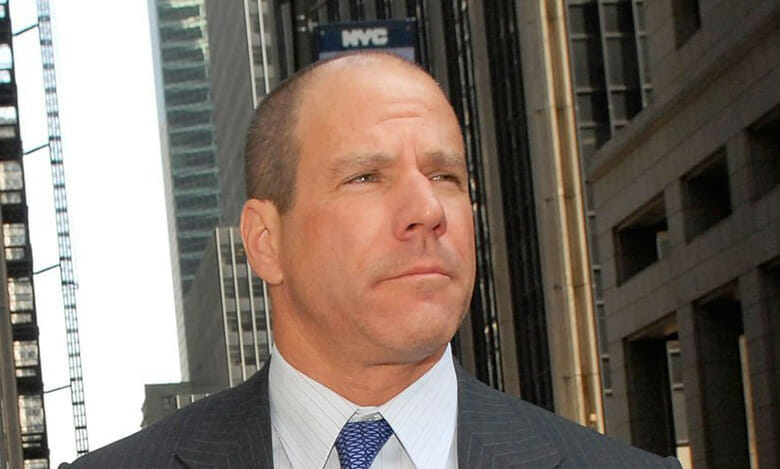

TPG chief executive Jon Winkelried is looking to buy Angelo Gordon (Getty Images)

Debt strategies are back in vogue and US fund management giant TPG may be willing to pay $2 billion to keep up with the trend, according to a report on Friday. Also making our headline roundup today, HSBC fends off Ping An’s bid to split the bank – for now, and China’s defaulting developers see their shares take a beating.

TPG Seeks $2B Buyout of Angelo Gordon in Return to Credit Investing

TPG Inc is in talks to acquire investment firm Angelo Gordon, which would be its first major foray into credit investing since separating from Sixth Street three years ago, according to people with knowledge of the matter.

A deal, which would value Angelo Gordon at more than $2 billion, hasn’t been finalized and the discussions may not ultimately lead to a transaction, said the people, who asked not to be identified because they aren’t authorized to speak publicly. TPG has $135 billion under management. Read more>>

HSBC Trounces Ping An Proposal to Split Bank

HSBC shareholders on Friday rejected a proposal by frustrated minority investors to increase the bank’s dividend payouts and radically change its structure in a major affirmation of the lender’s strategy under chief executive Noel Quinn.

The critical shareholder vote followed a year-long campaign by Ping An Insurance Group, the bank’s biggest shareholder, to shake up the lender and ongoing frustration by some of its Hong Kong retail investors over the cancellation of its dividend three years ago at the request of HSBC’s chief regulator in Britain. Read more>>

Troubled Mainland Developers Sink After Regulator Warnings

China’s weaker developers tumbled in Friday trading as exchanges issued risk warnings, including the potential for delisting.

Shanghai Shimao Co, Yango Group Co and Myhome Real Estate Development Group Co were all down by the 5 percent trading limit. Sundy Land Investment Co. lost as much as 4.7 percent. Read more>>

JD Plans to Build $870M in Apartments for Staff

JD.Com said it plans to invest more than RMB 6 billion ($870 million) to build apartments for the Chinese e-commerce giant’s employees to rent.

The JD Young City project will include nearly 4,000 self-owned rental apartments for workers, a kindergarten, a swimming pool, and leisure and fitness facilities, JD.Com announced on its WeChat account yesterday. The cost of renting one is likely to be about half of the going market rate, the firm added. Read more>>

China’s SF Holding Plans to Raise Up to $3B in Hong Kong IPO

China’s largest express delivery company SF Holding Co Ltd plans to raise up to $3 billion in a second listing in Hong Kong as soon as later this year, in what would be one of the largest public offerings in the city, two sources said.

The courier group, regarded as China’s answer to FedEx Corp and DHL, has picked Goldman Sachs Group Inc , Huatai Securities and JPMorgan Chase & Co to work on the listing, which could raise $2 billion to $3 billion, said the sources with knowledge of the matter. Read more>>

Baring Private Equity, ICICI Bank Back $5.5M Round for India Proptech Startup

Mumbai-based proptech startup PropertyPistol.com has raised INR 45 crore ($5.5 million) from investors including ICICI Bank and Baring Private Equity Partners to expand its business. The company, which was founded in 2012 by IIT alumni Ashish Narain Agarwal and later joined by Tushar Shrivastava as co-founder, offers various tech solutions and advisory services to home buyers, real estate brokers, and developers.

“We are thrilled to have received this investment from ICICI Bank and Baring Private Equity Partners, which will help expand the company’s operations into newer geographies and yield significant business growth and value in the future,” said Ashish Narain Agarwal, Founder and CEO of PropertyPistol.com. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply