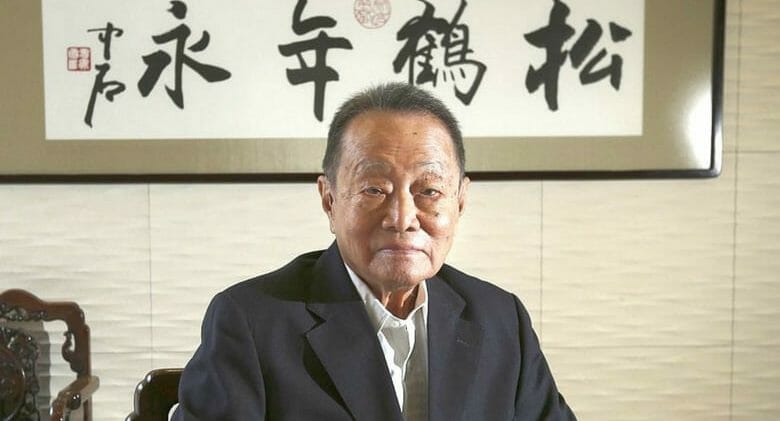

Kerry Group boss Robert Kuok has seen tough times before

In our latest roundup of regional news headlines, Hong Kong developer Kerry Properties posts a 22 percent profit decline for 2020, China’s HNA conglomerate begins a monumental restructuring process, and GLP J-REIT issues the first ultra-long sustainability bond in the Japan REIT market.

Kerry Properties’ Net Profit Drops to HK$5.4B

Kerry Properties said its net profit last year fell by 22 percent to HK$5.4 billion ($700 million now) due to a net increase in the fair value of investment properties and the related tax effects.

Contracted sales surged by 44.7 percent to HK$12.88 billion in 2020. Revenue fell by 19.4 percent to HK$14.52 billion. Earnings per share amounted to HK$3.71. Read more>>

Hongkong and Shanghai Hotels Suffers HK$1.94B Loss in 2020

Hongkong and Shanghai Hotels recorded a net loss in 2020 of HK$1.94 billion ($250 million now), reversing a net profit of HK$494 million the year before, and the Peninsula hotels owner expects to sustain an operating loss this year as the coronavirus pandemic takes its toll on travel and tourism.

Underlying loss was HK$864 million, compared with an underlying profit of HK$480 million in 2019. Revenue plunged 54 percent to HK$2.71 billion last year. Loss per share was HK$1.18. No dividend was declared. Read more>>

HNA Group Commences Restructuring

HNA Group, one of the largest conglomerates in China, has commenced a massive bankruptcy restructuring process involving 321 subsidiaries.

The restructuring follows creditors of the group filing applications with the People’s High Court in Hainan calling for the group’s bankruptcy, due to its debt crisis with liabilities totalling RMB 700 billion ($107 billion). Read more>>

GLP’s J-REIT Issues Record 20-Year Sustainability Bond

Singapore-based GLP’s Japan REIT (GLP J-REIT) has raised JPY 5 billion ($46 million) with the issuance of 20-year sustainability bonds, the first ultra-long sustainability bonds in the Japan REIT market.

As part of its environmental sustainability initiatives, GLP J-REIT has provided green finance and issued green bonds on three occasions since December 2018 with a total environmental, social and governance bond issuance of JPY 31.6 billion, making it the top Japan REIT in terms of ESG bonds outstanding. Read more>>

Hong Kong Bars Dry Up, Shut Down From Pandemic Closures

Hit hard by constant closures ordered by the government as part of anti-pandemic measures, some bars have seen rents reduced.

The industry has been ordered to close down repeatedly as part of measures to curb the virus, and businesses have faced severe challenges as a result. According to industry insiders, about 10 percent of bars have shuttered in the past three months, involving 140 shops. It’s expected that shop rents will continue to be adjusted because of this. Read more>>

Two-Storey SG Shophouse for Sale on Serangoon Garden Way

A commercial two-storey shophouse on Singapore’s Serangoon Garden Way has been put up for sale by CBRE at an indicative price of S$11.8 million ($8.8 million).

Located at 67/67A Serangoon Garden Way, the property sits on a 999-year site of approximately 2,782 square feet (258 square metres); the built-up area is 4,165 square feet. Read more>>

Far East Consortium Rebrands Manchester Project as Victoria North

Far East Consortium and Manchester City Council’s 390-acre masterplan will now be known as Victoria North, a move that aims to “create a sense of place”, according to Gavin Taylor, regional general manager at FEC in Manchester.

“The Northern Gateway has served us well as a name as we shaped plans for the area’s regeneration,” he said. “But as we begin to bring forward development this year, it’s the right time to start creating a sense of place for what will be a significant new district in Manchester, as well as an identity that people can engage with.” Read more>>

Sales of Singapore Distressed Homes Take Off

Sales of distressed residential properties may be moving at glacial speed, but some are getting sold as buyers pay near the opening prices, either at auction or by negotiation after the auction.

A mortgagee property at The Ladyhill was sold above the opening price of S$7,055,000 ($5.26 million) after the 7 January auction, said Sharon Lee, Knight Frank’s head of auction and sales. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply