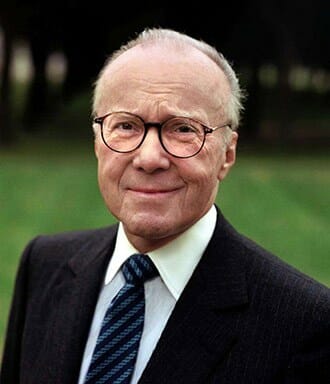

Gerald Hines and his crew are dabbling in Indian housing

South Korea continues to push its way back into the investment target area today as a $400 million Seoul office tower is said to receive bids from Singapore’s GIC and London-based M&G. Slightly to the south and west, Houston-based Hines enters a $23 million housing JV with Tata, and China’s Joy City targets a portfolio of 100 mainland malls. Read on for all these stories and more.

GIC, M&G Join Bidding for $400M Seoul Tower

Singapore’s GIC and M&G Real Estate of London-based Prudential are in the bidding for a new office building in South Korea, wholly owned by the Public Officials Benefit Association (POBA), in a deal that is expected to fetch around 450 billion won ($412 million).

The two bidders have submitted letters of commitment to unidentified South Korean asset managers to commit to real estate funds launched for the auction, according to industry sources with knowledge of the matter on Dec. 5. Read more>>

Hines in $23M India Residential JV with Tata Housing

Houston-based developer Hines has entered into a partnership with Tata Housing, one of the fastest-growing real estate companies in India, to invest $23 million toward the development of India’s first wellness homes project – Serein. Located in Thane, in Maharashtra state, the 7.3 acre project will comprise four 33-story towers, each with a central green activity area.

The project’s architectural design takes advantage of its strategic location at the edge of the Sanjay Gandhi National Park, social infrastructure including excellent schools and hospitals, and connectivity to BKC and South Mumbai via the Eastern Express Highway. Read more>>

Joy City Targets 100 Malls in Coming Decade After Deal with GIC, China Life

Joy City, the Hong Kong-listed commercial property arm of state-owned conglomerate Cofco, plans to leverage its funds to reach its new goal of operating 100 malls within 10 years, a highly ambitious target considering that it planned to own only 20 malls by 2020.

Zhou Zheng, chairman of Joy City Property, told the South China Morning Post on the sidelines of the company’s tenth anniversary celebrations that it would use its 11.4 billion yuan (US$1.73 billion) fund set up in August with Singaporean sovereign fund GIC, and insurance giant China Life, to expand its presence in tier and tier two cities, with the aim of expanding its portfolio to 50 projects in five years, and 100 in 10 years. Read more>>

Condo Complex in West Singapore Set for S$530M Collective Sale

The Brookvale Park condominium in Clementi has been launched for sale by tender for a minimum price of $530 million. The 160-unit condo in Sunset Way, built in 1983, could be redeveloped into an estate of 550 homes across 12 storeys, with an average apartment size of 1,100 sq ft.

A new development on the 999-year leasehold plot would have a total gross floor area of about 656,494 sq ft, including a 10 per cent bonus balcony area. Read more>>

CapitaLand Retail REIT Plans S$104M Private Placement

Capitaland Retail China Trust (CRCT) said on Thursday (Dec 7) it has obtained in-principle approval from the Singapore Exchange (SGX) for the listing of new units from its upsized S$103.8 million private placement of new units at S$1.612 apiece.

Some 64.4 million new units will be issued, with aggregate gross proceeds amounting to S$103.8 million. CRCT also said that the private placement has been over-subscribed and that the upsize option has been exercised in full. Read more>>

Airbnb to Double Mainland Team

Airbnb Inc, a US-based home-sharing service provider, has pledged to double its investment in China next year, while also doubling its size of local workforce in the country to expand its presence in more domestic cities.

“China is an incredibly important destination for Airbnb globally,” said Nathan Blecharczyk, co-founder and chairman of Airbnb China. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply