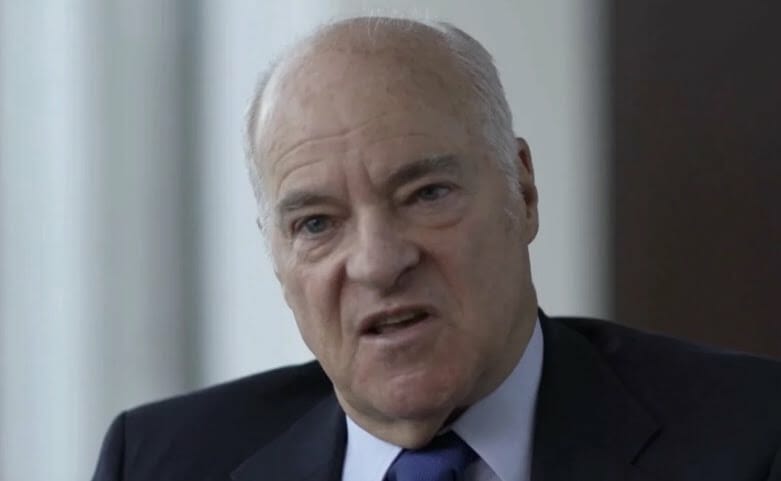

KKR co-founder and co-executive chairman Henry Kravis (Image: KKR)

In today’s roundup of regional news headlines, buyout giant KKR limits withdrawals from a real estate vehicle, investment bank Goldman Sachs sees Hong Kong home prices falling 10 percent this year, and flex space provider WeWork announces a round of job cuts.

KKR Caps Withdrawals on Real Estate Trust in Latest Pullback

KKR has joined rivals including Blackstone in limiting withdrawals from a REIT after investors sought to pull out more money.

KKR Real Estate Select Trust received requests in the first-quarter tender offer period to repurchase 8.1 percent of its net asset value, exceeding the 5 percent quarterly limit, according to a filing Wednesday. The trust fulfilled 62 percent of each shareholder’s request. KKR’s stock dropped 5.7 percent to $49.98 in Thursday afternoon trading. Read more>>

Hong Kong Home Prices to Drop 10% Before Rebound, Goldman Says

Goldman Sachs has raised its forecasts for Hong Kong home prices, citing the border’s reopening along with an improving economic outlook and equity market recovery.

Prices will fall 10 percent this year before rising 4 percent in each of the next two years, according to Goldman analysts. They had previously projected that values would drop 15 percent in 2023 and remain flat in 2024 and 2025. Read more>>

WeWork to Cut About 300 Global Jobs as It Pares Back Presence

WeWork plans to eliminate about 300 roles across countries, the flexible workspace provider said Thursday, as part of efforts to cut back on underperforming locations.

WeWork had enjoyed a pandemic-driven shift to flexible work outside traditional offices, but an uncertain economic environment is forcing companies to reduce their real estate footprint. Read more>>

Tangs Extend Closing Date for Chip Eng Seng Buyout

The closing date for the mandatory cash offer for Singapore property player Chip Eng Seng by its chairman Celine Tang and her husband Gordon Tang has been extended from Thursday (Jan 19) to Feb 2.

In a Thursday bourse filing, the offeror disclosed that together with its concert parties, it owns or is set to own 685.2 million shares, translating to about 87.26 per cent of the company. The Tangs are required to attain more than 90 per cent of Chip Eng Seng’s shares to take it private. Read more>>

Changsha, Nanjing Relax Homebuying Restrictions, Offer Generous Subsidies

An increasing number of mainland Chinese cities are rolling out favourable policies and subsidies to help skilled immigrants buy homes in an attempt to spur their COVID-affected economies.

Changsha, the capital of central China’s Hunan province, said Wednesday that diploma holders aged 45 or below, who have a hukou or household registration in the city, pay taxes or social security, can buy homes in areas where households are restricted to owning a maximum of two units. Read more>>

Prosecutors Indict Former Chairman of China Life Insurance

Wang Bin, former party chief and chairman of China Life Insurance, has been indicted for suspected crimes of taking bribes and concealing overseas savings, the Supreme People’s Procuratorate said Thursday.

The indictment said Wang had taken advantage of his posts at various financial institutions, including those at the Jiangxi branch of the Agricultural Development Bank of China, the Bank of Communications and China Life, to seek benefits for others. In return, he accepted an “especially huge amount” of money and gifts, an SPP statement said. Read more>>

Suntec REIT’s Second-Half DPU Down 9.7% as Financing Costs Rise

Suntec REIT’s distribution per unit fell 9.7 percent year-on-year to 4.074 Singapore cents for the second half of 2022.

The result came as higher interest expense for the period resulted in a 27.8 percent rise in finance costs for the REIT, its manager said Friday in a regulatory filing. Read more>>

Mapletree Logistics Trust’s 3Q DPU Up 1.9% From Year Earlier

Mapletree Logistics Trust reported distribution per unit of 2.227 Singapore cents for its financial third quarter, up 1.9 percent year-on-year.

Net property income rose 7.3 percent to S$157.2 million (now $118.9 million), while revenue jumped 8 percent to S$180.2 million. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply