Blackstone flips another deal to a Chinese investor

Leading the region’s real estate news today, Stephen Schwarzman’s attic must be emptying out quickly as the Blackstone boss sells yet another holding to a Chinese firm – and simultaneously redirects some angry phone calls from animal rights activists. Also in the news, Soho China’s Pan Shiyi says he would rather own Shanghai real estate than renminbi cash right now, and your plan to put that HK$20 million apartment on your mainland bank card may just have hit the wall. Read on for all these stories and more.

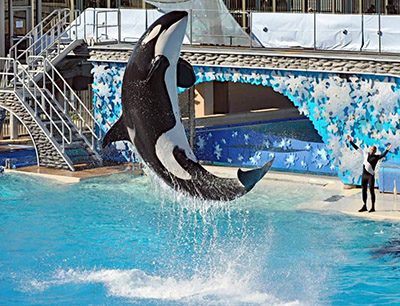

Blackstone Gives Chinese Group a Killer Whale of a Seaworld Deal

Blackstone Group LP will nearly triple its money on its seven-year investment in SeaWorld Entertainment Inc. after weathering backlash over the theme-park operator’s treatment of killer whales.

Blackstone agreed Friday to sell its remaining 21 percent stake in the theme-park operator to China’s Zhonghong Zhuoye Group Co. for about $449 million, or $23 a share. The sale caps a return of about 2.7 times the original equity investment by Blackstone and co-investors, according to regulatory filings. Read more>>

Soho China Backs Out of Deal to Sell Hongkou Project as Market Heats Up

Soho China Ltd, the biggest commercial developer in the Chinese capital, said it’s been forced to abandon its sale of a Shanghai property to a “famous” buyer, becoming the latest company to be snared by the country’s capital control regulations.

Soho had to drop the sale of Soho Hongkou, an office-and-commercial project with 95,000 square metres of usable space in Shanghai, according to the company’s founder and chairman Pan Shiyi. Read more>>

UnionPay Blocks HK Property Payments for Mainlanders

Soho China Ltd, the biggest commercial developer in the Chinese capital, said it’s been forced to abandon its sale of a Shanghai property to a “famous” buyer, becoming the latest company to be snared by the country’s capital control regulations.

Soho had to drop the sale of Soho Hongkou, an office-and-commercial project with 95,000 square metres of usable space in Shanghai, according to the company’s founder and chairman Pan Shiyi. Read more>>

China’s Third Wanda City Theme Park to Open in Harbin This June

The $5.8 billion Harbin Wanda City will be the largest leisure development in the country’s Northeastern region. Key features are set to include Russian-style theming and the world’s largest indoor skiing and snow entertainment park. The snow park will cover 1.5 square kilometres.

Further locations in line for Wanda Cities include Chengdu, Wuxi, Guangzhou and Chongqing. Read more>>

Kaisa Board Approving Release of Overdue 2014 Financials

Kaisa Group Holdings Ltd., the first and only Chinese property developer to default on overseas debt, will hold a board meeting on Saturday to approve the publication of its 2014-1016 annual results, Bloomberg reports.

Releasing the long-overdue results is the final condition the Shenzhen-based company needs to meet before applying to lift its two-year trading suspension, the report said. Read more>>

And here’s a link to Kaisa’s first set of financials in two and a half years Read more>>

Wang Shi Takes Back Control at China Vanke

Chinese property tycoon Wang Shi nearly lost control of his empire to an upstart investor. Now it appears he has gained it back, with an assist from China’s insurance regulator.

As China Vanke Co. prepares to report earnings Sunday, its future looks to be safely in the hands of its ally and largest shareholder, subway operator Shenzhen Metro Group Co. A wave of tighter insurance regulations prevented Mr. Wang’s challenger, the conglomerate Baoneng Group, from raising its stake, analysts say. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter for headlines as they happen.

Leave a Reply